Speak directly to the analyst to clarify any post sales queries you may have.

10% Free customizationThis report comes with 10% free customization, enabling you to add data that meets your specific business needs.

Government initiatives, such as the National Mission on Edible Oils, aim to boost domestic production and reduce import dependence. The market is also witnessing innovation in packaging and branding, with a shift toward healthier and premium edible oil variants. The report underscores a significant rise in per capita edible oil consumption in India over the past decades, reaching 19.7 kg per year. This surge in demand has outstripped domestic production, resulting in a heavy dependence on imports to cater to both household and industrial needs.

In 2022-23, India imported 16.5 million tonnes (MT) of edible oils, with domestic production meeting only 40-45% of the total demand. This import reliance poses a major challenge to the country’s self-sufficiency goals, highlighting the urgent need for enhanced domestic production, yield improvements, and strategic policy interventions in the edible oil sector.

Key Market Drivers

Rising Population and Increasing Consumption Demand

India’s growing population is a major driver of the edible oil market, leading to a steady rise in domestic consumption. With a population exceeding 1.4 billion, edible oil is a staple in Indian households, used daily for cooking and food preparation. As the middle class expands and disposable incomes rise, people are consuming more diverse and processed foods, further driving oil demand.The increasing shift towards urbanization and fast-paced lifestyles has led to a surge in demand for ready-to-eat and packaged food products, which require edible oils as a key ingredient. According to the Industry reports published in Jan 2025, highlight that India's per capita annual edible oil consumption has exceeded 20 kg, surpassing the recommended limits of 12 kg set by the Indian Council of Medical Research (ICMR) and 13 kg by the World Health Organization (WHO). These factors, along with changing dietary habits, urbanization, and rising disposable incomes, are key drivers of market demand, influencing purchasing patterns and shaping the growth trajectory of India's edible oil industry.

Key Market Challenges

High Dependence on Imports and Price Volatility

One of the most significant challenges in the Indian edible oil market is its heavy reliance on imports. India imports nearly 60-70% of its total edible oil consumption, mainly from countries like Indonesia, Malaysia, Argentina, and Brazil. Palm oil, soybean oil, and sunflower oil constitute the majority of these imports. This dependence makes India highly vulnerable to global price fluctuations, trade restrictions, and geopolitical tensions. For example, the Russia-Ukraine conflict severely impacted sunflower oil supplies, leading to price surges.Additionally, changes in international tariffs, export bans, and climate-related disruptions in major producing countries further contribute to unstable pricing. The fluctuating cost of crude edible oils directly affects consumer prices, making it difficult for households and businesses to manage their budgets. The Indian government frequently intervenes by adjusting import duties and stock limits, but long-term sustainability requires increased domestic production and diversification of sources.

Key Market Trends

Government Initiatives to Boost Domestic Production

India remains heavily dependent on imported edible oils, with nearly 60-70% of its total consumption sourced from Indonesia, Malaysia, Argentina, and Brazil. To reduce this reliance and promote self-sufficiency, the Indian government has launched initiatives to boost domestic oilseed production. The National Mission on Edible Oils - Oil Palm (NMEO-OP) is a major step in this direction, aiming to increase oil palm cultivation in states like Andhra Pradesh, Telangana, and Assam. Additionally, efforts are being made to increase mustard, groundnut, soybean, and sunflower production through subsidies, research, and improved farming techniques. While these initiatives hold promise, climate challenges, land availability, and concerns over environmental impact (especially for oil palm) remain key hurdles. The push for domestic refining and processing facilities is also growing, as India seeks to develop a stronger edible oil supply chain and reduce price fluctuations caused by global market dependencies.Key Market Players

- Adani Wilmar Limited

- Agro Tech Foods Limited

- BCL Industries Ltd.

- Bunge India Private Limited

- Cargill India Private Limited

- Emami Agrotech Limited

- Gulab Oils & Foods Pvt Ltd.

- Mahesh Edible Oil Industries Limited (Saloni Mustard oil)

- Marico Limited

- Patanjali Ayurved Limited

Report Scope:

In this report, the India Edible Oil Market has been segmented into the following categories, in addition to the industry trends which have also been detailed below:India Edible Oil Market, By Product Type:

- Mustard Oil

- Soybean Oil

- Sunflower Oil

- Palm Oil

- Olive Oil

- Others

India Edible Oil Market, By Packaging Type:

- Pouches

- Cans

- Bottles

- Others

India Edible Oil Market, By Sales Channel:

- Supermarkets/Hypermarkets

- Convenience Stores

- Online

- Others

India Edible Oil Market, By Region:

- North

- South

- East

- West

Competitive Landscape

Company Profiles: Detailed analysis of the major companies present in the India Edible Oil Market.Available Customizations:

With the given market data, the publisher offers customizations according to a company's specific needs. The following customization options are available for the report.Company Information

- Detailed analysis and profiling of additional market players (up to five).

This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned

- Adani Wilmar Limited

- Agro Tech Foods Limited

- BCL Industries Ltd.

- Bunge India Private Limited

- Cargill India Private Limited

- Emami Agrotech Limited

- Gulab Oils & Foods Pvt Ltd.

- Mahesh Edible Oil Industries Limited (Saloni Mustard oil)

- Marico Limited

- Patanjali Ayurved Limited

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 85 |

| Published | February 2025 |

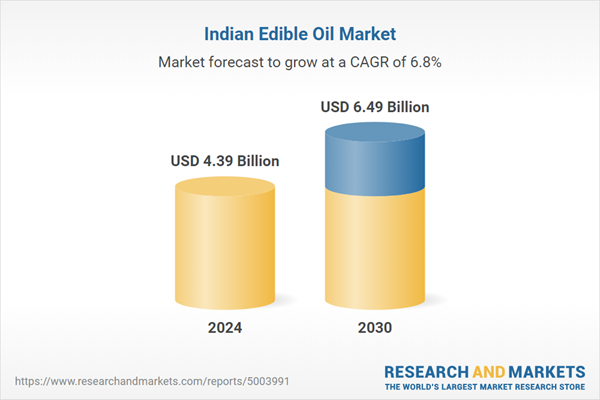

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 4.39 Billion |

| Forecasted Market Value ( USD | $ 6.49 Billion |

| Compound Annual Growth Rate | 6.7% |

| Regions Covered | India |

| No. of Companies Mentioned | 10 |