The generator sets market is expected to register a CAGR of more than 6.5% during the forecast period of 2020-2027. The COVID-19 pandemic had a negative impact on the generator sets market across the globe due to the reduction in power demand, mainly from institutional customers (industrial and commercial sector), as many manufacturing plants and retail businesses were closed during the lockdown. Factors, such as the ever-increasing demand for power, lack of reliable grid infrastructure, the need for emergency backup power solutions, and the demand for steady power supply, are driving the generator sets market. Moreover, the growing energy demands from the burgeoning manufacturing industry are expected to provide greater market opportunities for generators. However, factors, such as high installation and operating costs and the consumer preference towards eco-friendly alternatives (like solar, fuel cells, etc.), and overcapacity, are restraining the market’s growth during the forecast period.

The generator sets market is moderately fragmented. Some of the key players in this market are Caterpillar Inc., Cummins Inc., Generac Holdings Inc., Kohler Co. and Wartsila Corporation, among others.

This product will be delivered within 2 business days.

Key Highlights

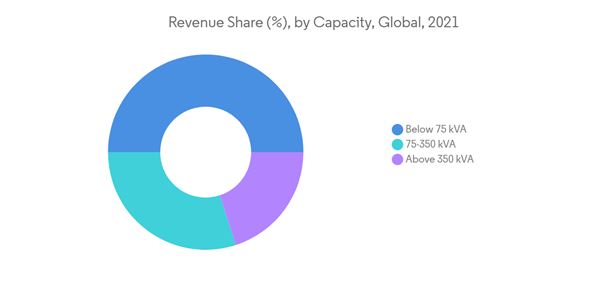

- Below 75 kVA capacity generators are estimated to have the largest market share during the forecast period, supported by the increase in demand from telecom, retail, other commercial buildings, and residential sectors.

- The commercial and industrial sectors of emerging economies, the residential sector of developed economies, and the increasing need for power in defense operations are expected to create significant opportunities for market participants in the near future.

- Asia-Pacific accounted for the largest share in the market in 2021, with the majority of the demand coming from countries, such as China and India.

Key Market Trends

Below 75 kVA Capacity Generators to Dominate the Market

- Less than or equal to 75 kVA generator sets are used in the telecom sector, commercial complexes, small restaurants, small-scale industries, and petrol stations, among others, primarily as backup power in grid-connected the main power source in off-grid areas.

- The purchase of small generators is mostly based on price and requirement rather than efficiency, as they offer emergency backup power. The unreliable and limited power access, especially in rural areas, has been the major reason for demanding low capacity generators in a huge manner.

- The demand for small generators in range 0-75 kVA is increasing drastically, with the change in the commercial sector landscape, especially in the developing countries of Asia-Pacific and African regions.

- As of 2020, India has close to 583,000 telecom towers, which requires a continuous power supply. Since 0-75 kVA diesel generators are used in the telecom sector for backup power in grid-connected areas, and as the main power source in off-grid areas, generator sets market is expected to grow exponentially.

- The building and construction market is on the rise in India and China, due to current government initiatives such as smart cities and green building initiatives, which are expected to create the demand for portable generators during the forecast period., and in turn, drive the generator sets market.

- Therefore, based on the above-mentioned factors, below 75 kVA capacity generator sets are expected to have the largest market share during the forecast period.

Asia-Pacific to Dominate the Market

- The generator sets market in the Asia-Pacific region is expected to hold the largest market in 2021 and is expected to dominate the market over the forecast period.

- China is the leading generator sets market in the Asia-Pacific region, due to the increasing infrastructure projects, widening power demand-supply gap, expansion of manufacturing facilities across the nation, and rising commercial office spaces. The country benefits from the cost and effectiveness of diesel generators, with improved living standards increasing the demand for power back-up devices.

- In addition, the rapid growth in various end-use sectors, such as infrastructure, telecommunication, and information technology (IT) and IT-enabled services, is expected further to spur the demand for generators sets in India. For instance, in September 2021, Bharti Airtel introduced new plans to make an investment of around INR 50 billion (USD 673 million) to expand its data centers business in India to meet the growing customer base in the country. Such investments in the telecom sector is likely to increase demand for generator sets during the forecast period.

- The increasing power blackouts have significantly hampered the manufacturing sectors in Indonesia, which has increased the adoption of generator sets in the country to ensure continuous and reliable power supply. South Sumatra and Jakarta are the key contributing areas for the growth of the market in Indonesia owing to the frequent power blackouts in these areas.

- Therefore, based on the above-mentioned factors, Asia-Pacific is expected to dominate the global generator sets market during the forecast period.

Competitive Landscape

The generator sets market is moderately fragmented. Some of the key players in this market are Caterpillar Inc., Cummins Inc., Generac Holdings Inc., Kohler Co. and Wartsila Corporation, among others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

This product will be delivered within 2 business days.

Table of Contents

1 INTRODUCTION

4 MARKET OVERVIEW

5 MARKET SEGMENTATION

6 COMPETITIVE LANDSCAPE

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- AKSA Power Generation

- Briggs & Stratton Corporation

- Caterpillar Inc.

- Cooper Corporation

- Cummins Inc.

- Doosan Corporation

- Generac Power Systems

- Honda India Power Products Ltd

- Kohler Co.

- Mitsubishi Heavy Industries Ltd

- MTU Onsite Energy

- Wartsila Corporation