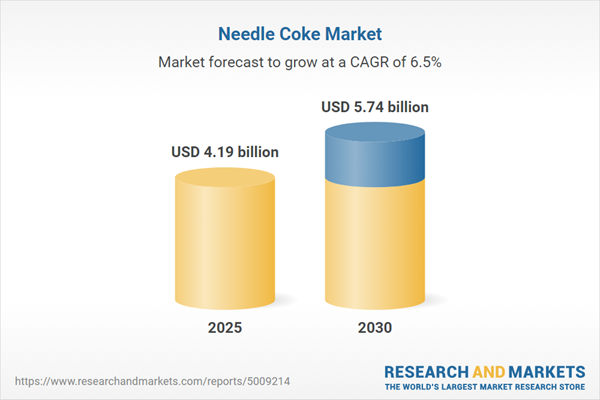

The global needle coke market is projected to experience robust growth from 2025 to 2030, driven by increasing demand for electric vehicles (EVs) and steel production, particularly through electric arc furnace (EAF) technology. Needle coke, a high-quality carbon material derived from petroleum or coal tar, is critical for manufacturing graphite electrodes used in EAF steelmaking and lithium-ion battery anodes for EVs. The market is fueled by stringent environmental regulations promoting sustainable steel production and the global push for electrification in transportation. Challenges include raw material supply constraints and high production costs.

Market Drivers

Rising Demand for Electric Vehicles

The surge in EV adoption is a primary driver of the needle coke market, as needle coke is essential for producing graphite anodes in lithium-ion batteries. The International Energy Agency reported significant EV sales growth, with global sales reaching 17 million in 2024, a 25% increase from 2023. This growth, particularly in China, drives demand for high-quality needle coke to meet battery production needs. Government policies, such as the U.S. mandate for 100% zero-emission vehicles by 2035 and India's target for 30% EV penetration in private cars by 2030, further boost demand for needle coke in battery applications.Increasing Steel Production via EAF

The global shift toward EAF steelmaking, driven by stricter environmental regulations, is increasing demand for needle coke, a key raw material for graphite electrodes. EAF technology, which emits less carbon than traditional blast oxygen furnaces, is gaining traction. In November 2023, JFE Steel announced plans to build a large-scale EAF at its Kurashiki plant in Japan, aiming to reduce emissions by 2.6 million tons annually by 2027. Similarly, HEG Limited expanded its graphite electrode capacity to 100 kilotons per annum in November 2023, reinforcing the growing need for needle coke. China's Industrial Carbon Peaking plan, issued in 2022, projects EAF steelmaking to account for over 20% of steel production by 2030, with an annual scrap processing capacity exceeding 180 million metric tons.Market Restraints

The needle coke market faces challenges due to limited raw material availability and high production costs, which can constrain supply and increase prices. Regulatory discrepancies and infrastructural limitations in some regions also hinder market growth. Additionally, economic uncertainties and supply chain disruptions pose risks to consistent production and distribution, particularly in emerging markets.Market Segmentation

By Application

The market is segmented into graphite electrodes, lithium-ion batteries, and other applications like specialty carbon and ferroalloys. Graphite electrodes dominate, holding over 55% of the market share in 2023, driven by their critical role in EAF steelmaking. Lithium-ion battery applications are growing rapidly, fueled by EV production and energy storage demands, with needle coke used in high-performance anode materials.By Grade

The market includes intermediate, premium, and super-premium grades. Intermediate-grade needle coke held over 50% of the market revenue in 2023 due to its cost-effectiveness and versatility in steel and battery applications. Super-premium grades are gaining traction for their low sulfur content and high performance in advanced applications.By Geography

The Asia-Pacific region dominates, accounting for 63.5% of global market revenue in 2024, with China leading due to its robust steel and EV industries. China's needle coke market is expected to reach $2.47 billion by 2030, driven by its position as the world's largest steel producer, with 67.4 million metric tons produced in 2023. India is the fastest-growing market in the region, with its lithium-ion battery market projected to grow at a CAGR of 50% to 220 GWh by 2030. North America and Europe are also significant, driven by EV adoption and steel industry modernization.Key Industry Developments

In January 2025, Chevron Lummus Global and TAQAT signed an agreement to enhance needle coke production for steel and battery applications, emphasizing technological advancements. In November 2023, Nippon Steel Corporation acquired a 20% stake in Elk Valley Resources to secure raw materials for needle coke production. These developments highlight the industry's focus on capacity expansion and sustainability.The needle coke market is set for strong growth from 2025 to 2030, driven by EV battery production and EAF steelmaking. Asia-Pacific, particularly China, leads due to its dominant steel and EV sectors. Despite challenges like raw material scarcity, strategic investments and technological innovations will drive market expansion. Industry players must focus on sustainable production and supply chain stability to capitalize on growing demand.

Key Benefits of this Report:

- Insightful Analysis: Gain detailed market insights covering major as well as emerging geographical regions, focusing on customer segments, government policies and socio-economic factors, consumer preferences, industry verticals, and other sub-segments.

- Competitive Landscape: Understand the strategic maneuvers employed by key players globally to understand possible market penetration with the correct strategy.

- Market Drivers & Future Trends: Explore the dynamic factors and pivotal market trends and how they will shape future market developments.

- Actionable Recommendations: Utilize the insights to exercise strategic decisions to uncover new business streams and revenues in a dynamic environment.

- Caters to a Wide Audience: Beneficial and cost-effective for startups, research institutions, consultants, SMEs, and large enterprises.

What do businesses use our reports for?

Industry and Market Insights, Opportunity Assessment, Product Demand Forecasting, Market Entry Strategy, Geographical Expansion, Capital Investment Decisions, Regulatory Framework & Implications, New Product Development, Competitive Intelligence.Report Coverage:

- Historical data from 2020 to 2024 & forecast data from 2025 to 2030

- Growth Opportunities, Challenges, Supply Chain Outlook, Regulatory Framework, and Trend Analysis

- Competitive Positioning, Strategies, and Market Share Analysis

- Revenue Growth and Forecast Assessment of segments and regions including countries

- Company Profiling: Strategies, Products, Financial Information, and Key Developments among others

Market Segmentation:

By Type

- Petroleum-Based Needle Coke

- Coal-Based Needle Coke

By Grade

- Intermediate

- Premium

- Super Premium

By Application

- Graphite Electrode

- lithium-ion batteries

- Others

By Geography

- North America

- USA

- Canada

- Mexico

- South America

- Brazil

- Argentina

- Others

- Europe

- UK

- Germany

- France

- Italy

- Others

- Middle East and Africa

- UAE

- Saudi Arabia

- Others

- Asia Pacific

- Japan

- China

- India

- South Korea

- Thailand

- Taiwan

- Indonesia

- Others

Table of Contents

Companies Mentioned

- Phillips 66

- Asbury Carbons

- Graf Tech International Holdings Inc.

- Mitsubishi Chemical Corporation

- SojitzJECT Corporation

- Indian Oil Corporation

- NIPPON STEEL Chemical & Material Co., Ltd.

- Sumitomo Corporation

- Cabot Corporation

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 144 |

| Published | August 2025 |

| Forecast Period | 2025 - 2030 |

| Estimated Market Value ( USD | $ 4.19 billion |

| Forecasted Market Value ( USD | $ 5.74 billion |

| Compound Annual Growth Rate | 6.4% |

| Regions Covered | Global |

| No. of Companies Mentioned | 9 |