Passenger car segment is expected to be the largest market during the forecast period, by vehicle type

The passenger car segment represents the largest category within the global automotive sector and is identified as the most promising market for automotive Vehicle-to-Everything (V2X) technology. The automotive industry has experienced rapid expansion in emerging economies, notably in China and India, where leading automobile manufacturers are increasingly investing due to factors such as available resources, a skilled yet cost-effective workforce, established auto-ancillary businesses, and supportive government policies for production and trade. The Asia Pacific region has emerged as a key production hub for the automotive sector, with China standing out as the region's largest market for passenger cars. In 2022, global sales of passenger cars reached approximately 57.4 million units. Various original equipment manufacturers (OEMs) have integrated V2X technology into their vehicle models. Notable examples include Ford's inclusion of V2X in the Mustang Mach E, Honda's implementation in models such as the Civic Tourer and CR-V, Mercedes Benz integrating the technology into the E-Class and S-Class, and NIO offering V2X in their ES7, ET7, and ET5 models. The passenger cars segment within the automotive V2X market is anticipated to experience substantial growth throughout the forecast period. Concerns surrounding fatalities resulting from accidents involving passenger cars have become a focal point for both the public and governments, potentially driving the expansion of this specific segment within the automotive V2X market.North America is expected to grow significantly during the forecast period

North America stands out as one of the globally burgeoning automotive sectors, characterized by rapid growth. This region, housing major industry players like Ford Motors, General Motors, and Fiat Chrysler Automobiles, particularly favors passenger cars equipped with advanced comfort and safety technologies. The United States, hosting the big three automakers, constitutes the largest market in North America, commanding over two-thirds of the overall automotive market, with Mexico and Canada following suit. Domination in the market is evident among American OEMs, including Ford Motors, General Motors, and Fiat-Chrysler Automotive, alongside established European and Asian counterparts such as Toyota (Japan), Nissan (Japan), Honda (Japan), Hyundai/Kia (South Korea), BMW Group (Germany), and Volkswagen Group (Germany). The North American Free Trade Agreement (NAFTA) has significantly contributed to the region's flourishing automotive and technology industries. North America has a sizable customer base and high disposable income and an appealing market for the entire automobile ecosystem. Ongoing advancements in safety regulations within North American countries, such as discussions on mandatory rear-view camera installations in the United States and considerations for mandates related to Vehicle-to-Everything (V2X) communication, coupled with the presence of key automotive sector players like Qualcomm Incorporated and HARMAN International, are poised to propel the North American V2X market. In May 2023, in collaboration with PG&E, BMW initiated V2X testing in California, USA. Subsequently, in September 2023, the BMW Group formalized a 5G-connected vehicle license agreement with Avanci, granting a license to essential patented technologies for 5G, including critical components such as Cellular Vehicle-to-Everything (C-V2X). This strategic move underscores the commitment of major industry players to advance technological frontiers in the North American automotive landscape.Cellular Vehicle to Everything (C-V2X) segment is estimated to be the fastest growing segment in the automotive V2X market during the forecast period

C-V2X stands out as a cutting-edge technology that has recently garnered global attention due to its exceptional efficiency and contributions to mobility safety. This advanced wireless technology empowers vehicles to maintain connectivity while in motion, facilitating communication with various entities in their vicinity, including other vehicles (V2V), pedestrians (V2P), roadside infrastructure (V2I), network (V2N), and cloud (V2C). Introduced by the 3rd Generation Partnership Project (3GPP) in June 2017 as LTE-V2X within its 3GPP release 14, C-V2X has become a focal point of innovation in wireless communication. The 3GPP, comprising seven telecommunication connectivity development organizations (ARIB, ATIS, CCSA, ETSI, TSDSI, TTC, and TTA), provides a stable environment for its members to generate reports and specifications defining 3GPP technologies. C-V2X operates in two transmission modes. The first, known as short-range direct transmission mode (< 1 km), facilitates V2V, V2P, and V2I communication, utilizing the 5.9 GHz frequency band designated as the Intelligent Transport System (ITS) spectrum. This mode functions independently of the cellular network. The second mode, long-range network communication (>1 km), operates in the mobile operator spectrum band, leveraging conventional mobile networks. This enables vehicles to access information from the cloud regarding traffic and road conditions in a given area. Key advantages of C-V2X encompass enhanced security and real-time, low-latency communications. Anticipated advancements in 5G technology are poised to enhance transmission speed and quality further. Notably, C-V2X supports short- and long-range transmission among vehicles and other connected devices. Countries are already planning to develop V2X-enabled vehicle ecosystem. China, for instance, has focused on the burgeoning C-V2X technology, with an expectation that approximately 30 - 40% of new cars will come equipped with pre-installed C-V2X capabilities by 2025.Prominent original equipment manufacturers (OEMs) have embarked on developing and providing C-V2X, albeit on select models. This includes BYD, which features C-V2X in the BYD Han EV; Ford, incorporating it into models such as the F - 150, Mustang Mach E, and Bronco; Mercedes Benz, integrating the technology into the E-Class and S-Class; NIO, providing C-V2X in the ES7, ET5, and ET7 models; SAIC, equipping the Buick GL6 and GL8 with C-V2X connectivity; Stellantis, including it in the Jeep Wrangler; Volvo, incorporating C-V2X into the XC90; FAW, integrating it into the Hongqi H7 and E-HS9 models; and Great Wall, offering C-V2X connectivity in the Mocha. Furthermore, certain OEMs, such as Geely and Hyundai, plan to integrate C-V2X technology into their forthcoming vehicle models. This strategic move underscores the industry-wide recognition of the significance of C-V2X in advancing connectivity and communication capabilities within the automotive landscape.

