COVID-19 has significantly impacted the growth of the systemic lupus erythematosus market because SLE patients are prone to COVID-19 infection on account of the aberrant immune responses inherent to the disease and the frequent treatment of immune suppressants. For instance, according to an article published by the National Library of Medicine, in May 2022, the prevalence of COVID-19 infection varied between 0.0% and 18.1% in SLE patients, and the hospitalization rates ranged from 0.24% to 10.6%. A decline in SLE hospitalization rate was found during the COVID-19 pandemic, and disease flare (38.9%) and infection (22.2%) were considered the main reasons for hospitalization in SLE patients. Furthermore, as per the study published in May 2022, by the National Library of Medicine, during the pandemic, SLE patients with COVID-19 experienced medicine supply shortages, missed medication doses, financial hardships, and psychological suffering. However, currently, as there is better access to drugs as compared to the initial pandemic phase due to the lockdown, the market is expected to gain its growth pace over the coming 3-4 years.

Factors such as the increasing prevalence of systemic lupus erythematosus, growing risk factors, and medical advancements by biopharmaceutical companies in SLE are expected to drive the market over the forecast period. For instance, according to an article published by Frontiers Media S.A., in April 2021, the prevalence rate of SLE varied from 4.8 to 91 per 100,000 people across sexes, age groups, geographical regions, and ethnic backgrounds. The incidence and prevalence rates in people of African or Asian backgrounds were approximately 2-3-times higher than those in white populations. Furthermore, according to a CDC update, in July 2022, poor access to care, late diagnosis, less effective treatments, and poor adherence to therapeutic regimens may increase the damaging effects of systemic lupus erythematosus, causing more complications and an increased risk of death. SLE can affect people of all ages, including children. Thus, when SLE risk factors increase, so does the demand for SLE drugs, propelling the market's growth over the forecast period.

Several biopharmaceutical companies are seeking approval for the advancement of SLE to improve the treatment of SLE including the identification of genetic variations, an enhanced understanding of innate and adaptive immune activation and regulation of tolerance, and dissection of immune cell activation. For instance, in August 2021, AstraZeneca received approval from the United States Food and Drug Administration for Saphnelo (nivolumab-final) for the treatment of adult patients with moderate to severe systemic lupus erythematosus (SLE) who are receiving standard therapy. Additionally, in July 2022, US FDA approved GSK plc's Benlysta (belimumab) for the treatment of children aged 5 to 17 with active lupus nephritis (LN) who are receiving standard therapy. In lupus nephritis, SLE causes kidney inflammation of the small blood vessels that filter wastes in your kidney. BENLYSTA is indicated for patients aged ≥5 with active SLE. These improvements in clinical trial design, form a platform from which to launch the development of a new generation of lupus therapies.

Thus, the above-mentioned factors are expected to fuel growth in the SLE market over the forecast period. However, the high cost of treatment and several misconceptions and social stigmas are expected to be the primary hindrances.

Systemic Lupus Erythematosus Market Trends

Biologics Segment is Expected to Witness a Significant Growth Over the Forecast Period

