Originally Tonic water was used as a medicine against malaria, but now there is significantly lower quinine content and is consumed for its distinctive bitter flavor. It is often used in alcoholic drinks, particularly in gin. But now tonic water is available as a regular drink with low quinine levels and different flavors. The market players have been innovating tonic water with low quinine, corn syrup, high fructose sugar, and various flavors. For instance, in September 2022, the Australian beverage company Capi partnered with Malfy Gin to launch the all-natural ingredient "Sunset Tonic." The tonic pairs with Malfy Gin's refreshing citrus-flavored gin and makes Gin-Tonic called Malfy Sunset. Additionally, the rising disposable income drives the market due to modernization, the tonic water promotion as a mixer with alcohol, and the increasing tonic water popularity, which is surging demand.

Tonic water is growing in many regions owing to its health benefits. Due to quinine content, tonic water is used for malaria treatment. It reduces leg cramps, works as a stress buster, works as a substitute for alcohol, causing a reduction in alcohol consumption, and re-energizes due to high sugar content. Due to the increased alcohol consumption on casual occasions and parties, the tonic water requirement also increased. Since consumers have become more health conscious, demand for low-sugar or sugar-free beverages increased. Tonic water manufacturers are making products according to consumer needs and wants. For instance, in February 2022, the United Kingdom-based functional beverage brand Buzzed launched a new energy tonic water powered by natural caffeine, pure blossom honey, and stevia.

Tonic Water Market Trends

Increasing Demand for Low-Sugar and Naturally Flavored Tonic Water

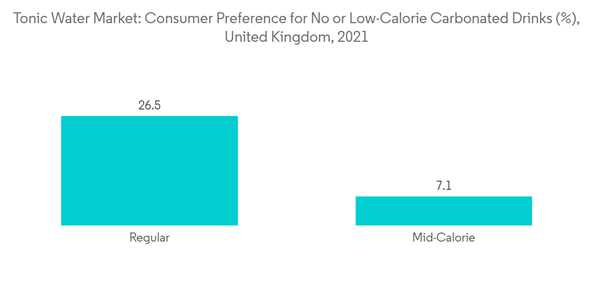

Consumers have developed a strong preference for premium spirits and are willing to spend money on innovative products with a distinct characters. As a result, there is a growing preference for premium-priced mixers, including tonic water. The cocktail trend resurgence in emerging economies boosted growth for the super-premium tonic water category. Due to the rise in obesity and diabetes problems, consumers want their drinks to be low or zero sugar with good taste.The young population became more health conscious and avoided having products with high carbohydrate content. In addition, diet tonic water is gaining increasing acceptance among consumers owing to its lesser sugar content than regular diet variants that possess fewer calories or carbohydrates. Companies are also bringing in new naturally flavored water in this product segment, intending to cater to the consumers' specific needs for diet consciousness and taste factors. For instance, in May 2022, the Famous Gloucestershire arm, Daylesford Organic, launched organic tonic water manufactured in the United Kingdom. The new organic tonic waters come in four flavors - light, cucumber, wild elderflower, and Damascena rose - and are made with dandelion instead of quinine.

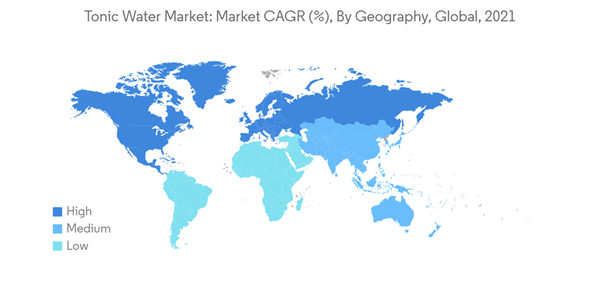

Europe Dominates the Market

Europe is famous for its Gin consumption. Gin and tonic are one of the most famous cocktails in Europe. Tonic water is renowned in the region for its flavors and multiple uses in different beverages. The market for tonic water is growing in Europe owing to the new and innovative product launches by market players. It is available in different flavors, prices, and packaging. As consumers are focused on health, different calorie-free and sugar-free tonic waters are also available in the market.Furthermore, the tonic water availability in supermarkets and retail stores is also a factor in the market's growth. For instance, the on-trade value of Fever Tree Mixers and tonic water was 25.1% in 2021. The demand for tonic water increased due to the number of pubs, bars, and lounges. For instance, in June 2022, Fever Tree opened a new bar and cafe at Edinburgh Airport. The drinks menu includes selected spirits alongside beer, wine, and bubbles.

Tonic Water Industry Overview

Some major key global players in the tonic water market include The Coca-Cola Company, El Guapo Bitters, Fentimans Ltd., Fever Tree Drinks Plc, Keurig Dr. Pepper Inc., London Essence Company, and Franklin & Sons Ltd. In recent years, Fever-Tree expanded its offering to include mixers for other spirits alongside tonic water. The product line-up includes Sicilian lemonade, Madagascan cola, ginger beer, and ginger ale. As with the company's tonic water, drinks come in various flavors. In May 2021, Fentimans launched a new 200 ml mixer and tonic range. The new 200 ml mixer range, including Tonic Water and its iconic Ginger Beer and Rose Lemonade, will continue to be made using Fentiman's unique 100-year-old artisanal technique. The range also includes Fentiman's versatile range of colored and flavored tonics, suitable for pairing with a broad range of spirit categories.Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

This product will be delivered within 2 business days.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Fevertree Drinks PLC

- Keurig Dr Pepper, Inc.

- Fentimans Ltd

- PepsiCo, Inc.

- White Rock Beverage Ltd

- New Orleans Beverage Group, LLC (El Guapo Bitters)

- The Coca-Cola Company (Schweppes)

- Franklin & Sons Ltd

- Britvic PLC (The London Essence Company)

- Bickford & Sons

- East Imperial Beverage Corporation

- Sepoy & Co.