COVID-19 impacted the growth of the spirometer market owing to the decline in the diagnosis and treatment of patients suffering from respiratory diseases. For instance, according to the research study published in Elsevier Public Health Emergency, September 2021, it has been observed that the use of spirometry is restricted to immunocompromised patients for urgent treatment only, such as bone marrow transplants, lung transplants, and pre-chemotherapy treatments. Also, according to the research study published in PLOS One in February 2021, it has been observed that the risk for all-cause mortality is approximately two times higher in patients with COPD than in those without COPD, and a steep decline in visits to hospitals and clinics due to the lockdown measures imposed by the government has severely impacted the market growth during a pandemic. However, resumed diagnosis and treatment services for respiratory diseases and increased patient visits have increased market growth, are expected to regain their potential over the years, and may record healthy growth during the forecast period.

Factors such as the rise in the prevalence of chronic obstructive pulmonary disease (COPD), technological advancements in the field of spirometers, and a growing preference for home healthcare are boosting market growth.

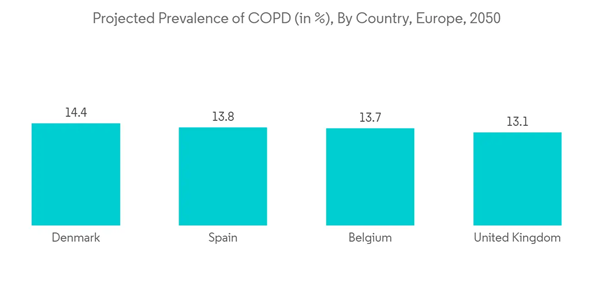

The rising burden of COPD among the population raises the need for early detection of the COPD condition, which is expected to fuel the demand for spirometry tests. This is anticipated to augment market growth over the forecast period. For instance, as per an article published in the European Respiratory Journal, in November 2021, about 49,453,852 Europeans are expected to suffer from COPD by 2050, as compared to 36,580,965 in 2020. In addition, as per the same source, the Netherlands is expected to have the highest prevalence of COPD (14.6%) in Europe by 2050.

Additionally, according to the study published in PLOS ONE in January 2021, in France, there are currently 2.6 million people who have chronic obstructive pulmonary disease (COPD), and by 2025, that number is expected to rise to 2.8 million. Also, as per the 2022 statistics published by the NHS, about 1.17 million people in England were diagnosed with chronic obstructive pulmonary disorder (COPD) in 2020-2021, accounting for 1.9% of the total population. Thus, the expected increase in the number of people suffering from COPD is expected to increase the demand for technologically advanced spirometers, hence propelling market growth.

Furthermore, technological advances and the increasing portability and ease of operation of devices are anticipated to drive segment growth. For instance, in March 2021, Vyaire Medical launched the AioCare (HealthUp SA, Poland) mobile spirometry system in more than 15 countries, including Australia and other countries. This clinically proven technology expands upon Vyaire's deep respiratory diagnostics expertise and allows physicians to promptly diagnose pulmonary diseases including asthma and COPD as accurately as hospital-grade spirometers.

Moreover, the preference for home healthcare has increased among patients, which has increased the development of tele-spirometers or virtual spirometry tests, which is also contributing to the market's growth. For instance, in June 2021, eResearch Technology (ERT) launched ERT iSpiro Virtual Visits, which enables real-time coaching during at-home pulmonary function tests (PFT). iSpiro Virtual Visits makes it possible to gather high-quality spirometry data at home, keeping respiratory clinical studies on schedule, even when a patient is unable to visit a clinic.

Therefore, owing to the aforementioned factors, the studied market is expected to grow over the forecast period. But not enough people know about chronic obstructive pulmonary disease (COPD), which is likely to slow the growth of the spirometer market over the next few years.

Spirometers Market Trends

Hand-Held is Expected to Witness Significant Growth in the Spirometers Market

The hand-held spirometers segment is expected to witness significant growth in the spirometers market over the forecast period owing to factors such as the increasing number of COPD and asthma cases, the growing number of smokers across the globe, and increasing product launches.Hand-held spirometers are small, lightweight, and easily portable, thereby becoming more ubiquitous in the industry. The advantages of hand-held spirometers over conventional spirometers, such as being easy to use and being able to be used outside the hospital setting too, are expected to augment segment growth.

