The Hodgkin lymphoma (HL) treatment market is expected to register a CAGR of 12.5% during the forecast period.

Patients with Hodgkin lymphoma are at a higher risk for SARS-CoV-2 infection as they typically receive immunosuppressive and chemotherapy drugs during treatment. For instance, in November 2021, a research study published by the Baishideng Publishing Group Inc. stated that patients with lymphoma appeared particularly vulnerable to SARS-CoV-2 infection, only partly because of the detrimental effects of the anti-neoplastic regimens (chemotherapy, pathway inhibitors, monoclonal antibodies) on the immune system. Furthermore, according to the same source, there is an increased risk of COVID-19-related serious events (ICU admission, mechanical ventilation support, or death) in patients with lymphomas as compared to COVID-19 patients without cancer and confirms the high vulnerability of such patients in the current pandemic. Hence, with the vulnerability of Hodgkin lymphoma to COVID-19, the need for its treatment has increased, driving the growth of the market. Additionally, there is better access to treatment as compared to the initial pandemic phase due to the lockdown, the market has reached its pre-pandemic level growth and is expected to grow significantly over the forecast period.

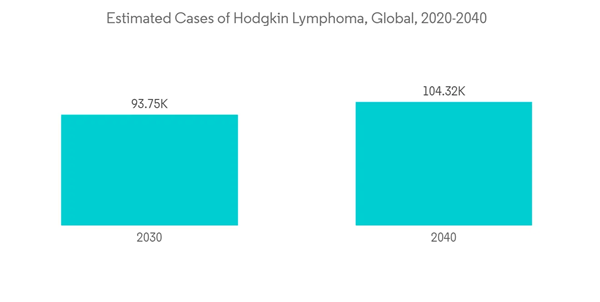

The growing burden of Hodgkin lymphoma as well as increasing awareness about it and high unmet needs in older patients and patients with relapsed or refractory (R/R) HL are key factors expected to drive the market over the forecast period. For instance, according to a CDC update in September 2022, the estimated 5-year limited duration prevalence counts for Hodgkin Lymphoma, is 38,289 out of which 17,437 are female and 20,851 are male. Various research studies on the efficacy of better treatments have been conducted. For instance, in June 2022, a research study published by the Journal of Clinical Oncology stated that the anti-CD30 antibody-drug conjugate, Brentuximab vedotin (Bv) is approved for adults with advanced-stage HL but its use has not been established in children or adolescents. Brentuximab vedotin with AVE-PC in a dose-intensive regimen has superior efficacy to ABVE-PC for pediatric patients with high-risk HL. A 59% risk reduction in EFS was achieved with no increase in toxicity. Such development is expected to drive the growth of the market over the forecast period.

Several biopharmaceutical companies are seeking approval for the advancement of Hodgkin lymphoma to improve the treatment which is expected to drive the market growth over the forecast period. For instance, in November 2022, the FDA approved brentuximab vedotin (Adcetris, Seagen, Inc.) in combination with doxorubicin, vincristine, etoposide, prednisone, and cyclophosphamide for pediatric patients two years of age and older with previously untreated high-risk classical Hodgkin lymphoma (cHL). This is the first pediatric approval for brentuximab vedotin.

Hence, various ongoing studies on HL to provide better treatment options and product approval is contributing to the overall market growth. However, adverse long-term side effects and the high cost of treatment are expected to restrain the growth of the Hodgkin lymphoma treatment market.

Many companies entered into a partnership to provide the radiopharmaceutical industry with a unique service solution for the treatment of cancers. For instance, in July 2021, Oncodesign, Covalab, CheMatech, and ABX-CRO entered into a partnership to launch the DRIVE-MRT (Molecular Radiotherapy) solution, which will have all technologies related to the validation of targets, the generation, and optimization of vectors, and the radiochemistry and PET/SPECT imaging techniques. Likewise, in May 2021, United Imaging, a China-based company involved in medical imaging and radiotherapy equipment, launched its uAIFI Technology Platform for MR and uExcel Technology Platform for PET/CT at the China International Medical Equipment Fair (CMEF).

Various research and clinical trials have provided insight into Hodgkin's lymphoma treatment. For instance, in June 2022, Roswell Park Comprehensive Cancer Center showed that a combination of brentuximab vedotin (Bv) and standard chemotherapy is safe and more effective than standard chemotherapy in pediatric patients up to age 21 years with newly diagnosed high-risk Hodgkin lymphoma. Such studies will increase the market share by improving the advantages of the established treatment. Thus, the increasing number of new cases, developed healthcare infrastructure and advanced treatment options are contributing to the growth of the Hodgkin lymphoma treatment market.

This product will be delivered within 2 business days.

Patients with Hodgkin lymphoma are at a higher risk for SARS-CoV-2 infection as they typically receive immunosuppressive and chemotherapy drugs during treatment. For instance, in November 2021, a research study published by the Baishideng Publishing Group Inc. stated that patients with lymphoma appeared particularly vulnerable to SARS-CoV-2 infection, only partly because of the detrimental effects of the anti-neoplastic regimens (chemotherapy, pathway inhibitors, monoclonal antibodies) on the immune system. Furthermore, according to the same source, there is an increased risk of COVID-19-related serious events (ICU admission, mechanical ventilation support, or death) in patients with lymphomas as compared to COVID-19 patients without cancer and confirms the high vulnerability of such patients in the current pandemic. Hence, with the vulnerability of Hodgkin lymphoma to COVID-19, the need for its treatment has increased, driving the growth of the market. Additionally, there is better access to treatment as compared to the initial pandemic phase due to the lockdown, the market has reached its pre-pandemic level growth and is expected to grow significantly over the forecast period.

