The Germany market dominated the Europe Dust Control Systems Market by Country in 2023, and would continue to be a dominant market till 2031; thereby, achieving a market value of $1,644.8 million by 2031. The UK market is exhibiting a CAGR of 3.7% during (2024 - 2031). Additionally, The France market would experience a CAGR of 5.4% during (2024 - 2031).

Industrial facilities and manufacturing plants generate dust emissions from various processes, including material handling, grinding, sanding, and machining operations. Dust control systems such as local exhaust ventilation, dust collectors, and filtration units are employed to capture and remove airborne particulates, reduce workplace exposure, and comply with emission standards.

Grinding, machining, and cutting operations produce airborne dust particles from metalworking fluids, abrasive materials, and metal chips. These systems such as dust collectors, wet scrubbers, and mist collectors capture and remove dust generated during these processes. Dust collectors capture airborne particulates via filtration media or cyclonic separation, whereas moist scrubbers capture and neutralize dust via wetting and absorption with water or other liquids.

As per Eurostat, in the EU in 2020, the mining and quarrying sector generated €27.1 billion of value-added, which was 0.4 % of the total non-financial business economy. In output, other mining and quarrying sectors accounted for 40.5 % of EU sectoral turnover and 17.1 % from mining metal ores. Poland recorded the highest share (26.3 %) of EU value added within the mining and quarrying sector in 2020. Germany was also a relatively large producer within the EU in value-added terms (13.6 %). Additionally, as per the data from the Government of the United Kingdom, in terms of gross value added (GVA), beverages was the largest manufacturing category with a value of £6.5 billion in 2021. It contributed 21.4% to the total food and drink manufacturing GVA. The other food products category was the second largest, valued at £6.3 billion in the same year, contributing 20.6% to the total food and drink manufacturing GVA. Therefore, Europe's growing food & beverage and mining sectors will drive the expansion of the regional market.

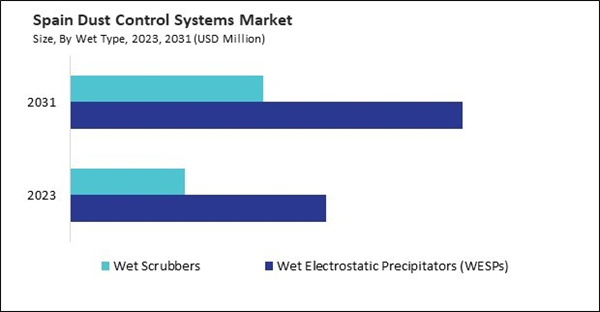

Based on Product, the market is segmented into Wet (Wet Electrostatic Precipitators (WESPs), and Wet Scrubbers), and Dry (Bag Dust Collectors, Vacuum Dust Collectors, Electrostatic Dust Collectors, and Others). Based on End User, the market is segmented into Construction, Pharmaceutical, Chemical, Mining, Food & Beverage, Oil & Gas, and Others. Based on countries, the market is segmented into Germany, UK, France, Russia, Spain, Italy, and Rest of Europe.

List of Key Companies Profiled

- Donaldson Company, Inc.

- Nederman Holding AB

- Spraying Systems Co.

- Absolent Air Care Group AB (Mexab Industri AB)

- BossTek, Inc.

- EmiControls Srl (TechnoAlpin SpA)

- Beltran Technologies, Inc.

- Camfil AB

- Sly, Inc.

- Parker Hannifin Corporation

Market Report Segmentation

By Product- Wet

- Wet Electrostatic Precipitators (WESPs)

- Wet Scrubbers

- Dry

- Bag Dust Collectors

- Vacuum Dust Collectors

- Electrostatic Dust Collectors

- Others

- Construction

- Pharmaceutical

- Chemical

- Mining

- Food & Beverage

- Oil & Gas

- Others

- Germany

- UK

- France

- Russia

- Spain

- Italy

- Rest of Europe

Table of Contents

Companies Mentioned

- Donaldson Company, Inc.

- Nederman Holding AB

- Spraying Systems Co.

- Absolent Air Care Group AB (Mexab Industri AB)

- BossTek, Inc.

- EmiControls Srl (TechnoAlpin SpA)

- Beltran Technologies, Inc.

- Camfil AB

- Sly, Inc.

- Parker Hannifin Corporation