Artificial intelligence integration further enhances tax accuracy, enabling real-time anomaly detection, automated rule application, and faster reporting cycles. Additionally, the global rollout of e-invoicing mandates pushes enterprises to modernize legacy tax platforms to meet structured data and regulatory submission requirements. However, the market also faces notable restraints. Among them is the challenge of integrating modern tax solutions with legacy enterprise systems, which slows the adoption of cloud-based platforms and limits the ability to deploy advanced technologies across distributed environments.

Indirect tax type is expected to account for the fastest growth during the forecast period.

Indirect tax, comprising value-added tax, goods and services tax, sales tax, customs duties, and other transactional levies, is expected to emerge as the fastest-growing segment in the tax management market as regulatory mandates shift decisively toward real-time compliance and digitalized reporting. In April 2024, Sovos launched its Indirect Tax Suite to address growing complexity in over 70 jurisdictions, integrating determination, e-invoicing, and automated filings into a single cloud-native platform. The October 2024 release of a clean-core, ready solution for SAP environments demonstrated the need for deep ERP integration and scalable configuration across VAT, GST, and sales tax regimes.These developments reflect the urgency among global enterprises to operationalize indirect tax automation across core finance processes. This creates a strong opportunity for vendors to deliver purpose-built platforms that apply country-specific tax rules, ensure structured compliance with invoicing mandates, and adapt dynamically to ongoing regulatory changes.

To stay competitive in the high-growth indirect tax segment, vendors must differentiate through jurisdiction-specific invoice clearance, cross-border duty automation, and rule engines that adapt to real-time policy changes. Success will depend on delivering pre-certified e-invoicing modules, intelligent reconciliation workflows, and continuous configuration updates. As enterprises prioritize agility and accuracy, providers that enable real-time exception handling and offer co-engineered deployment support will drive deeper integration into core tax operations, positioning themselves as long-term transformation partners and unlocking sustained revenue in complex compliance environments.

Large enterprises are expected to hold the largest market share during the forecast period.

Large enterprises require advanced tax solutions to manage complex, multi-jurisdictional compliance and integration with ERP systems. Their scale and regulatory exposure drive demand for automation, real-time calculation, and audit-ready reporting. In October 2024, Sovos partnered with IFS to integrate its indirect tax suite into IFS Cloud, enabling embedded, real-time compliance across more than 20,000 global jurisdictions, tailored explicitly for large multinational entities.Reinforcing this shift, the April 2025 Thomson Reuters Generative AI in Professional Services Report confirmed that 21% of tax and accounting firms now deploy GenAI at scale, while 92% of corporate tax professionals expect it to be part of daily tax operations within five years. These trends signal a decisive enterprise push toward intelligent, high-capacity platforms that combine automation, compliance, and strategic insight. Providers that align with large enterprises' priorities, which are accuracy, agility, and control, will gain a competitive advantage, expand recurring revenue streams, and position themselves as core infrastructure partners in global tax modernization.

North America is expected to lead the tax management market with established regulatory frameworks, advanced digital infrastructure, and high adoption among large enterprises, while Asia Pacific is the fastest-growing region driven by accelerated e-invoicing mandates, expanding cross-border trade and government-led digitalization of tax administration systems.

North America is expected to lead the tax management market, driven by complex regulatory frameworks, high enterprise demand for automation, and early adoption of AI-powered compliance platforms. In April 2025, Intuit enhanced its TurboTax Business suite with generative AI, improving real-time tax insights and filing accuracy for corporate users. This reflects the region's focus on intelligent, large-scale tax automation. In contrast, Asia Pacific is the fastest-growing region, fueled by rapid tax digitization, cross-border trade, and government-mandated e-invoicing initiatives across India, Indonesia, and Vietnam. Enterprises actively invest in scalable, cloud-based tax platforms, creating strong opportunities for vendors to deliver localized rule engines, real-time reporting tools, and pre-integrated ERP connectors.

Breakdown of Primaries

In-depth interviews were conducted with Chief Executive Officers (CEOs), innovation and technology directors, system integrators, and executives from various key organizations operating in the tax management market.- By Company: Tier I - 40%, Tier II - 25%, and Tier III - 35%

- By Designation: C-Level Executives - 25%, D-Level Executives - 37%, and others - 38%

- By Region: North America - 38%, Europe - 24%, Asia Pacific - 40%, and Rest of the World - 6%

