Speak directly to the analyst to clarify any post sales queries you may have.

A focused orientation to the converging technical, commercial, and regulatory forces redefining vehicle communication architectures and supplier strategies

The automotive communication landscape has entered a period of rapid transformation driven by software-defined architectures, the electrification of powertrains, and an accelerating demand for vehicle connectivity that spans in-vehicle networks to vehicle-to-everything interactions. This executive summary synthesizes cross-cutting trends and strategic implications to equip senior leaders with a concise, high-impact view of the forces reshaping how vehicles communicate, how suppliers are reorganizing, and how standards and regulation are steering deployment timelines.Today’s vehicle architectures demand greater bandwidth, lower latency, and stronger cybersecurity postures, prompting OEMs and suppliers to re-evaluate bus protocols, component partitions, and integration strategies. In parallel, changing trade policies and tariff environments are introducing new dynamics into supply chain planning. This introduction frames the subsequent sections by highlighting the technological inflection points, commercial pressures, and structural shifts that will determine competitive advantage in automotive communication systems over the coming strategic planning cycles.

How accelerating software centricity, electrification, and regulatory expectations are jointly accelerating architectural consolidation and standards harmonization

The landscape for automotive communications is being shaped by multiple, convergent transformations that are as technical as they are commercial. Advancements in vehicle electrification and automated driving systems are increasing demands for deterministic, high-throughput links across domains, which in turn favor migration from legacy low-speed buses toward unified high-speed fabrics and service-oriented middleware. These technical drivers are complemented by a software-centric shift, where functionality is increasingly abstracted into modular software layers that require robust middleware and security services to enable over-the-air updates, feature monetization, and lifecycle management.Regulatory pressure and public expectations around safety and privacy are accelerating investment in security architectures and rigorous validation practices, while standardization initiatives and alliances are promoting interoperable interfaces to reduce integration risk. Concurrently, the commercial model for automotive electronics is evolving: strategic partnerships, joint ventures, and platform-sharing agreements are becoming common as OEMs seek to balance control of user experience with the need to scale software and hardware investments. Taken together, these shifts mean that stakeholders must think beyond discrete components and toward systems-of-systems engineering, where software, silicon, and connectivity converge to create resilient and updatable in-vehicle ecosystems.

Understanding how evolving trade measures originating from United States policy are reshaping supplier footprints, procurement strategies, and technology adoption decisions

Recent trade measures originating from the United States have a cumulative effect that extends beyond immediate cost adjustments and into strategic sourcing, supplier relationships, and technology roadmaps. Tariffs that affect components, semiconductors, or finished modules alter the relative economics of manufacturing locations, prompting both OEMs and Tier suppliers to evaluate nearshoring, regional sourcing, and vertical integration strategies to preserve margin and ensure continuity of supply. This rebalancing often favors suppliers with diversified manufacturing footprints and those able to absorb short-term cost volatility through hedging, long-term contracts, or redesigns that emphasize locally sourced alternatives.Beyond cost pressures, tariffs influence the cadence of technology adoption and procurement decisions. When duty regimes increase the landed cost of specific communication components or modules, decision-makers may delay migrations to newer bus technologies or prioritize incremental upgrades to existing architectures to defer capital expenditure. Conversely, tariffs can accelerate consolidation around architectures that enable economies of scale across regions, encouraging common platforms and shared components that reduce exposure to trade fluctuations. Importantly, the policy environment also shapes investment in domestic manufacturing capacity and semiconductor packaging capabilities, which in turn changes where design validation, compliance testing, and software integration activities are located. For leaders, the implication is clear: tariff-driven cost signals must be integrated into multi-year product and procurement planning, with contingency models that account for rapid shifts in trade policy and their knock-on effects on lead times, component obsolescence, and supplier viability.

Segment specific dynamics that reveal where technical design choices, commercial capture points, and deployment timing differ across bus modules components vehicle categories and applications

A granular view of segmentation reveals differentiated dynamics across bus technologies, component types, vehicle categories, and application domains, each influencing architectural choices and commercial priorities. When examining bus modules, legacy Controller Area Network (CAN) installations remain ubiquitous for many body and diagnostics functions, while Ethernet is gaining traction as the backbone for high-bandwidth domains and zonal architectures. FlexRay continues to play a role in deterministic control applications where legacy investments exist, and Local Interconnect Network (LIN) persists for low-speed body control tasks. Media-Oriented Systems Transport (MOST) is still relevant in certain infotainment topologies, but its role is gradually evolving as convergence toward IP-based transport increases.Component-level distinctions further clarify where value migrates: hardware remains critical for deterministic performance and safety-critical execution, while software is the primary locus of differentiation through middleware that abstracts hardware heterogeneity and security solutions that protect communications and update channels. The partitioning between middleware and security services reflects commercial decisions about where to capture value-embedded software stacks enable rapid feature deployment, whereas security layers are increasingly monetized as subscription-grade capabilities.

