The COVID-19 pandemic had a significant impact on the growth of the market. With the nationwide lockdowns, the number of people getting on the roads declined, and there was a drastic decrease in the number of accidents and injuries. For instance, as per the article published by Wound Repair and Regeneratiound Repair and Regeneration in October 2021, levels 2-5 evidence revealed a paradigm shift in wound care toward hybrid telemedicine and home healthcare models to keep patients at home to minimize the number of in-person visits at clinics and hospitalizations, except in severe cases such as chronic limb-threatening ischemia. Hence, all the factors mentioned above showed that COVID-19 had a notable impact on the negative pressure wound therapy market. However, as the pandemic has currently subsided, the market is expected to experience pre-pandemic levels of growth during the forecast period of the study.

Negative pressure wound therapy (NPWT) is the most preferred choice of treatment, especially for deep acute wounds and persistent chronic wounds, including leg ulcers. Some of the factors that are driving the overall market growth are the increasing number of accidents and traumatic events, rising chronic wounds such as diabetic foot ulcers, and technological advancements in NPWT devices.

Chronic wounds lead to complications such as infection, ulceration, and insufficient blood supply, thus prolonging the wound healing period. The most common chronic wounds include venous ulcers, diabetic foot ulcers, and pressure ulcers. As per the 2022 update from the International Diabetic Federation (IDF), approximately 537 million adults (20-79 years) were living with diabetes in 2021. The total number of people living with diabetes is projected to rise to 643 million by 2030 and 783 million by 2045. Moreover, as per the IDF 2021 report, diabetic foot ulcers affect 40 to 60 million people globally. As a result, the market is likely to grow due to the increased prevalence of diabetic foot ulcers. Also, the localized use of negative pressure wound therapy in infected wounds offers advantages such as wound drainage, angiogenesis stimulation, proteinase excretion, and decreased local and systemic bacterial load.

Moreover, the study published by Sage Journals in August 2021 reported that venous leg ulcers (VLU) account for 70% of all chronic leg ulcers and are associated with a recurrence rate of 60-70% at 10 years. The deep venous ulcers are responsible for 90% of the venous return to the right atrium from the lower extremities. Such a recurrence of the condition creates the need for NPWT devices and is thus expected to drive the growth of the market.

Additionally, the developments by various market players are also expected to boost the market growth. For instance, in March 2022, Cork Medical entered into a partnership with MedTech Solutions Group (MTSG). As per the agreement, MTSG will manage Cork Medical's international negative pressure wound therapy (NPWT) business in all countries except the United States. Such strategic initiatives are expected to boost the growth of the market.

Thus, due to the above-mentioned factors such as the high prevalence of chronic wounds and the developments by market players, the negative pressure wound therapy market is expected to grow at a significant rate during the forecast period. However, the high cost of devices and treatment can restrain the market's growth.

Negative Pressure Wound Therapy Market Trends

Diabetic Foot Ulcers Segment is Expected to Have a Significant Market Share During the Forecast Period

A diabetic foot ulcer is an open sore or wound that occurs in patients with diabetes and is commonly located on the bottom of the foot. The use of negative pressure wound therapy (NPWT) was found to be effective in achieving faster wound bed granulation in diabetic foot ulcers. Due to the increased application of NPWT in diabetic foot ulcers, this segment is expected to project significant growth over the forecast period.Moreover, according to the International Diabetes Federation Diabetes Atlas, February 2022 report, an estimated 61 million adults (20-79 years) were living with diabetes in the Europe Region in 2021. The number of adults with diabetes is predicted to rise to 69 million by 2045, an increase of 13%. The surge in the prevalence of diabetes among all ages in the European Region is likely to increase the cases of diabetic foot ulcers, which will ultimately augment the segment's growth. Due to the increasing number of people with diabetic foot ulcers globally, there is a growing demand for negative pressure wound therapy devices, as it is one of the most efficacious, safe, and cost-effective methods of treating diabetic foot ulcers.

Additionally, the growing number of studies demonstrating the importance of NPWT is also expected to propel the growth of the segment. For instance, an article published by Burns & Trauma in June 2021 concluded that the treatment of diabetic foot requires a cross-disciplinary and systematic approach, within which NPWT is an important adjunct treatment for diabetic foot wounds. It also reported that the standardised management and application of NPWT may improve wound exudate drainage, enhance blood perfusion, and promote wound healing.

Hence, due to the efficacy of negative pressure wound therapy in healing diabetic foot ulcers in less time, the demand for negative pressure wound therapy is increasing. Adding to that, the rising incidence and prevalence of diabetic foot ulcers across the globe also fuel the segment's growth. Thus, the market segment is expected to show significant growth over the forecast period.

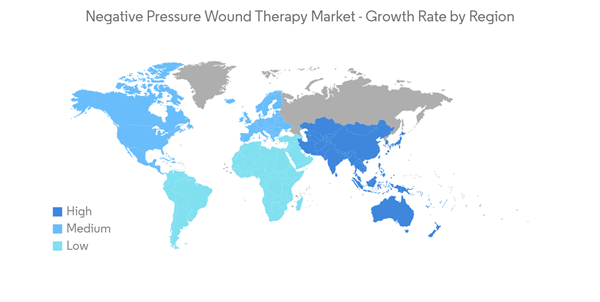

North America is Expected to Hold a Significant Share in the Market Over the Forecast Period

North America is expected to hold a significant market share in the negative pressure wound therapy market due to the rising prevalence of chronic wounds and the increased number of accidents in this region. The United States, being one of the most developed economies and technologically advanced countries, holds a notable share of the studied market.The high burden of diabetes in the region is also expected to drive the growth of the market. For instance, according to the International Diabetes Federation, in 2021, there were 32.2 million prevalent cases of diabetes (20-79 years old) in North America, and this is expected to reach 36.8 million by 2045. Such an increasing burden of diabetes raises the risk of diabetic foot ulcer and is thus expected to drive the growth of the market.

Additionally, the strategic initiatives taken by the market players are expected to drive the growth of the market in the region. For instance, in April 2021, Joerns Healthcare signed a distribution agreement with Medela to distribute Medela's negative pressure wound therapy (NPWT) product line on a national basis to skilled nursing and long-term acute care hospital settings. Also, the market players are focusing on user experience to gain a competitive edge.

Thus, owing to the abovementioned factors, such as the rising prevalence of chronic wounds and the strategic initiatives by market players, the studied market is expected to show significant growth in the North American region over the forecast period.

Negative Pressure Wound Therapy Industry Overview

The market for negative pressure wound therapy is moderately competitive with the presence of most international companies. In terms of market share, a few of the major players are currently dominating the market. Some of the companies which are currently dominating the market are 3M, Smith & Nephew, Molnlycke Health Care AB, Covatec Inc., Cardinal Health, and others.Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

This product will be delivered within 2 business days.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- 3M

- Talley Group Ltd

- Smith & Nephew

- Otivio (FlowOx)

- Molnlycke Health Care AB

- Medela AG

- DeRoyal Industries Inc.

- ConvaTec Inc.

- Cardinal Health

- Paul Hartmann AG