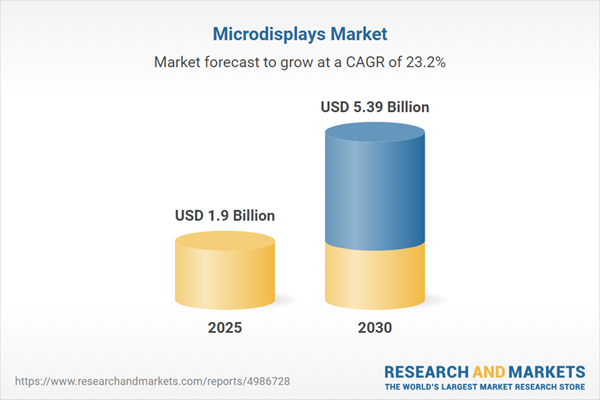

The microdisplays market, characterized by compact CMOS-based displays requiring magnifying optics, is set for rapid growth over the next five years, driven by their integration into devices like smartphones, smart bands, and cameras. Key attributes such as high resolution, pixel density, and power efficiency are fueling demand across industries, particularly in wearables, automotive, and AR/VR applications.

Market Drivers

Rising Demand for Smart Bands and Smartwatches: The surge in wearable technology, particularly in developed economies, is a primary growth driver. Enhanced functionalities and consumer preference for IoT-enabled devices like smartwatches and smart bands are boosting the market. For instance, Qualcomm’s IoT sector revenue reached USD 1.82 billion in Q2 2023, reflecting strong demand for chipsets used in these devices, which rely on microdisplays for compact, high-quality visuals.Automotive Sector Expansion: Microdisplays are increasingly vital in automotive applications, enhancing driver safety and convenience. Head-mounted microdisplays aid in prototyping vehicle designs, while OLED-based microdisplays are prioritized for rear-seat entertainment systems in vehicles, driven by consumer demand for advanced in-car experiences.

Advancements in AR and VR Technology: The automotive industry’s adoption of augmented reality (AR) head-up displays (HUDs) is a significant growth factor. Microdisplays are integral to AR HUDs, dashboard screens, and multimedia systems, providing critical information to drivers. These systems leverage technologies like RGB laser beams and holographic optical elements to project virtual images, enhancing functionality in modern vehicles.

Geographical Outlook

North America is expected to dominate the microdisplays market, driven by its leadership in AR and VR technologies. The U.S. gaming industry, a major consumer of AR/VR applications, relies on microdisplays for immersive experiences, integrating sensors like cameras and GPS to overlay graphics and audio. This regional strength underscores robust market potential.Key Developments (2023 Onward)

- In June 2023, Xiaomi launched the Watch S1 Pro, featuring a 1.47-inch touch microdisplay, Bluetooth 5.0, GPS, NFC, and health monitoring capabilities (e.g., heart rate, SpO2, sleep tracking). Its 15-day battery life and advanced features highlight the growing role of microdisplays in high-demand wearables, further driving market growth.

Challenges and Opportunities

The market faces challenges such as high development costs for advanced microdisplay technologies and the need for specialized optics, which may limit adoption in cost-sensitive sectors. However, opportunities abound in expanding wearable and automotive applications, with power-efficient and high-resolution microdisplays meeting the needs of next-generation devices. Continued advancements in AR/VR and IoT integration will further propel demand, particularly in North America and other developed markets.Key Benefits of this Report:

- Insightful Analysis: Gain detailed market insights covering major as well as emerging geographical regions, focusing on customer segments, government policies and socio-economic factors, consumer preferences, industry verticals, and other sub-segments.

- Competitive Landscape: Understand the strategic maneuvers employed by key players globally to understand possible market penetration with the correct strategy.

- Market Drivers & Future Trends: Explore the dynamic factors and pivotal market trends and how they will shape future market developments.

- Actionable Recommendations: Utilize the insights to exercise strategic decisions to uncover new business streams and revenues in a dynamic environment.

- Caters to a Wide Audience: Beneficial and cost-effective for startups, research institutions, consultants, SMEs, and large enterprises.

What do businesses use our reports for?

Industry and Market Insights, Opportunity Assessment, Product Demand Forecasting, Market Entry Strategy, Geographical Expansion, Capital Investment Decisions, Regulatory Framework & Implications, New Product Development, Competitive IntelligenceReport Coverage:

- Historical data from 2022 to 2024 & forecast data from 2025 to 2030

- Growth Opportunities, Challenges, Supply Chain Outlook, Regulatory Framework, and Trend Analysis

- Competitive Positioning, Strategies, and Market Share Analysis

- Revenue Growth and Forecast Assessment of segments and regions including countries

- Company Profiling (Strategies, Products, Financial Information, and Key Developments among others).

Microdisplays Market Segmentation

By Technology

- LCD

- LCOS

- OLED

- Others

By Application

- Near-To-Eye (NTE) Device

- Projectors

- Others

By End-User

- Consumer Electronics

- Automotive

- Aerospace & Defense

- Healthcare

- Others

By Industry

- Consumer Electronics

- Healthcare

- Automotive

- Aerospace and Defense

- Others

By Geography

- North America

- United States

- Canada

- Mexico

- South America

- Brazil

- Argentina

- Others

- Europe

- Germany

- France

- UK

- Spain

- Italy

- Others

- Middle East and Africa

- Saudi Arabia

- UAE

- Israel

- Others

- Asia Pacific

- China

- Japan

- India

- South Korea

- Thailand

- Indonesia

- Others

Table of Contents

Companies Mentioned

- SONY Group Corporation

- Himax Technologies, Inc

- Yunnan OLiGHTEK Opto-Electronic Technology Co., Ltd.

- AU Optronics Corporation

- Samsung Corporation

- Kopin Corporation

- MicrooLED

- Syndiant

- RAONTECH Inc

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 149 |

| Published | July 2025 |

| Forecast Period | 2025 - 2030 |

| Estimated Market Value ( USD | $ 1.9 Billion |

| Forecasted Market Value ( USD | $ 5.39 Billion |

| Compound Annual Growth Rate | 23.1% |

| Regions Covered | Global |

| No. of Companies Mentioned | 9 |