Key Highlights

- The market for nicotine gums and patches is driven by various factors, including the growing preference for smoking cessation aids, government initiatives to control tobacco consumption, and the rising number of deaths caused by smoking. For example, the United Kingdom government's objective to be smoke-free by 2030 has led to significant investments in stop-smoking services and other initiatives aimed at helping consumers quit smoking.

- Similarly, Johnson & Johnson's donation of nicotine patches to the Ministry of Health of Jordan exemplifies efforts to support smoking cessation during the COVID-19 pandemic and beyond. Cigarette smokers looking to reduce their exposure to hazardous chemicals in tobacco smoke have driven up worldwide demand for nicotine replacement therapy (NRT) products like nicotine gum in recent years. Recent developments in the worldwide NRT industry include the introduction of longer-lasting gums and the rising popularity of flavored alternatives. The number of persons utilizing nicotine replacement therapy (NRT) to help them stop smoking has also increased, as has the percentage of doctors who advocate for its use.

- The Food and Drug Administration (FDA) approves nicotine gum as a medicine to aid in quitting smoking. It is often combined with nicotine patches to manage stronger cravings and prevent withdrawal symptoms. The increasing awareness of the health hazards associated with smoking has resulted in a rise in the number of people attempting to quit smoking, thereby boosting sales of nicotine gum products.

- Moreover, the high number of deaths caused by smoking has prompted manufacturers to develop new products that reduce tobacco-related harm, thereby driving market growth. For example, according to the World Health Organization (WHO), the number of tobacco smokers in the African, American, European, and South East Asian regions will be 62, 118, 168, and 418 million, respectively 2025.

Nicotine Gum Market Trends

Rising Awareness Regarding Health Hazards Associated with Smoking

- The market for nicotine cessation products has seen a significant increase in demand from medical institutions and rehab clinics in both developed and developing countries. This trend is driven by consumers' preference for nicotine replacement therapies, such as gums and patches, to help them quit smoking due to the growing awareness of the harmful health hazards of smoking cigarettes.

- The American Heart Association (AHA) reports that smoking-related diseases result in more than 440,000 deaths yearly in the United States alone. Moreover, women aged 35 and older who smoke and take birth control pills are at a higher risk of stroke or heart disease, and cigarette smokers are 2-4 times more likely to develop heart disease than non-smokers.

- Governments are also taking comprehensive measures to reduce smoking rates, such as banning tobacco advertising and promotion, restricting smoking in public places, and implementing health education campaigns with bold health warnings on tobacco products. India's National Tobacco Control Cell (NTCC) is responsible for planning, policy formulation, monitoring, implementing, and evaluating the different activities under the National Tobacco Control Programme (NTCP). These measures have encouraged consumers to look for alternatives to reduce tobacco consumption, driving demand for the nicotine gum market.

- Additionally, the availability of various flavors has also contributed to the success of nicotine gum. Nicotine gum comes in a wide variety of flavors, including mint, fruit, and cinnamon, to make quitting smoking easier for the smoker without sacrificing flavor. Because of this, the popularity of nicotine gum has risen among smokers, who the flavor of conventional tobacco products may have turned off.

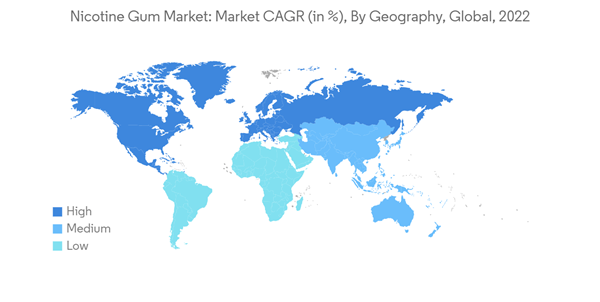

North America Holds Significant Share in the Market

- North America has experienced an increase in the percentage of health-consciousness consumers supported by government initiatives and campaigns driving market growth in the region. Moreover, the region has the presence of major brands focusing on product innovations to capture the growing demand and achieve a competitive advantage in the market.

- For instance, Nicorette has launched a new nicotine gum product coated with ice mint lozenge with a smoother texture. Such factors are anticipated to drive the market growth during the study period. The United States holds the major share of the North American nicotine gum market.

Nicotine Gum Industry Overview

The market for nicotine gum is highly competitive, with numerous global, regional, and private-label companies vying for a significant market share. Key players in the market include British American Tobacco, Haleon Group of Companies, Johnson & Johnson, Perrigo Company plc, and Philip Morris International Inc., among others.Key players are focused on expanding their product portfolios and offering unique products, such as sugar-free gums, to differentiate themselves from the competition and meet the increasing demand for nicotine gum. Manufacturers are also attempting to improve nicotine gum's taste, flavors, and functionality and are promoting their products through various marketing campaigns to gain a competitive edge.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

This product will be delivered within 2 business days.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- British American Tobacco

- Haleon Group of Companies

- ITC Limited

- Johnson & Johnson

- Perrigo Company plc

- Philip Morris International Inc.

- Rubicon Research (Rubicon Consumer Healthcare)

- Alchem International Pvt. Limited

- Cipla Limited

- Die betapharm Arzneimittel GmbH

- Alkalon A/S