Research Coverage

This research report categorizes the tax management market based on Offering (Solutions (Tax Compliance & Optimization, Tax Preparation & Reporting, Audit & Risk Management Tools, Tax Analytics Tools, Document Management & Archiving), Services (Implementation & System Integration, Tax Configuration & Advisory Services, Support & Regulatory Maintenance)), Deployment Mode (Cloud, On-premises), Tax Type (Direct Taxes (Corporate Tax, Capital Gains Tax, Property Tax, Other Direct Taxes), Indirect Taxes (Value-Added Tax (VAT), Goods & Services Tax (GST), Sales Tax, Customs Duties, Other Indirect Taxes)), Organization Size (Large Enterprises, SMEs), Vertical (Banking, Financial Services & Insurance (BFSI), IT & Telecom, Retail & E-commerce, Manufacturing, Healthcare & Life Sciences, Government & Public Sector, Energy & Utilities, Other Verticals (Transportation & Logistics, Education, Construction & Real Estate)), and Region (North America, Europe, Asia Pacific, Middle East & Africa, and Latin America). The scope of the report covers detailed information regarding the major factors, such as drivers, restraints, challenges, and opportunities, influencing the growth of the tax management market. A thorough analysis of the key industry players was done to provide insights into their business overview, solutions, and services; key strategies; contracts, partnerships, agreements, new product & service launches, mergers and acquisitions; and recent developments associated with the tax management market. This report also covered the competitive analysis of upcoming startups in the tax management market ecosystem.Reason to Buy This Report

The report would provide market leaders/new entrants with information on the closest approximations of the revenue numbers for the overall tax management market and its subsegments. It would help stakeholders understand the competitive landscape and gain more insights to better position their businesses and plan suitable go-to-market strategies. It also helps stakeholders understand the market's pulse and provides information on key market drivers, restraints, challenges, and opportunities.This report provides insights on the following pointers:

- Analysis of key drivers (Global business growth demands an agile tax management infrastructure, Boosting tax accuracy & efficiency with AI, E-invoicing mandates drive tax platform modernization), restraints (Integration with legacy system delay cloud-based tax adoption), opportunities (Automation adoption by SMEs fuels tax management expansion, Advisory services boost innovation in tax management), and challenges (Shortage of skilled workforce slows tax tech adoption, Multi-system complexity hampers tax automation).

- Product Development/Innovation: Detailed insights on upcoming technologies, research & development activities, and product & service launches in the tax management market.

- Market Development: Comprehensive information about lucrative markets - the report analyzes the tax management market across varied regions.

- Market Diversification: Exhaustive information about new products & services, untapped geographies, recent developments, and investments in the tax management market.

- Competitive Assessment: In-depth assessment of market shares, growth strategies and service offerings of leading players such Avalara (US), Intuit (US), ADP (US), Thomson Reuters (Canada), Wolters Kluwer (Netherlands), H&R Block (US), SAP (Germany), Sovos (US), Vertex (US), TaxBit (US), Sailotech (US), TaxCalc (UK), Clear (India), Xero (Australia), Exemptax (US), Taxbuddy (India), Feb.ai (India), Drake Software (US), Tax Cloud (US), Lovat Software (UK), Webgility (US), Global Tax Management Inc. (US), Taxdome (US), and TaxGPT (US). The report also helps stakeholders understand the pulse of the tax management market and provides them with information on key market drivers, restraints, challenges, and opportunities.

Table of Contents

Companies Mentioned

- Wolters Kluwer

- Thomson Reuters

- Avalara

- Adp

- Vertex

- Sovos

- Intuit

- H&R Block

- SAP

- Xero

- Taxbit

- Sailotech

- Exemptax

- Clear

- Drake Software

- Taxcloud

- Lovat Software

- Webgility

- Global Tax Management Inc.

- Taxdome

- Taxgpt

- Febi.AI

- Taxbuddy

- Taxcalc

- Capium

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 295 |

| Published | July 2025 |

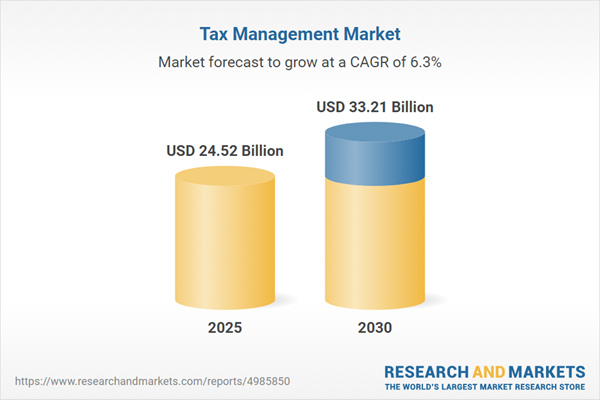

| Forecast Period | 2025 - 2030 |

| Estimated Market Value ( USD | $ 24.52 Billion |

| Forecasted Market Value ( USD | $ 33.21 Billion |

| Compound Annual Growth Rate | 6.3% |

| Regions Covered | Global |

| No. of Companies Mentioned | 25 |