At the outbreak of the COVID-19 pandemic, most pharmaceutical companies and governments are working toward offering efficient medical treatment to COVID-19 patients, and drug delivery devices are expected to play a vital role in this context. For instance, according to the article 'EU regulatory roundup: Combination products, Eudamed, COVID-19 IVDs,' published in April 2021, Europe issued new guidelines related to drug-device combination products used for COVID-19 testing where it explains quality requirements that manufacturers must address in their marketing authorization reports. Such guidelines help in the development of improved drug-device combination products for COVID-19 testing, driving market growth during the pandemic. Furthermore, post-pandemic, drug-device combination products are expected to show significant growth due to the rise in the adoption of innovative products for the effective delivery of the drug, ease of use of these products, and ease of availability after the pandemic restrictions, among others.

The market is primarily driven by the growing prevalence of chronic diseases such as diabetes, respiratory diseases, and cancer and the adoption of novel drug delivery systems for these diseases. For instance, according to the IDF 2021, approximately 537 million adults are living with diabetes, and the number of people adults living with diabetes is projected to rise to 643 million by 2030 and 783 million by 2045. Such a rise in metabolic diseases is expected to drive market growth due to the rise in the adoption of drug delivery combination products in uniform drug delivery.

Moreover, expanding applications of drug-device combination products and the launch of new products over the period are expected to bolster market growth. For instance, in November 2021, Becton, Dickinson, and Company launched BD UltraSafe Plus 2.25 mL Passive Needle Guard in drug-device combination products. When combined with a prefillable syringe, the BD UltraSafe Plus 2.25 mL system enables the subcutaneous delivery of biologic solutions of different viscosities up to 30 cP and fill volumes up to 2 mL.

In addition, growing healthcare infrastructure and advances in drug delivery technologies are expected to aid the market growth over the period. However, stringent regulatory policies, product recalls, and complications associated with some of the drug-device combinations are expected to hamper the market.

Drug Device Combination Products Market Trends

Drug Eluting Stents are Expected to Grow at Notable Rates Over the Forecast Period.

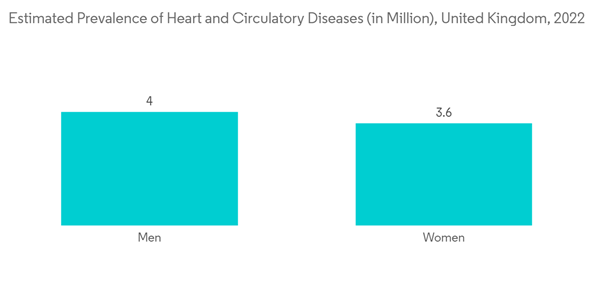

The drug-eluting stent is a semi-rigid, tube-like device that is made of metal and coated with medication that is slowly released or eluted, which helps to block cell proliferation. The introduction of the drug-eluting stent (DES) has further pushed medical technology to a new standard of care. The drug-eluting stents are of different types, first, second, and third-generation DESs (drug-eluting stents).The increasing prevalence of cardiovascular disease is one of the major factors leading to increased demand for drug-eluting stents. Additionally, key players in the studied market are focusing on frequent product developments and approvals, which is substantially driving the market growth during the forecast period.

In August 2021, in collaboration with the National University of Ireland Galway (NUI Galway), SINOMED publicized the first commercial implantation of the HT Supreme Drug-Eluting Stent (DES) at University Hospital Galway, marking the start of the European rollout. This will likely help interventional cardiologists to treat patients with coronary artery disease (CAD) who have small vessels often untreatable with larger stent technologies during the percutaneous coronary intervention (PCI).

Furthermore, the rise in initiatives from the key market players for the launch of innovative devices is expected to drive this segment's growth over the forecast period due to increased adoption. For instance, in August 2022, Medtronic launched its newest drug-eluting coronary stent, the Onyx Frontier drug-eluting stent (DES). The DES leverages the best-in-class stent platform with an enhanced delivery system designed to improve deliverability and increase acute performance in the most challenging cases.

Thus, these aforementioned factors are expected to contribute to the overall segment, with a significant growth rate expected over the forecast period.

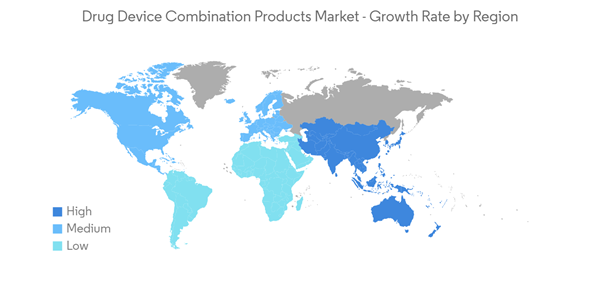

North America is Projected to Have Significant Market Share in the Market Studied

North America is projected to have a significant market share among the regions owing to the adaptation of drug-device combination products coupled with well-established healthcare infrastructure in the region.The United States is home to some of the largest research and academic institutes and pharmaceutical companies in the world. With increasing investments being made in the research and development of products by companies, there is likely to be an increase in demand for drug-device combination products since many vaccines and other therapeutics are produced by these sectors.

The United States is expected to hold a significant market in the overall drug-device combination products market throughout the forecast period due to the growing incidence of chronic diseases, the strong foothold of key market players, and the increase in the geriatric population. For instance, in March 2022, Viatris Inc received approval from the United States Food and Drug Administration (FDA) for its Abbreviated New Drug Application (ANDA) for Breyna (Budesonide and Formoterol Fumarate Dihydrate Inhalation Aerosol), the first approved generic version of AstraZeneca's Symbicort. Breyna is a drug-device combination product that is indicated for certain patients with asthma or chronic obstructive pulmonary disease (COPD). Such launches of drug-device combination products in the United States are expected to drive market growth in this region due to the rise in the adoption of such devices for controlled drug delivery.

Furthermore, the rise in partnerships and acquisitions among key market players for developing innovative products for chronic diseases is expected to surge the market growth in this region. For instance, in May 2021, Lilly partnered with four companies on insulin pen tech. These partners provide app compatibility for the Tempo Smart Button and Tempo Pen to streamline diabetes care by automating data collection for tracking insulin doses. In addition, in December 2021, Assertio Holdings, Inc. acquired Otrexup (methotrexate), a drug-device combination single dose once weekly auto-injector, from Antares Pharma, Inc.

All these factors are expected to boost the market growth in the region during the forecast period.

Drug Device Combination Products Industry Overview

The drug-device combination market is moderately fragmented, with many market players. Market players focus on new product developments, collaborations, and regional expansion to expand their market share. Some of the key market players operating in this market include Abbott Laboratories, Medtronic Plc, Boston Scientific Corp, Becton, Dickinson and Company, Novartis AG, and GlaxoSmithKline plc, among others.Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

This product will be delivered within 2 business days.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Abbott Laboratories

- Medtronic Plc

- Boston Scientific Corp

- Becton, Dickinson and Company

- Novartis AG

- GlaxoSmithKline plc

- Allergen, Inc.

- W. L. Gore & Associates, Inc.

- Stryker Corporation

- Terumo Corporation

- Mylan NV

- Cook Medical