The emergence of the COVID-19 pandemic had an adverse effect on the Canadian healthcare system. Due to the fear of the risk of contamination and other factors such as the diversion of resources to COVID-19 care, the number of surgeries performed in the nation reduced drastically, which impacted the growth of the general surgical devices market. For instance, as per the report published by CIHI in May 2022, since the start of the pandemic, there have been around 600,000 fewer procedures conducted in Canada, with joint replacements and cataract operations accounting for about 25% of the overall decline. Hence, the wait times for patients in Canada have gotten longer. The increase in the number of people requiring surgery is expected to create a demand for general surgical devices in the nation, which is likely to propel the growth of the market over the forecast period.

The factors that are accelerating the growth of the market include increasing demand for surgeries and advancements in general surgical devices and rising expenditure on health. For instance, as per CIHI, in 2021 the estimated hip replacement surgeries wait times in Canada is reported as 369 days to reach the 90% percentile of cases to be completed. Thus the large wait times are expected to have a high demand for surgeries in the region. Furthermore, there is a rising interest in the utilization of technologically advanced minimally invasive devices in the nation which increases the usage of surgical devices and drives the market over the study period. For instance, in June 2022, Olympus performed the first commercial treatment of benign prostatic hyperplasia (BPH) in Canada using the minimally invasive iTind device. Thus the usage of minimally invasive devices in various applications increases the scope of the general surgical devices that helps in the growth of the market during the forecast period.

Moreover, the new product approvals and launches in the region help to improve the efficiency of the surgeries performed owing to technological advancements, which are likely to add to the market growth. For instance, in May 2021, Santen Canada Inc a subsidiary of Santen Pharmaceutical Co., Ltd. received approval from Health Canada for its PRESERFLOTM MicroShunt. PRESERFLO MicroShunt is a surgical device that helps to drain eye fluid and reduce intraocular pressure (IOP) in patients with primary open-angle glaucoma (POAG) whose IOP is not controlled when using maximum tolerated glaucoma medications. Such product launches increase the usage of devices with new applications which aid in the market growth in the nation over the study period. Therefore, owing to the aforementioned factors the studied market is anticipated to witness growth over the analysis period. However, the high capital expenses required for the manufacturing of surgical equipment are likely to slow down the growth of the studied market over the forecast period.

Canada General Surgical Devices Market Trends

Handheld Devices Segment Under Product is Expected to Record Highest CAGR Over the Forecast Period

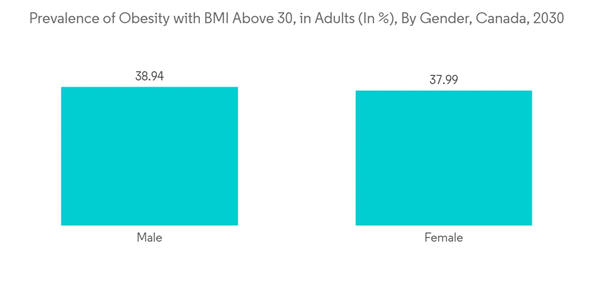

Handheld surgical devices are being widely used due to the advancements that aid in easier and more efficient surgical outcomes. Some of the most often used handheld surgical devices include graspers, dilators, retractors, scalpels, and forceps. All these devices have various applications in departments like neurosurgery, cardiovascular, orthopedic, plastic and reconstructive surgery, obstetrics, and gynecology. The development of advanced robotic hand-held surgical devices for laparoscopic interventions enhances a surgeon’s dexterity, making the device a desirable option. Hence, the handheld devices segment is expected to hold the largest market share during the forecast period.The rising prevalence of obesity in the region is expected to increase the demand for liposuction procedures which is expected to increase the growth of the market. For instance, as per the report published by World Obesity Federation 2022, the prevalence of obesity in Canada is estimated at 38.5% by 2030, which is considered very high. Hence the demand for liposuction procedures is expected to increase which needs handheld liposuction devices thereby increasing the growth of the segment over the forecast period.

Moreover, the recent product launches by key market players in the country focusing on handheld surgical instruments are likely to play a vital role in the growth of the segment. For instance, in November 2021, Smith and Nephew launched its Real Intelligence brand of enabling technology solutions, as well as its next-generation handheld robotics platform, the CORI Surgical System, in Canada. Such product launches with new technology increase the scope and add to the segmental growth in the nation over the forecast period.

Orthopaedic Application Segment is Expected to Have a Significant Growth Over the Forecast Period

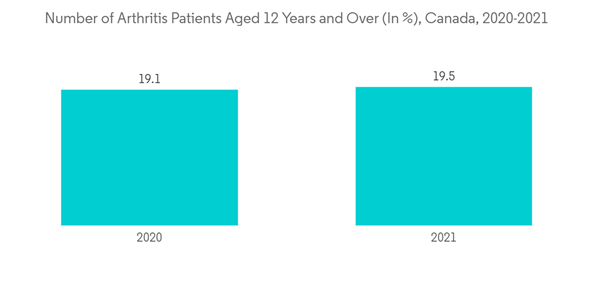

The application of general surgical devices in orthopedics is expected to have a significant impact on the market due to the large waiting time for orthopedic surgeries and the growing elderly population in the region. For instance, as per the Fraser Institute, 2021, the number of orthopedic surgeries for which patients are waiting after an appointment with a specialist in Ontario, Canada is estimated as 46,542 in 2021 compared to the previous year. It also stated that orthopedic surgeries had the longest wait time in Canada, with a national average of 30.2 weeks in 2021. Furthermore, as per the Health Authorities in British Columbia, 2022, the surgery wait time for an adult - hip replacement surgery is estimated at 48.1 weeks to complete 90% of hip replacements. The cases waiting for hip replacement surgery as of September 2022 are estimated at 4,368 which is expected to grow over the period. Thus, the increase in the wait time for orthopedic surgeries will pool the cases for the future which is going to increase the demand for general surgical devices and boost the market growth over the forecast period.Moreover, with the implementation of new technology in surgical procedures, it is expected to have growth in the surgical devices market. For instance, in December 2021, Medtronic received a Health Canada license for use of the Hugo robotic-assisted surgery system. This robotic-assisted surgery needs various surgical devices to be equipped in the platforms which are expected to have significant growth over the study period.

Canada General Surgical Devices Market Competitor Analysis

The market for general surgical devices in Canada is highly competitive with the presence of global and a few local players in the country. A large share of the market is occupied by the global players whereas local companies are also having intense competition to gain a substantial share in this market. In terms of market share, a few of the major players are currently dominating the market. Some of the companies which are currently dominating the market are Boston Scientific Corporation, CONMED Corporation, Medtronic, B. Braun SE, Johnson & Johnson Services, Inc, Stryker, Integer Holdings Corporation, Alcon Laboratories Inc., Smith+Nephew, Olympus Corporation, Cook Group.Additional benefits of purchasing the report:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

This product will be delivered within 2 business days.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- B. Braun SE

- Boston Scientific Corporation

- CONMED Corporation

- Integer Holdings Corporation

- Johnson & Johnson Services, Inc

- Medtronic

- Stryker

- Alcon Laboratories Inc.

- Smith & Nephew

- Olympus Corporation

- Cook Group