Due to the COVID-19 pandemic and with the travel restrictions and social distancing norms imposed, all recreational activities were muted. Consequently, the recreational boating market saw a dip in its revenues. With no public movement and the down phase of global economy, neither new purchases were made, nor any transactions occurred. This forced the market toward economic downfall.

The recreational boating industry continues to attract large volumes of participants competing strongly with rival luxury leisure pursuits. It is estimated that there are at least 140 million active boaters and watersports participants worldwide, including almost 100 million across the United States and Canada, a further 36 million across Europe, and more than 5 million in Australia.

The growth in the watersports tourism industry is majorly driving the recreational boating market. Rising attraction toward recreation activities and watersports from millennial and post-millennial generations is further boosting the demand in the market studied. However, dynamics in the cost range of diversified boats might serve as a challenge.

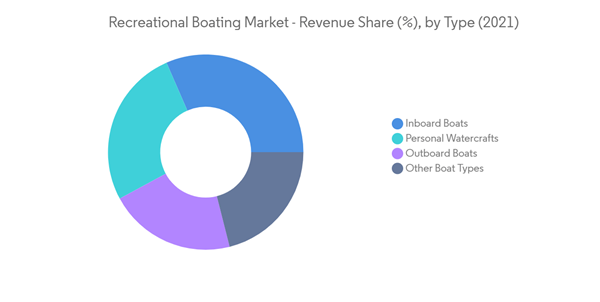

At present, the recreational boating industry represents a small percentage of the overall global leisure industry; however, the share of recreational boats is anticipated to grow over the Forecasts period.

Key Market Trends

Increasing Watersports and Recreational Activities

The growing interest of people in outdoor recreational activities and increased participation rates across all age groups for the same are some of the major factors driving the recreational boating industry.

Watersports are becoming popular not only for the excitement or adrenaline rush of getting fit but also because of several health benefits. As a result, increasing health benefits associated with water sports are supporting market growth worldwide.

A study from North Carolina State University found that outdoor play and nature-based activities helped buffer some of the negative mental health impacts of the COVID-19 pandemic for adolescents. In 2020, the coronavirus pandemic fueled the surge in recreational boat sales which is registered on the sales volume during 2021 and presumed to continue in 2022 as well.

New age groups and female boat buyers played a huge role in the growth which is further capitalize by the players by expanding their product portfolio and introducing new technologies. For Instance, Tiaga offers Orca electric jet ski in their portfolio, the electric watercraft space has begin to shape the business sphere. The watercraft is offered with a 23-kWh battery pack. Its electric powertrain generates over 134 kW and can achieve a top speed of up to 104km/h.

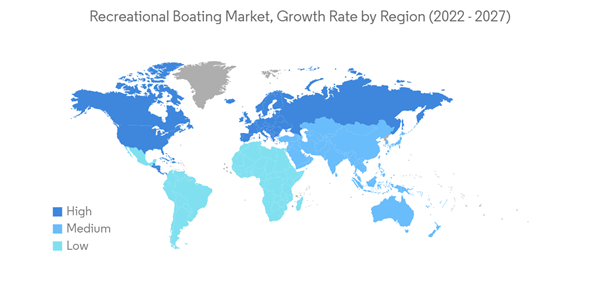

The North American Region is Likely to Dominate the Market

There is already an uptrend in the domestic boating industry, where people are opting to do watersports in their own country rather than going foreign. This ongoing trend is boosting the watersport industry domestically.

The National Marine Manufacturers Association (NMMA) reported that retail unit sales of new powerboats in the United States exceeds 300,000 Units for two consecutive years during 2020 and 2021. Moreover NMMA has announced that the year 2022 will remain positive and the sales volume of new boats may increase by 3% as compared to 2021.

Additionally, restrictions are likely to continue into 2021, which will fuel the demand for safe outdoor recreation activities, including boating.

According to the US Bureau of Economic Analysis (BEA), around 100 million Americans go boating each year. Outdoor recreation makes up 2.1% of country’s GDP, generating USD 788 billion in real gross output. Boating and fishing are the largest outdoor recreation activities in the country, totaling near to USD 23.6 billion.

Another country where the recreational boating industry is a major contributor to the economy is Canada. Canadian pastime brings more than 12 million people together on the water every year, thereby generating more than USD 10 billion in revenues and has a GDP impact of USD 5.6 billion.

Competitive Landscape

The recreational boating market is fragmented and dominated by industry players such as American Sail Inc., Ferretti, Sunseeker, Beneteau, Brunswick, MacGregor, Azimut-Benetti, Hunter, Hobie Cat Corporation, Princess Cruise, Bavaria Yachtbau, and Catalina Yachts. The boat manufacturers are expanding their business to increase their revenue generation opportunities. For instance:

- In March 2022, Sportsman Manufacturing Inc. has announced to invest USD 8 million to expand their operations in Dorchester County, South Carolina, this will increase the manufacturing capacity of company in order to meet the growing demands.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

This product will be delivered within 2 business days.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Groupe Beneteau

- Azimut Benetti Group

- Marine Product Corporation

- Bennington Marine LLC

- Sunseeker International Limited

- Ranger Boats

- Catalina Yachts

- Brunswick Corporation

- Hobie CAT Company

- Bavaria Yachtbau

- Mahindra Odyssea

- Tracker Boats

- Godfrey Pontoon Group

- Ferretti Group

- Sportsman Boats Manufacturing Inc.