Key Highlights

- The onshore is expected to have the maximum share in the market. Onshore drilling encompasses all the drilling sites located on dry land and accounts for 70% of worldwide oil production.

- The demand for oil and gas production has been increasing, leading to increased exploration activities. This factor is expected to help grow the market during the forecast period. Also, there has been an increasing demand for safe and time-efficient drilling methods, which may create a good opportunity for robotic drilling systems in the future.

Key Market Trends

Onshore to Dominate the Market

- The market for robotic drilling systems saw a growth slowdown due to the volatile oil prices in recent years. However, with the oil prices becoming stable, the market is expected to grow during the forecast period.

- There has been increasing pressure on drilling companies to reduce the risk and number of accidents related to the drilling industry. This factor is resulting in the operator companies moving toward robotic drilling systems to reduce human error and increase efficiency.

- Onshore oil production accounts for around 70% of global oil production. Increased onshore exploration activity worldwide during the forecast period is expected to boost the market for robotic drilling.

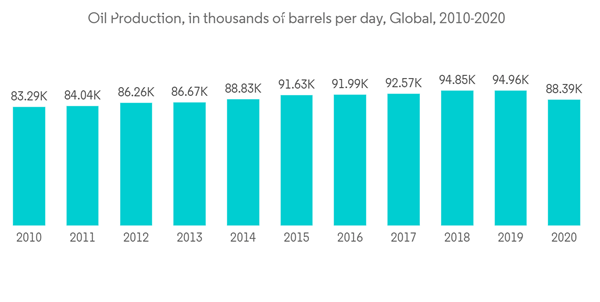

- As of 2020, global oil production reached 88,391 thousand barrels per day, increasing by 6.12% since 2010.

- In October 2021, the Italian energy services group Saipem signed onshore drilling contracts in the Middle-East and South America worth USD 70 million.

- Moreover, in January 2022, Indonesia Energy Corp. Ltd planned to begin drilling its two new wells at 63,000-acre Kruh block onshore Sumatra and a third well before the end of the year. The wells (Kruh 27, Kruh 28, Kruh 29) are estimated to be worth USD 1.5 million each to drill and complete.

- As the crude oil prices increase, the upstream investment is expected to grow significantly and bring several projects online, thereby driving the market.

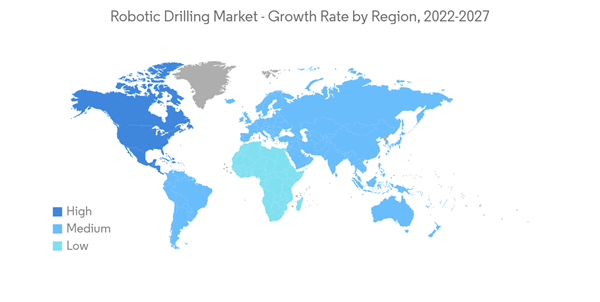

North America to Dominate the Market

- North America is a major market for robotic drilling systems due to the recent shale gas exploration. Exploration in the Gulf of Mexico is also on the rise, further boosting the robotic drilling systems market in the region.

- As a result of higher oil prices and declining drilling costs, the offshore rig count and oil production in the United States increased significantly, indicating growing offshore drilling, which is expected to be a major driver for the robotic drilling market in the country.

- As of May 1, 2021, the Bureau of Ocean Energy Management (BOEM) manages about 2,287 active oil and gas leases on approximately 12.1 million Outer Continental Shelf (OCS) acres in the United States. In 2020, offshore federal production reached approximately 641 million barrels of oil and 882 billion cubic feet of gas, which is improving the demand for robotic drilling in the region.

- In November 2021, Petrobras awarded two contracts worth USD 549 million to the offshore drilling contractor Seadrill Limited for the West Carina and West Tellus rigs, which will work on the Búzios field offshore Brazil.

- Therefore, rising oil and gas investments, the development of shale plays, and increasing focus on reducing risk, time, and cost of drilling activities are expected to boost the robotic drilling systems market during the forecast period.

Competitive Landscape

The robotic drilling market is moderately consolidated with a few active players, namely, National-Oilwell Varco Inc., Nabors Industries Ltd, Drillform Technical Services Ltd, Huisman Equipment BV, and Drillmec Inc.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

This product will be delivered within 2 business days.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Ensign Energy Services Inc.

- Huisman Equipment BV

- Drillmec Inc.

- Sekal AS

- Abraj Energy Services SAOC

- Drillform Technical Services Ltd

- National-Oilwell Varco Inc.

- Rigarm Inc.

- Automated Rig Technologies Ltd

- Nabors Industries Ltd