Vehicle type segmentation highlights that commercial vehicles and passenger cars present divergent requirements and adoption trajectories. Commercial vehicle segments, including both heavy and light platforms, emphasize ruggedness, telematics, and fleet management integration, which favours robust V2X connectivity and modular retrofit paths. Passenger cars, spanning hatchback, sedan, and SUV form factors, prioritize differentiated user experiences, infotainment, and ADAS features, with SUVs often serving as early adopters of higher-option content bundles.

Application segmentation delineates the split between In-Vehicle Communication and Vehicle-to-External Communication, each with its own set of technical and business drivers. In-Vehicle Communication encompasses domains such as body control and comfort, infotainment systems, powertrain, and safety and advanced driver assistance systems, all of which demand an orchestration layer that balances deterministic control with data-rich information flows. Vehicle-to-External Communication covers Vehicle-to-Grid interactions for energy management, Vehicle-to-Infrastructure interfaces that support traffic optimization and safety use cases, Vehicle-to-Pedestrian channels that improve vulnerable road user awareness, and Vehicle-to-Vehicle exchanges that underpin cooperative maneuvers. The resulting segmentation map implies that successful strategies will be multifaceted: some players will double down on hardware differentiation for deterministic domains, others will compete on middleware and security stacks for cross-domain orchestration, and many will pursue hybrid models that integrate software monetization with long-term maintenance and cybersecurity services.

Regional contrasts in regulatory pressure manufacturing capacity and connectivity infrastructure that determine differentiated go to market pathways and sourcing approaches

Regional dynamics continue to exert a profound influence on technology adoption, supplier strategies, and regulatory compliance obligations. In the Americas, OEMs and suppliers are navigating a combination of domestic policy incentives, reshored manufacturing initiatives, and strong demand for connected and electrified vehicles. This environment encourages investments in local supply capacity and partnerships that shorten lead times for critical communication modules and facilitate region-specific validation and certification processes.Across Europe, Middle East & Africa the landscape is shaped by stringent safety and emissions regulations, a heavy emphasis on standardization, and a complex mosaic of national rules that influence deployment timetables for connected services. Collaborative standard-setting and regional testing frameworks are particularly influential here, as stakeholders must demonstrate compliance across multiple jurisdictions while also addressing urban mobility challenges in dense metropolitan centers.

Asia-Pacific presents a mix of high-volume manufacturing capabilities, active semiconductor ecosystems, and aggressive deployment of connectivity infrastructure that supports vehicle-to-everything use cases. Market heterogeneity within the region creates both scale opportunities and localization requirements: players that can align global platforms with local regulatory, language, and feature preferences will unlock growth potential, while those that rely on single-source supply chains may face increased exposure to regional disruptions. Taken together, these regional characteristics underscore the need for differentiated go-to-market strategies, a layered supplier footprint, and targeted investment in region-specific certification and cybersecurity practices.

How leading players are reshaping portfolios through software integration strategic partnerships and capability expansions to capture value across the communication stack

Corporate strategies in automotive communication are converging around several common themes even as companies pursue diverse execution models. Strategic suppliers and Tier providers are expanding capabilities through acquisitions, software integration, and partnerships that enable them to offer full-stack solutions encompassing network fabrics, middleware, and security services. Semiconductor vendors are increasingly positioning themselves not just as silicon suppliers but as partners that provide reference architectures, software stacks, and co-engineering support to accelerate time-to-market for high-bandwidth domains.OEMs are redefining supplier relationships by seeking partners that can deliver modular, scalable platforms that accommodate rapid feature updates and cross-vehicle deployment. This approach often results in multi-year strategic agreements and joint development programs that reduce integration risk and ensure alignment on safety and cybersecurity obligations. New entrants and software-first firms are driving competitive pressure by offering specialized middleware and security capabilities, frequently winning pilot deployments that can scale into broader programs. Across all actors, there is a clear premium on companies that can demonstrate a viable path to secure, updatable systems, interoperability with existing vehicle domains, and the operational excellence required to support fleet-wide software maintenance and certification cycles.

Practical strategic moves and investment priorities that executives should deploy to secure technological leadership and supply chain resilience in vehicle communications

Leaders in the automotive communication space should adopt a set of pragmatic, high-leverage actions to navigate near-term headwinds while building durable advantage. First, prioritize investments in scalable, IP-based network fabrics and middleware stacks that enable domain consolidation and reduce system complexity; this reduces long-term integration costs and positions organizations to deliver richer, software-driven features. Second, embed security by design across hardware and software layers, combining cryptographic controls, secure boot, and authenticated update mechanisms to protect the vehicle lifecycle and meet stringent regulatory expectations.Third, implement supply chain diversification strategies that combine nearshoring for critical components with multi-sourcing agreements and qualified second-source plans to mitigate tariff and geopolitical risks. Fourth, accelerate partnerships with infrastructure stakeholders and utilities to pilot Vehicle-to-Grid and Vehicle-to-Infrastructure use cases, as these collaborations unlock new value pools and support larger ecosystem adoption. Fifth, establish clear commercial models for software monetization, aftersales services, and cybersecurity subscriptions to capture recurring revenue and justify continuous investment in feature evolution. Finally, invest in talent and organizational capability, including systems engineering, over-the-air operations, and compliance functions, to ensure that strategic plans translate into reliable, certified deployments across diverse regional requirements.

