The blood testing market was significantly impacted by the number of COVID-19 cases that increased worldwide. According to the study article published in May 2022 in Scientific Reports, a machine learning model was constructed for COVID-19 diagnosis based and cross-validated on the routine blood test of 5,333 patients with various bacterial and 160 patients having COVID-19 infections. Blood cultures are used to detect the presence of bacteria or fungi in the blood, to identify the type present, and to guide treatment. Testing is used to identify a blood infection (septicemia) that can lead to sepsis, a severe and life-threatening complication. Individuals with a suspected blood infection are often treated in intensive care units, so testing is usually done in a hospital setting.

The blood is the most important factor in the body's circulation system, along with the plasma and serum, which are widely studied for the detection of biomarkers, especially for cancer detection and early diagnosis. The growing burden of several chronic diseases has increased the demand for early and effective diagnosis, as delay in diagnosis may lead to complications and can be fatal. Therefore, these diseases are creating a burden on the healthcare system. Hence, regular monitoring and diagnosing of these diseases are recommended, which is expected to fuel the market growth during the study period. According to Globocan 2020, the new cancer cases that were diagnosed accounted for 1.92 million in 2020 globally, with 9.95 million deaths. Among all cancers, breast cancer accounted for 2.26 million new cases, followed by lung (2.20 million), prostate (1.41 million), and colon, with 1.14 million new cases in 2020.

The study article published by WHO in January 2022 stated that an estimated 100-400 million dengue infections occur each year globally. Early detection of disease progression associated with severe dengue and access to proper medical care lowers fatality rates of severe dengue to below 1%. Therefore, a decrease in mortality rate due to early diagnosis of the disease boosts the demand for timely diagnosis, thus driving the market. The increasing diversity of diseases and the growing focus on the development of better treatment options for chronic and infectious diseases drives the blood testing market globally.

Blood Culture Tests Market Trends

Automated Blood Culture Tests are Expected to Grow at a High Pace

With the need for rapid diagnosis of infections and other diseases, the automated blood culture tests segment is expected to grow at significant rates. In addition, a high adaptation of automated equipment and accuracy in the results eliminate the manual errors in the results of automated blood culture tests gaining traction in the market.According to the World Health Organization, in 2021, an estimated 12 million people were affected by tuberculosis worldwide. Tuberculosis is one of the leading causes of death around the world. The increasing prevalence of bacterial infections, especially in underdeveloped and developing countries, is expected to boost the growth of the bacterial culture testing segment. The advent of novel diagnostic technologies in culture-based tests, reduction of diagnosis time, and early prevention of disease spreading are expected to boost the growth of the market.

The advantages associated with automated blood culture drive the growth of the market. For instance, as per the National Library article published in September 2021, automated blood culture systems are intended to make the processing of blood cultures more efficient. This is accomplished by eliminating the need for blind or terminal subcultures of bottles, reducing the number of times bottles must be handled during processing, standardizing and speeding detection of microbial growth, and maximizing blood culture sensitivity and specificity. Thus, the abovementioned factors are propelling the growth of the market.

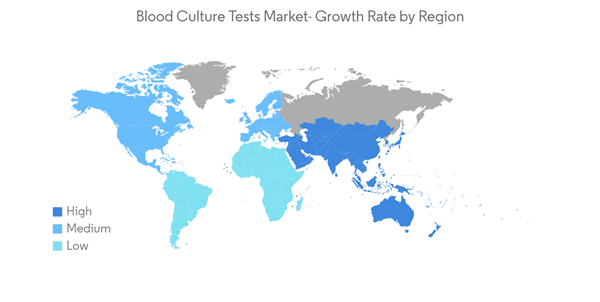

North America is Expected to Hold Significant Share

The North American region is expected to have significant market growth over the forecast period, which is mainly attributed to well-established healthcare infrastructure and better access to diagnostics. Technological advancements, awareness regarding early diagnosis, and the treatment of infectious diseases are expected to boost market growth over the forecast period.The rising burden of chronic diseases in the United States, such as diabetes, thyroid, and other diseases requiring blood tests, will boost the market studied. For instance, as per the National Diabetes Statistics Report, 2020, approximately 34.2 million people, or 10.5% of the US population, had diabetes. Type 1 diabetes accounted for about 5.2% of all diagnosed cases of diabetes, affecting approximately 1.6 million people in the United States.

Furthermore, the launch of technologically advanced blood tests in the country will also positively contribute to market growth. For instance, in January 2022, Eurofins subsidiary empowered launched PFAS Exposure in the United States, the direct-to-consumer at-home test to determine levels of Per- and Polyfluorinated Alkyl Substances (PFAS) in a person's blood and measure 47 of the PFAS forever chemical compounds. Also, in August 2021, Smart Meter launched the glucose monitor for managing gestational diabetes. It provides an easy and reliable way to test, monitor, and manage blood glucose levels, ensuring that all care providers have immediate access to testing results. Thus, the abovementioned factors are propelling the growth of the market.

Blood Culture Tests Industry Overview

The blood culture test market is moderately competitive with many market players. Market players focus on new product launches, innovations, and geographic expansions. Key market players operating in the market include Becton, Dickinson and Company, Terumo Corporation, bioMerieux, Bruker Corporation, T2 Biosystems Inc., Abbott Laboratories, Luminex Corporation, Siemens Healthineers AG, F. Hoffmann-La Roche AG, and Danaher Corporation.Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

This product will be delivered within 2 business days.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Becton, Dickinson and Company

- Terumo Corporation

- bioMerieux

- Bruker Corporation

- T2 Biosystems Inc.

- Abbott Laboratories

- Luminex Corporation

- Siemens Healthineers AG

- F. Hoffmann-La Roche AG

- Danaher Corporation