In-depth interviews have been conducted with chief executive officers (CEOS), Directors, and other executives from various key organizations operating in the automotive V2X market.

- By Respondent Type: OEMs - 31%, Tier 1 - 21%, and Tier 2 - 48%

- By Designation: CXOs - 40%, Directors - 35%, and Others - 25%

- By Region: North America - 30%, Europe - 50%, Asia Pacific - 15% and RoW - 5%

The study includes an in-depth competitive analysis of these key players in the automotive V2X market, with their company profiles, recent developments, and key market strategies.

Research Coverage

The report covers the automotive V2X market, in terms of Connectivity (DSRC, and Cellular), Communication (V2V, V2I, V2P, and V2G), Vehicle Type (Passenger Cars, and Commercial Vehicles), Propulsion (ICE Vehicles, and Electric Vehicles), Unit (On-Board Units, and Roadside Units), Offering (Hardware, and Software), Technology (Automated Driver Assistance, Intelligent Traffic Systems, Emergency Vehicle Notification, Passenger Information System, Fleet & Asset Management, Parking Management System, Line of Sight, Non-line of Sight, Backing, and Others), Aftermarket Offering (Hardware, Software, and Service) and Region (Asia Pacific, Europe, North America, and Row). It covers the competitive landscape and company profiles of the major automotive V2X market ecosystem players.The study also includes an in-depth competitive analysis of the key players in the market, along with their company profiles, key observations related to product and business offerings, recent developments, and key market strategies.

Key Benefits of Buying the Report:

- The report will help market leaders/new entrants with information on the closest approximations of revenue numbers for the overall automotive V2X market and its subsegments.

- This report will help stakeholders understand the competitive landscape and gain more insights to position their businesses better and plan suitable go-to-market strategies.

- The report also helps stakeholders understand the market pulse and provides information on key market drivers, restraints, challenges, and opportunities.

- The report also helps stakeholders understand the current and future pricing trends of different automotive V2X systems based on their capacity.

The report provides insight on the following pointers:

- Analysis of key drivers (Increasing demand for advanced technologies to address vehicle safety concerns, growing adoption of C-V2X connectivity, development in connected car technology, advancements in 5G technology), restraints (Lack of infrastructure for proper functioning), challenges (Government support for V2X technology, increasing adoption of V2V and V2I technology in connected vehicles, OEM and EVCS providers providing V2g services), and opportunities (Vulnerability to cyberattacks, prohibition on DSRC technology in US, latency/reliability challenges), influencing the growth of the authentication and brand protection market.

- Product Development/Innovation: Detailed insights on upcoming technologies, research & development activities, and new product & service launches in the automotive V2X market.

- Market Development: Comprehensive information about lucrative markets - the report analyses the automotive V2X market across varied regions.

- Market Diversification: Exhaustive information about new products & services, untapped geographies, recent developments, and investments in the automotive V2X market.

- Competitive Assessment: In-depth assessment of market ranking, growth strategies, and service offerings of leading players like Qualcomm Incorporated (US), Autotalks (Israel), Harman International (US), Huawei Technologies Co., LTD. (China), and NXP Semiconductors (Netherlands) among others in automotive V2X market.

Table of Contents

Companies Profiled

- Qualcomm Incorporated

- Autotalks

- Harman International

- Huawei Technologies Co. Ltd.

- Nxp Semiconductors

- Continental AG

- Robert Bosch GmbH

- Cohda Wireless

- Infineon Technologies AG

- Denso Corporation

- Stmicroelectronics

- Hyundai Mobis

- Kapsch Group

- Marben Products

- Capgemini Engineering

- Nokia

- Dspace GmbH

- Ficosa Internacional SA

- Escrypt

- Vector Informatik GmbH

- Volkswagen AG

- BMW AG

- Mercedes-Benz Group AG

- Audi AG

- Renault Group

- Mclaren Group

- Unex Technology Corp.

- Mitsubishi Electric Corporation

- Flex Ltd.

- Tata Motors

- Hitachi Solutions, Ltd.

- Nissan Motor Co. Ltd.

- Lear Corporation

- Intel Corporation

- Danlaw, Inc.

- Commsignia Ltd.

- General Motors

- Ford Motor Company

- Soar Robotics

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 321 |

| Published | January 2024 |

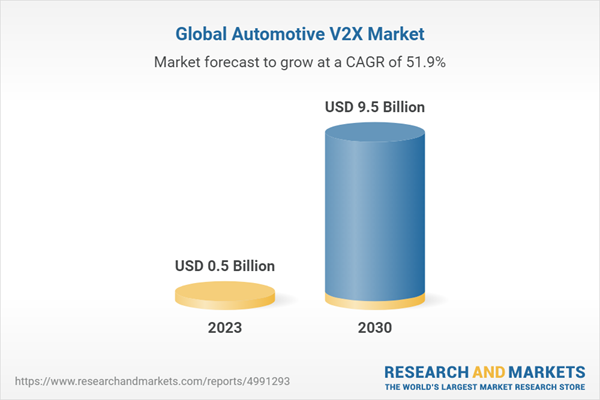

| Forecast Period | 2023 - 2030 |

| Estimated Market Value ( USD | $ 0.5 Billion |

| Forecasted Market Value ( USD | $ 9.5 Billion |

| Compound Annual Growth Rate | 51.9% |

| Regions Covered | Global |

| No. of Companies Mentioned | 39 |