The growing burden of Hodgkin lymphoma as well as increasing awareness about it and high unmet needs in older patients and patients with relapsed or refractory (R/R) HL are key factors expected to drive the market over the forecast period. For instance, according to a CDC update in September 2022, the estimated 5-year limited duration prevalence counts for Hodgkin Lymphoma, is 38,289 out of which 17,437 are female and 20,851 are male. Various research studies on the efficacy of better treatments have been conducted. For instance, in June 2022, a research study published by the Journal of Clinical Oncology stated that the anti-CD30 antibody-drug conjugate, Brentuximab vedotin (Bv) is approved for adults with advanced-stage HL but its use has not been established in children or adolescents. Brentuximab vedotin with AVE-PC in a dose-intensive regimen has superior efficacy to ABVE-PC for pediatric patients with high-risk HL. A 59% risk reduction in EFS was achieved with no increase in toxicity. Such development is expected to drive the growth of the market over the forecast period.

Several biopharmaceutical companies are seeking approval for the advancement of Hodgkin lymphoma to improve the treatment which is expected to drive the market growth over the forecast period. For instance, in November 2022, the FDA approved brentuximab vedotin (Adcetris, Seagen, Inc.) in combination with doxorubicin, vincristine, etoposide, prednisone, and cyclophosphamide for pediatric patients two years of age and older with previously untreated high-risk classical Hodgkin lymphoma (cHL). This is the first pediatric approval for brentuximab vedotin.

Hence, various ongoing studies on HL to provide better treatment options and product approval is contributing to the overall market growth. However, adverse long-term side effects and the high cost of treatment are expected to restrain the growth of the Hodgkin lymphoma treatment market.

Hodgkin Lymphoma Treatment Market Trends

Radiotherapy Segment is Expected to Register a Significant Growth over the Forecast Period

Radiotherapy is a well-established technique for destroying Hodgkin’s disease cells by using high-energy beams or particles to kill cancer cells and may be delivered from a source outside the body, i.e., external beam radiation or internally, such as brachytherapy. Radiotherapy remains an integral component in the management of many patients with Hodgkin lymphoma, and its role is stage-dependent.Many companies entered into a partnership to provide the radiopharmaceutical industry with a unique service solution for the treatment of cancers. For instance, in July 2021, Oncodesign, Covalab, CheMatech, and ABX-CRO entered into a partnership to launch the DRIVE-MRT (Molecular Radiotherapy) solution, which will have all technologies related to the validation of targets, the generation, and optimization of vectors, and the radiochemistry and PET/SPECT imaging techniques. Likewise, in May 2021, United Imaging, a China-based company involved in medical imaging and radiotherapy equipment, launched its uAIFI Technology Platform for MR and uExcel Technology Platform for PET/CT at the China International Medical Equipment Fair (CMEF).

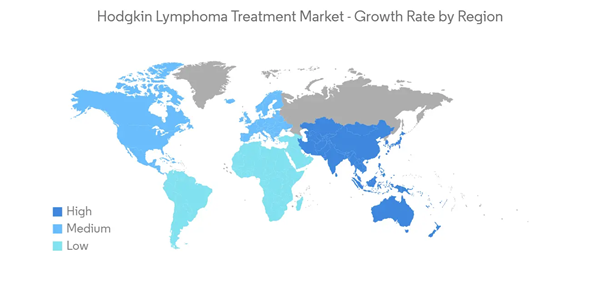

North America Expected to Hold a Significant Market Share in the Hodgkin Lymphoma Treatment Market

North America is expected to hold a significant position in the global market due to the rising prevalence of Hodgkin lymphoma coupled with recent developments by key market players. For instance, the American Cancer Society’s estimates for Hodgkin lymphoma in the United States for 2023 are about 8,830 new cases. Additionally, according to an article published by the American Journal of Hematology in September 2022, Hodgkin lymphoma affects 8,540 new patients annually and represents approximately 10% of all lymphomas in the United States. Due to the increasing burden of Hodgkin lymphoma cancer, the market is expected to grow in the region over the forecast period.Various research and clinical trials have provided insight into Hodgkin's lymphoma treatment. For instance, in June 2022, Roswell Park Comprehensive Cancer Center showed that a combination of brentuximab vedotin (Bv) and standard chemotherapy is safe and more effective than standard chemotherapy in pediatric patients up to age 21 years with newly diagnosed high-risk Hodgkin lymphoma. Such studies will increase the market share by improving the advantages of the established treatment. Thus, the increasing number of new cases, developed healthcare infrastructure and advanced treatment options are contributing to the growth of the Hodgkin lymphoma treatment market.

Hodgkin Lymphoma Treatment Industry Overview

The Hodgkin lymphoma treatment market is moderate due to the presence of companies operating globally and regionally. The competitive landscape includes an analysis of a few international as well as local companies which hold significant market shares and are well known, including Bristol-Myers Squibb Company, Merck & Co. Inc., Biogen Inc., Amneal Pharmaceuticals, Inc., Seagen Inc., among others.Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

This product will be delivered within 2 business days.

Table of Contents

1 INTRODUCTION

4 MARKET DYNAMICS

5 MARKET SEGMENTATION (Market Size by Value - USD million)

6 COMPETITIVE LANDSCAPE

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Actiza Pharmaceutical Private Limited

- Alkem Laboratories

- Amneal Pharmaceuticals, Inc.

- Biogen Inc.

- Bristol-Myers Squibb Company

- F Hoffmann-La Roche Ltd

- Incyte Corp

- LGM Pharma

- Merck & Co. Inc.

- Seagen Inc.

- Teva Pharmaceutical Industries Ltd.

Methodology

LOADING...