Key Highlights

- The rice yield in China increased from 6.9 metric tons/ha in 2016 to 7.1 metric tons/ha in 2021, owing to the widespread adaptation of improved rice varieties, nutrient management, and cultivation methods.

- The demand for specialized rice varieties, such as aromatic rice and long-grain rice, is steadily driving the market. The government is also undertaking a number of efforts for the production of rice and related industries, which is boosting the China rice market.

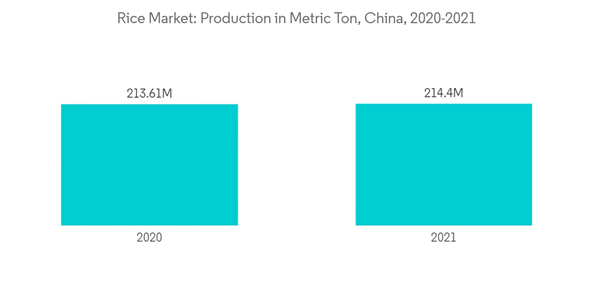

- According to Food and Agriculture Organization (FAO), China produced about 214.4 million metric tons of rice in 2021, with the area harvested being 30.4 million ha. The country has dominated production over the ages and continues to do so. All rice cultivation is highly labor-intensive.

- Rice is an annual crop typically grown under flooded conditions through bunds to keep water in the field. China's climate is highly favorable for paddy cultivation, hence, the widespread production.

- Broken rice has accounted for about 50% of China's rice imports, primarily from India and Burma, for feed, liquor, and snack production. Between January and July of 2022, China imported 2.6 million metric tons of Indian rice, 2.5 million of which was broken rice. Rice farms are mainly located in Central China (in the provinces of Jiangsu, Anhui, Hubei, and Sichuan along the Yangtze River Valley), accounting for about 49% of total Chinese rice production (National Bureau of Statistics of China).

China Rice Market Trends

Various Measures are adopted to enhance the Rice Production

- China is the world's largest producer of rice. It is the most important cereal crop in China, with about 65% of the Chinese population relying on rice as their staple food. Nearly 95% of the rice grown in China is produced under traditional puddled transplanted conditions with prolonged periods of flooding, which requires intense labor. It accounts for 30% of the total world production and consumption of rice.

- China has implemented a series of programs to promote rice productivity. It also brought about trade restrictions and policies aimed at increasing farmers' income while managing domestic food demand. Various research studies are being undertaken in China to increase yield in an eco-friendly manner via international organizations, such as International Rice Research Institute (IRRI).

- Technological innovation has become a driving force for rural rice production. Moreover, continuous developments in rice mill machinery and attractive packaging increase the product demand in the country. The increasing demand for specialty rice varieties has increased trade for long-grain rice, driving the market steadily during the forecast period.

Increasing Rice Exports from China

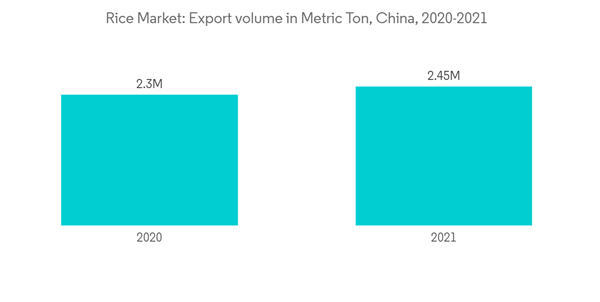

- China is a major exporter of rice. Despite the huge domestic demand, the country has been able to increase its export volumes over the years. According to ITC Trademap, China exported around 2.08 million metric tons of rice in 2018, which reached 2.44 million metric tons in 2021, with a value of USD 1.03 billion.

- People in China eat sticky rice with a rich taste when fresh. The flavor of fresh rice is different from the old rice stock; thus, there is always demand for fresh rice in China. Due to the growing demand for fresh rice, the government exports its old stock at very low rates to Middle Eastern and African countries.

- Major importers of Chinese rice are Ivory Coast, Egypt, Turkey, Korea, the Philippines, and Japan. The continuous high rice production in the region is likely to increase export quantity further during the forecast period.

- Higher rice exports signify the ability of Chinese farmers to meet the requirement of domestic consumption and yet produce a surplus to export to the rest of the world. Government policies and schemes to enhance export performance and trade agreements signed by China will likely benefit many farmers, which in turn drives the market.

China Rice Industry Overview

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

This product will be delivered within 2 business days.