According to an article published in Primary Care Respiratory Medicine in April 2022, the accuracy of three portable spirometers, the PIKO-6, COPD-6, and PEF, was determined. It has been observed that the accuracy of PIKO-6 was higher (0.95) than that of COPD-6 (0.91) and PEF (0.82). In addition, as per the same source, portable spirometers, such as the PIKO-6 and COPD-6, can provide a variety of respiratory function indicators that aid in the diagnosis of COPD patients, as well as in determining the severity of the condition and assisting in the selection of an effective treatment strategy. Thus, portable spirometers are ideal for primary care use and offer a practical method for the early detection of COPD due to their high accuracy, user-friendliness, patient-friendliness, affordability, and portability. This is expected to increase their adoption among patients, hence propelling the segment's growth.

Furthermore, the rising company activities and increasing product launches are also expected to increase the availability of hand-held spirometer devices, which in turn is anticipated to fuel the segment's growth. For instance, in November 2021, Cipla launched a pneumotach-based portable, wireless spirometer in India. With this launch, the company intends to revolutionize obstructive airway disease (OAD) diagnosis, in line with its ambition to strengthen its position as the lung leader in India.

Therefore, owing to the aforementioned factors, such as the growing number of smokers, the increasing burden of COPD, and increasing product launches, the studied segment is expected to grow over the forecast period.

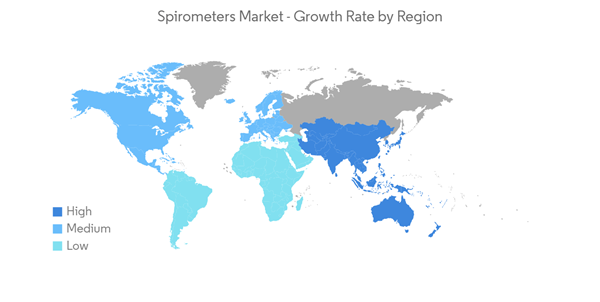

North America is Expected to Have the Significant Market Share Over the Forecast Period

North America is expected to witness healthy growth in the spirometer market over the forecast period. The factors contributing to market growth are the rising prevalence and incidences of respiratory diseases, the presence of a well-established healthcare infrastructure along with high healthcare spending, and the growing adoption of home-health devices among consumers.The rising burden of respiratory diseases such as asthma, COPD, and others is expected to increase the demand for spirometers, thereby boosting market growth. For instance, according to the Asthma and Allergy Foundation of America (AAFA), in April 2022, roughly 1 in 13 Americans had asthma, which is about 25 million people. According to the same source, about 5.1 million American children have asthma under the age of 18. The same source stated that asthma is more common in female adults than in male adults.

Furthermore, the United States is under pressure to reduce the burden of respiratory disease, and the economic impact is significant.For instance, in an article published in the International Journal of COPD in March 2021, the researchers estimated that the annual direct costs of COPD in the United States are USD 18 billion and are expected to reach USD 22 billion by 2030.

Furthermore, the rise in the number of initiatives undertaken by government and non-government organizations is increasing overall revenue. For instance, the CDC's National Asthma Control Program (NACP) provides funds for educating asthma-affected patients. Such initiatives are likely to increase awareness about asthma, which will increase the adoption of spirometry tests, which in turn is anticipated to augment market growth over the forecast period.

Moreover, the increasing product approvals and launches in the region are also contributing to market growth. For instance, in April 2021, Vitalograph launched a next-generation Pneumotrac spirometer in the United States. The Pneumotrac spirometer is integrated with Spirotrac PC software and is a powerful tool for respiratory diagnosis in both adults and pediatrics.

Therefore, owing to factors such as the high burden of respiratory diseases and increasing product approvals, the studied market is expected to grow in the North America region over the forecast period.

Spirometers Industry Overview

The spirometer market is moderately fragmented and consists of several major players. There has been a significant presence of companies that are significantly contributing to the market's growth. Product innovation and ongoing R&D activities to develop advanced technologies have helped boost the growth of the market. Some of the major players in the market are MGC Diagnostics Corporation, NDD Medical Technologies, KoKo PFT, Koninklijke Philips N.V., and ICU Medical, Inc., among others.Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

This product will be delivered within 2 business days.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Baxter International (Hill-Rom Services, Inc)

- Jones Medical Instrument Company

- MGC Diagnostics Corporation

- Midmark Corporation

- NDD Medical Technologies

- KoKo PFT

- OHD (SCHAUENBURG International Group)

- Koninklijke Philips N.V.

- ICU Medical, Inc.

- Teleflex Incorporated

- Vitalograph

- Vyaire Medical Inc.