Key Highlights

- In the UAE, Ras al-Khaimah produces most of the country's vegetables, including tomatoes. The climate in the UAE is not well suited for the cultivation of tomatoes. The various initiatives from the UAE government are promoting tomato market growth. The favorable government policies supporting tomato cultivation, like the high adoption of modern agriculture practices such as hydroponics and greenhouse cultivation, drive the UAE tomato market's growth.

- Along with this, various varieties of tomatoes are grown in the UAE. Some of them are cherry plum tomatoes, cherry vine tomatoes, beef tomatoes, Roma tomatoes, etc. The markets for cherry tomatoes and beef tomatoes are expected to grow at the fastest rate during the forecast period.The growing consumer preference for these tomatoes as salad toppings is driving demand for these tomato varieties.

Moreover, many regional companies are venturing into tomato cultivation by incorporating advanced farming technologies in order to make tomatoes available to their consumers year-round and move away from dependency on trade imports. For instance, in 2021, Madar Farms in Dubai opened a commercial-scale indoor tomato farm using only LED lights to grow fresh tomatoes and satisfy domestic demand. Therefore, the favorable government initiatives, coupled with the introduction of advanced technologies by well-known companies, are catering to the market's growth in the forecast period.

UAE Tomato Market Trends

Government Support to increase the Tomato Production

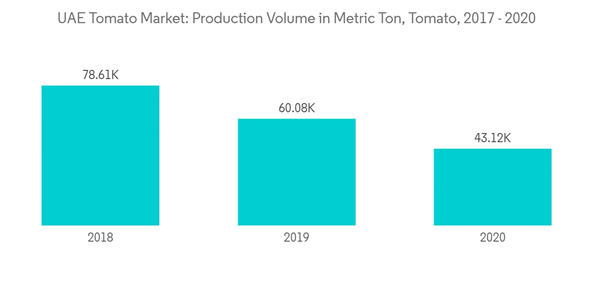

Due to its geographic location, the UAE's agriculture sector is not the most significant one. In addition, the nation is characterized by a lack of adequate natural waterways, extremely high temperatures, low soil quality, a lack of arable land, and very little rainfall, all of which contribute to the absence of a significant agricultural sector. The total arable land in the UAE is only approximately 1600 square kilometers out of the total land area of around 71,023 square kilometers.Due to the lack of agricultural resources, the production of tomatoes is decreasing. For instance, according ng to FAO, in 2020, the tomato production volume decreased to 43.12 thousand metric tons from 60.8 thousand tons in 2019. Hence, owing to the decreased production volume and despite various agricultural challenges faced by the country, the government has taken it as a challenge and is taking various measures to improve food production and security in the country. For instance, the Abu Dhabi government is backing four vertical farming initiatives to the tune of USD 100 million.to FAO, in 2020, the tomato production volume decreased to 43.12 thousand metric tons from 60.8 thousand tons in 2019. Hence, owing to the decreased production volume and despite various agricultural challenges faced by the country, the government has taken it as a challenge and is taking various measures to improve food production and security in the country. For instance, the Abu Dhabi government is backing four vertical farming initiatives to the tune of USD 100m. To 'turn sand into farmland, solve complex global agriculture challenges, and raise the profile of local food producers,' the Abu Dhabi Investment Office (ADIO) is supporting AeroFarms, Madar Farms, RNZ, and Responsive Drip Irrigation (RDI) in their efforts to establish new R&D and production facilities in the nation.

The UAE government claimed that the investment in 'farming' in a controlled environment is 'dedicated to developing next-generation agriculture in arid and desert agriculture.' Vertical farming is gaining popularity among UAE farmers, especially for growing local vegetables such as tomatoes with small water sources. Vertical farming needs much less space for vegetables to grow, making it a great farming solution to the challenges posed by the soil and the country's limited water.

Similarly, the national food security strategy 2051, which consists of 38 both long-term and short-term projects, was also introduced in November 2018 with the main goal of employing agricultural practices that enhance the quantity of food produced sustainably. Among other things, the strategy's main objectives include increasing domestic food production, implementing measures to increase food's nutritional value, and forming international alliances with other nations to diversify food sources. The national system for sustainable agriculture was approved by the UAE Cabinet on June 28, 2020. Its goals are to enhance farm productivity, increase food self-sufficiency, and develop new opportunities to guarantee that the agriculture sector is consistently listed among the best. Such government initiatives with extensive financial and political support for enhanced agricultural production in the country through technological innovation are anticipated to raise the production level of tomatoes during the forecast period.

Increase in adoption of high technology farming practices

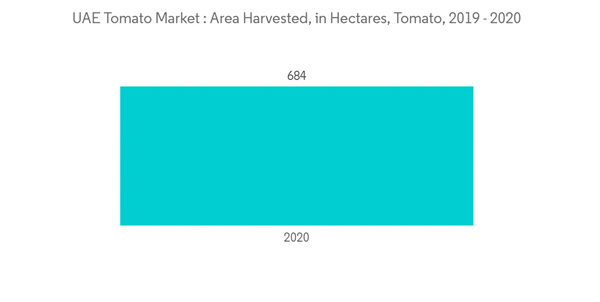

The United Arab Emirates is located in an arid zone, where the desert environment accounts for more than three-quarters of the country's total area. Its climate is characterized by low rainfall and high temperatures. As a result, cropland is becoming increasingly scarce, particularly for tomatoes.For instance, according to FAO, the total land under tomato cultivation was 890 ha in 2019, which decreased to 684 ha in 2020. Despite these challenges, the country has made tremendous efforts over the last decade by adopting sustainable and smart agriculture techniques such as hydroponics, smart irrigation, and aquaponics that have improved the optimum utilization of arable land and the quality of fresh produce, including tomatoes.Hydroponics, the predominant system used in vertical farming, is gaining popularity among UAE farmers, especially in growing local vegetables, including tomatoes, with minimal water resources. Vertical farming requires less space for vegetables to grow, making it the best farming solution to the challenges presented by the country’s limited arable land and water. For instance, according to the UAE Ministry of Climate Change and Environment, hydroponics is permitted to save about 120 m3 of water for producing each ton of tomato as compared to conventional soil systems under protected agriculture in the region.

Moreover, the roadmap for the UAE’s National Future Food Security Strategy, which aimed to ensure adequate food production in the country with a minimum use of resources through the adoption of advanced technologies, has enabled many companies to venture into greenhouse cultivation of tomatoes. For instance, in 2021, Sokovo, a high-tech agricultural enterprise, made an agreement to develop a hydroponic farm in Dubai Industrial City to grow fresh, pesticide-free organic fruits and vegetables, including tomatoes. Therefore, the rapid use of modern farming techniques such as hydroponics and smart irrigation methods across farms in the UAE is enabling tomato production all year around, thereby boosting the UAE’s tomato crop productivity.

UAE Tomato Market Competitor Analysis

NAAdditional benefits of purchasing the report:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

This product will be delivered within 2 business days.