High consumption of beverages remained one of the key factors, driving the market studied, during the forecast period. Despite rising concern against the detrimental attributes of soft drinks, the sector lays vast scope for the niche ingredients like phosphoric acid, about the robust consumption share of cola drinks in the overall soft drink industry. Moreover, companies, promoting their products and supplementing their sales, are constantly emphasizing the fact that phosphorus acid, when taken in small quantities, causes no harm. For instance, Pepsi, in response to several epidemiological studies, stated a research finding about the health-effectiveness of phosphoric acids. Additionally, companies like Coca-Cola are even comparing the incorporated phosphorus content with food products, including milk, rice, and chicken, to gain consumers' confidence.

The market studied is increasingly being driven by its evolving role as a food additive in a variety of processed food products. Thus, the growing demand for preservative food products, especially in the beverage industry, is providing a thrust to the market. Furthermore, the multidimensional role of food-grade phosphoric acid in the leavening process of baking, moisture, color, texture, and flavor retention, and its important role as an anti-caking agent is augmenting the growth of the market studied. Hence, brands such as Bell Chem have been offering food-grade phosphoric acid that acts as a food source for yeast and is often employed as an ingredient to leaven baked goods.

Food Grade Phosphoric Acid Market Trends

Increasing Demand as a Food Additive

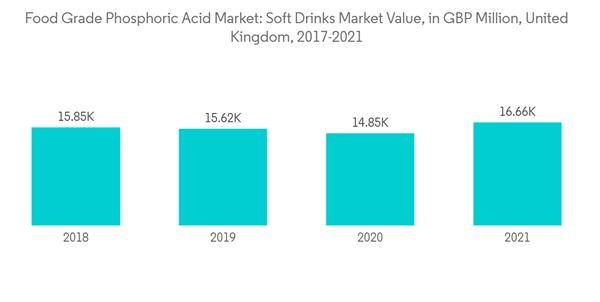

The market studied is increasingly being driven by its evolving role as a food additive in a variety of processed food products. Thus, the growing demand for preservative food products, especially in the beverage industry, boosts the market. The inorganic chemical is used to acidulate cola-type beverages. Pure food-grade phosphoric acid is an important food additive in food sauces, mayonnaise, and fruit juices. Sodium and potassium phosphate salts serve as food preservatives. Phosphates in processed foods can maintain and improvise the structure, color, flavor, and other sensory attributes of the food and improve performance in baked food items by achieving optimum leavening.The increasing demand for convenience and processed food such as ready-to-eat foods, ready-to-drink beverages, snacks, frozen meals, and others is one of the significant factors driving the food additives market. With the rising urbanization, growing middle-class population, increasing number of working women, and rising disposable income, the developed and developing regions across the world are witnessing a rising demand for processed and packaged food, thereby increasing the need for food packaging and processing solutions. Therefore, food additives are extensively used in processed and convenience food products to preserve the freshness, safety, taste, appearance, and texture of processed foods. Phosphoric acid is often added to carbonated drinks for a sharper and tangy taste. It also helps slow down the growth of molds and bacteria in sugar formula. Leading beverage companies across the world have been using phosphoric acid in their product compositions. For instance, Coca-Cola incorporates phosphoric acid, which is used in its certain sparkling beverages to add tartness. Hence, the food-grade phosphoric acid market has been growing proportionally, along with the beverage industry's growth. For instance, in 2021, the UK soft drink industry's revenue was GBP 16.66 billion, thus boosting the demand for food-grade phosphoric acid.

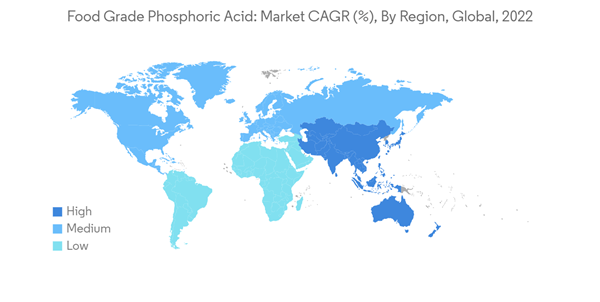

Asia-Pacific Constitutes the Largest and Fastest-growing Market

The food-grade phosphorus acid and phosphates have gained strong benefits from the rapid development of the food processing industry in countries like China, India, and other developing countries. Most manufacturers are consistently expanding production capabilities to cater to the growing demand for food-grade phosphoric acid. Factors such as high production rates and lower labor rates have led Asian countries like China to account for the major share of the food-grade phosphoric acid market.The sugar industries in the Asia-Pacific region use the additive in sugar refining. Also, as per the M.S. Asia Group, food-grade phosphoric acid salts are blended with baking soda to manufacture baking powder used as a fermenting agent in many baked products. Poultry products in Southeast Asian countries are improved with salt solutions to enhance their flavor and moisture. In Taiwan, it is used to process bean products, such as bean curd, meat products, juice beverages, and yeast powder.

According to the Bureau of Indian Standards, the use of food-grade phosphoric acid is permitted in India under the Prevention of Food Adulteration Rules, 1955, unless it contains sulfate, fluoride, and chloride impurities. The country utilizes 85% food-grade phosphoric acids in beverages, seed processing, sugar juice, sugar refining, and food and phosphate manufacturing.

Food Grade Phosphoric Acid Industry Overview

The leading players in the food-grade phosphoric acid market enjoy a dominant presence worldwide. However, the market studied is highly fragmented in nature due to the presence of a huge number of players in the market. These players focus on leveraging opportunities posed by emerging markets to expand their product portfolios to cater to the requirements of various industries, especially the food processing industry. Some of the major players in the market include Brenntag SE, OCP SA, Grasim Industries Limited, Prayon SA, and Guangxi Qinzhou Capital Success Chemical Co. Ltd. The players adopt strategies such as expansions and product innovations to maintain their stronghold in the market. Such strategies help the players efficiently cater to the end-user demand and maintain a leading position in the market.Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

This product will be delivered within 2 business days.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Brenntag AG

- Nutrien Ltd

- Guangxi Qinzhou Capital Success Chemical Co. Ltd

- OCP SA

- Grasim Industries Limited

- Merck KGaA

- Spectrum Chemical Manufacturing Corp.

- Prayon SA

- Emco Dyestuff Pvt. Ltd

- Vinipul Inorganics Private Limited