Transparent explanation of the mixed methods research approach combining primary industry engagement with technical validation regulatory review and scenario analysis

The research behind this executive summary combines primary engagement with industry practitioners and structured analysis of publicly available technical and regulatory information. Primary inputs included interviews with vehicle manufacturers, Tier suppliers, semiconductor firms, and software specialists to understand real-world deployment challenges, architecture preferences, and procurement priorities. These perspectives were triangulated with analysis of standards body publications, patent filings, regulatory guidance, and product roadmaps to validate technological trajectories and compliance constraints.Complementary methods included comparative case studies of architecture migrations, forensic supply chain mapping to identify concentration risks and lead time exposures, and scenario analysis to evaluate the effects of trade policy changes on procurement and sourcing strategies. Validation exercises with independent experts and technical reviewers refined the conclusions and ensured that recommendations are actionable and aligned with the operational realities of system integration, testing, and certification. The research process emphasized transparency in assumptions and robustness checks across multiple possible futures to provide leaders with a defensible basis for strategic decisions.

Concise conclusion synthesizing the strategic implications of emerging technical trends trade dynamics and evolving commercial models for automotive communications

In summary, the automotive communication domain is undergoing a decisive shift toward unified, software-enabled architectures that demand new approaches to network design, security, and supplier engagement. Technical imperatives such as the move to high-bandwidth fabrics and the need for deterministic control in safety-critical domains are intersecting with commercial pressures from trade policy, changing procurement models, and the monetization of software-driven services. Organizations that align their architectures, supply chains, and commercial models to these realities will be better positioned to deliver differentiated user experiences, maintain regulatory compliance, and capture recurring revenue streams.Moving forward, the balance of opportunity will favor entities that combine systems-level engineering with adaptable sourcing strategies and proactive security postures. By integrating the insights and recommendations offered here into product planning and procurement frameworks, leaders can reduce integration risk, accelerate time-to-market for new features, and create sustainable competitive advantage in an increasingly connected and software-defined vehicle ecosystem.

Additional Product Information:

- Purchase of this report includes 1 year online access with quarterly updates.

- This report can be updated on request. Please contact our Customer Experience team using the Ask a Question widget on our website.

Table of Contents

7. Cumulative Impact of Artificial Intelligence 2025

16. China Automotive Communication Market

Companies Mentioned

The key companies profiled in this Automotive Communication market report include:- Advanced Micro Devices

- AutoTalks Ltd.

- Continental AG

- Daimler AG

- Delphi Technologies PLC

- General Motors Company

- Harman International Industries, Inc.

- Infineon Technologies AG

- Microchip Technology Inc.

- NXP Semiconductors N.V.

- Qualcomm Incorporated

- Renesas Electronics Corporation

- Robert Bosch GmbH

- Rohm Co., Ltd.

- Semiconductor Components Industries, LLC

- Siemens AG

- STMicroelectronics International N.V.

- Tata Communications Limited

- Texas Instruments Incorporated

- Toshiba Electronic Devices & Storage Corporation

- Toyota Motor Corporation

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 191 |

| Published | January 2026 |

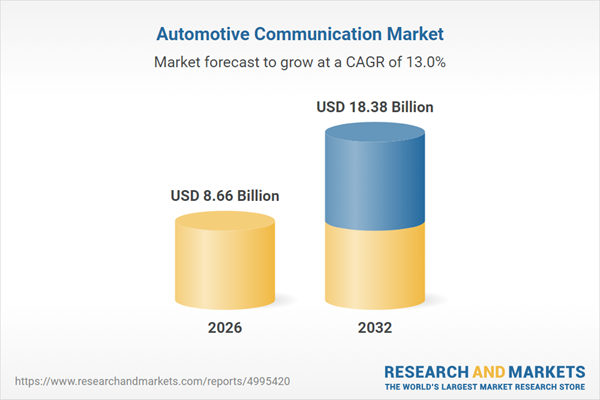

| Forecast Period | 2026 - 2032 |

| Estimated Market Value ( USD | $ 8.66 Billion |

| Forecasted Market Value ( USD | $ 18.38 Billion |

| Compound Annual Growth Rate | 13.0% |

| Regions Covered | Global |

| No. of Companies Mentioned | 22 |