Biologic drugs target specific pathways i.e. T-B lymphocyte interaction, cytokines, and complimentary system, and have been proposed as a tool for SLE treatment. B-cell targeted therapies, including anti-B lymphocyte stimulator (BLyS) and anti-CD20 monoclonal antibodies are at forefront of SLE treatment. Biologics are designed to interact with the immune system in certain ways, making them a more targeted treatment option. They bind with high specificity to their targets on intracellular components or cell surfaces. Thus, biologics are better as compared to others due to the side effects caused by other treatment modalities such as cardiovascular damage caused by NSAIDs. Furthermore, according to an article published by National Resource Center on Lupus, in November 2022, several investigational biologic drugs have already been approved by the FDA for treating other conditions and are now being studied for SLE and other treatments which are not yet approved for any diseases and are not on the market or available to any individuals except those in clinical trials. These drugs are Blisibimod (like belimumab (Benlysta)), which was been designed to block signals that come from a protein, Lupuzor which was developed to change the behavior of a specific type of T cell involved in lupus disease activity, Rituximab (Rituxan) approved for the treatment of lymphoma and rheumatoid arthritis that targets a specific protein called CD20 on the surface of B cells, and Ustekinumab (Stelara) that targets a protein that becomes unregulated due to a particular imbalance in how T Cells develop in lupus. Therefore, such an increase in the development of SLE biologic drugs is expected to drive the growth of the segment.Furthermore, an increase in biologics clinical study for the treatment of SLE is a factor driving the market growth. For instance, in June 2021, Biogen Inc. announced that the first patient has been dosed in the global clinical study, TOPAZ-1. The Phase 3 study will evaluate the clinical efficacy and assess the safety of BIIB059, a first-in-class, humanized IgG1 monoclonal antibody (mAb) targeting blood dendritic cell antigen 2 (BDCA2), as compared to placebo, in participants with active systemic lupus erythematosus (SLE). TOPAZ-1 is expected to be conducted at approximately 135 sites worldwide and aims to enroll 540 adults with active SLE. Such an initiative is expected to drive the market. As a result, the aforementioned reasons will likely contribute to this segment's strong growth over the forecast period.

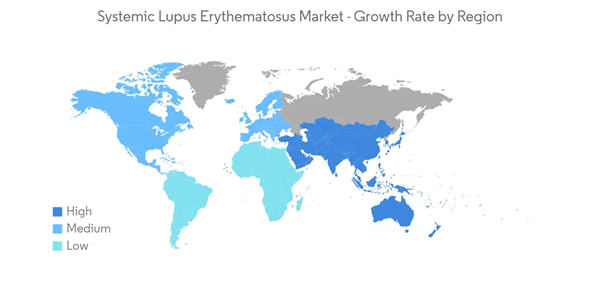

North America is Expected to Dominate the Systemic Lupus Erythematosus Market Over the Forecast Period

North America is expected to hold a significant market share in the global systemic lupus erythematosus market owing to increased awareness about the disease, better healthcare infrastructure, and a growing number of foundations and independent venture groups supporting biopharmaceutical manufacturers. This is boosted by the many non-profit organizations and funding communities supporting the cause. For instance, in October 2022, the National Institute of Arthritis and Musculoskeletal and Skin Diseases of the National Institutes of Health-funded USD 8.30 million to identify biomarkers of drug resistance and to develop new approaches to care for pediatric SLE. Additionally, in September 2022, the Lupus Research Alliance's 2022 Global Team Science Awards (GTSA) grant provided USD 3 million for 3 years to researchers working tirelessly to advance lupus research. Thus, it is expected to fuel the overall market growth during the forecast period.In addition, the burden of growing autoimmune diseases also fuels the growth of the systemic lupus erythematosus market. As per the study published by, the National Library of Medicine, in April 2021, the number of systemic lupus erythematosus cases in the United States was 72.8 per 100,000 person-years. Furthermore, according to an article published by the American College of Rheumatology, in June 2022, site monitors and coordinators were provided with study toolkits to educate SLE patients and families about the clinical trial process and assist sites in raising awareness of the study through local outreach. Therefore, the growing prevalence rate of systemic lupus erythematosus along with the increased awareness about the disease is expected to increase the demand for effective treatment which eventually is expected to drive the market. Thus, owing to the abovementioned factors, the studied market in the North American region is expected to project growth over the forecast period.

Systemic Lupus Erythematosus Market Competitor Analysis

The systemic lupus erythematosus market is moderate due to the presence of companies operating globally as well as regionally. The competitive landscape includes an analysis of a few international as well as local companies which hold significant market shares and are well known including GlaxoSmithKline, F. Hoffmann-La Roche AG, Pfizer Limited, Sanofi SA, and AstraZeneca, among others.Additional benefits of purchasing the report:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

This product will be delivered within 2 business days.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- GlaxoSmithKline

- F. Hoffmann-La Roche AG

- Pfizer Limited

- Sanofi SA

- Eli Lilly & Company

- Viatris Inc.

- Novartis AG

- ImmuPharma PLC

- Bristl Myers Squibb Company

- AstraZeneca

- Merck & Co., Inc.