Enzymes are proteins that exist in the body of all living organisms, including humans, that function as catalysts. On the other hand, enzymes are necessary substances for vital activities and help many of the complex and diverse activities in substance metabolism. Growing consumer health consciousness has increased consumption of functional food products, which is predicted to have a favorable impact on the demand for enzymes over the forecast period. In March 2021, International Flavors & Fragrances Inc. announced the launch of Enovera 3001 enzyme as the newest addition to its ingredients for the bakery industry range. The new enzyme offers a label-friendly formulation for strengthening the bakery dough without compromising on its texture and taste. Over the past 10 years, the demand for enzymes has increased due to the natural flavor and taste of food items as well as unique food products, which has led to market expansion. The product is used for a variety of purposes, including the clarity of fruit juice, brewing germination, making cheese, pre-digesting infant food, and tenderizing meat. Additionally, the imminent population boom, increased food quality, and greater consumer awareness of nutritional requirements are all expected to have a beneficial impact on market growth.

The market is witnessing rapid growth due to the increasing demand for processed food in the country and the wide applications of enzymes in the processed food industry. Moreover, innovation in food technology in the country and increasing awareness about better-quality products being manufactured by utilizing enzymes are further driving the market. For instance, DSM launched a new range of baking enzymes, specifically formulated for gluten-free applications, that improve the softness and moistness of bread. These enzymes are also used in further applications, such as corn tortillas, rye bread, and white bread. The rapid growth of India's food, beverage, and pharmaceutical industries has supported this expansion, and the demand for food enzymes is eventually expected to surpass the demand for industrial enzymes. The majority of these businesses either specialize in marketing or formulations of food enzymes. Moreover, the sports nutrition industry has been expanding at a rapid pace for the past few years due to increased health awareness and a high preference for an active lifestyle.

Specialty Enzymes Market Trends

Increasing Demand for Processed Food

The processed foods segment has witnessed a significant rise in the market in recent years, owing to changes in the lifestyle patterns of consumers and a strong influence on the consumption of convenience foods. The demand for processed and packaged foods is rising in both developed and developing regions of the world due to factors such as urbanization, a growing middle-class population, an increase in the number of working women, and an increase in disposable income. As a result, there is a greater need for food packaging and processing solutions. Food additives are therefore widely employed in processed and convenience food products to maintain the freshness, safety, taste, appearance, and texture of processed foods.The increased demand for convenience and processed foods such as ready-to-eat foods, ready-to-drink beverages, snacks, frozen dinners, and others is one of the key drivers fueling the expansion of the food additives market. Customers want both a diversity of flavors and nutritious eating choices. To increase customer interest, several processed foods that are high in calcium, fiber, and protein and are regarded as healthy for diabetics are being sold. These products have features that are functional, such as being devoid of gluten, cholesterol, GMOs, and salt, among others. Due to their low cost and great production, microbial sources are the primary source of enzymes used in food and beverages. The digestive, softening, and anti-staling properties of food enzymes are anticipated to propel market expansion. The demand for bakery and dairy goods such as cheese, yogurt, cakes, biscuits, and bread is extremely high. Notably, the bakery uses the most enzymes in the entire nation. Thus, the rise in demand for processed foods has always contributed to the rise in demand for enzyme application due to the expansion and convenience of food retail chains.

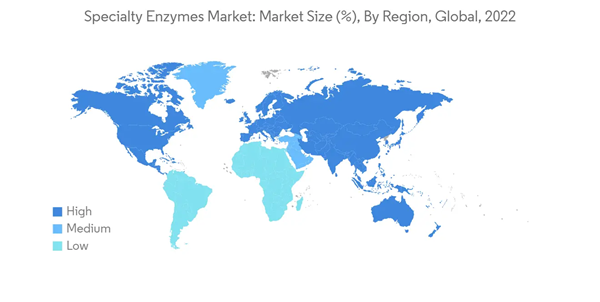

North America Leading the Market

North America is the largest market for specialty enzymes with its major applications in the food and feed industries. It accounts for a prominent share of the global specialty enzyme market. The market is driven by the increased consumption of processed food products, increased expenditure on premium quality products, and consumer preference for the natural ingredients used in the products. New food enzyme applications in markets such as protein fortification are expected to prompt growth in the food enzymes market and create lucrative opportunities for industry participants. For instance, in June 2021, International Flavors & Fragrances, Inc., launched Nurica, a dairy enzyme that naturally harnesses the lactose present in milk in the United States. The enzyme helps in naturally generating a higher yield of prebiotic galactooligosaccharides (GOS) fibers that help in managing lactose intolerance and optimizing fiber intake one of the main factors driving the demand for carbs in the United States is likely to be the rising desire for dietary fibers and functional foods.The market's rapid expansion in North America is linked to the expanding trend of consumers choosing naturally derived meals. The demand for food enzymes in the region is developing as a result of the growing consumer perception that organic additives are secure and nutritious. According to the Organic Trade Association, in 2021, organic food sales in the United States amounted to about USD 57.5 billion. The use of enzymes in various food systems has increased in response to the rising demand for premium processed meals free of chemical additives. Market expansion in the region is being fueled by major players' increased investments in novel solutions, like more precise enzymes. Furthermore, innovation in food technology in the region, extensive R&D investment, and the growing awareness about better-quality products being manufactured by utilizing enzymes, are further driving the market.

Specialty Enzymes Industry Overview

The Specialty Enzymes Market is fragmented, with top global and regional players competing fiercely with local companies to gain market shares. Kerry Group, Novozymes, Chr. Hansen, and DuPont are some of the major players in the specialty enzymes market. These companies majorly focus on expanding their businesses and undertaking strategies, such as mergers and acquisitions, expansions, and novel product innovations. Partnerships are the next strategy preferred by companies in order to strengthen their market presence and develop innovative products. Kerry Group has planned to develop new technologies for specialty enzyme production. Connell Brothers is focusing on increasing distribution in the market.Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

This product will be delivered within 2 business days.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Novozymes

- Kerry Inc.

- Chr. Hansen Holding A/S

- DuPont de Nemours, Inc.

- Associate British Foods PLC

- Specialty Enzymes & Probiotics

- Koninklijke DSM N.V.

- International Flavors & Fragrances

- Mitsubishi Chemical Corporation

- Amano Enzymes

- AST Enzymes