Key Highlights

- Growing healthier and more sporting lifestyles in the country, along with the increasing craze of fitness and the use of whey protein products by fitness practitioners, is driving the market's growth in China. These factors are pushing manufacturers in the country to add whey protein as an ingredient in most healthy products toattract consumers. For instance, in January 2021, United States-based food technology company Perfect Day, backed by Li Ka-shing's Horizons Ventures, partnered with a Hong Kong ice cream maker to launch an animal-free dairy variety of the dessert. The company claimed that the range of ice creams launched uses whey protein developed by fermentation from the gene sequence of bovine whey protein.

- Additionally, whey is a very nutrient-dense by-product of the cheese industry that can be fed to animals in various ways, including dried whey products, liquid whey, condensed whey, or dried whey to improve their health and performance. For instance, ruminants can consume up to 30% of their dry-matter intake as liquid whey without impaired performance. Nonruminant rations frequently contain small amounts of dried whey or partially lactose whey to boost weight increases, feed effectiveness, protein, and fat digestibility, as well as mineral absorption and retention.

- Owing to these factors, both consumers and manufacturers frequently tend to prefer whey-based feed products, which are rising in demand. However, domestic feed supplies have been unable to keep up with soaring demand, and imports of whey powder expanded rapidly. Moreover, increasing applications of whey protein in different industries like animal feed, food and beverages, personal care, cosmetics, and supplements are expected to raise the demand for whey protein in the country during the forecast period.

China Whey Protein Market Trends

Growing Fitness Trend in the Country

- There is a growing trend for fitness among the Chinese population, especially among the youth population. Additionally, fitness clubs are making changes in response to the demand from the urban Chinese population, who wishes to shape and pamper their bodies. For instance, according to styd.cn, in 2021, the number of fitness club members in China exceeded 75 million, representing an increase of almost five million from the previous year. With growing awareness of health and fitness in the past few years, the gym sector experienced a period of prosperity.

- This increasing number of gym and fitness enthusiasts directly impacts the growth of the market, as whey protein can enhance fitness levels and aid in reaching fitness goals faster. This has also led to a growth in the demand for sports and wellness nutrition products, where whey protein is a major ingredient.

- Moreover, government initiatives and fitness campaigns being carried out in the country are expected to further support the growth of the market. In order to motivate and help people to keep themselves fit, in August 2021, the State Council of China issued a circular to push forward a new five-year extensive mass fitness program spanning from 2021 to 2025. According to the circular, by 2025, the general public will have access to all exercise facilities in counties, towns, and administrative villages, as well as settlements that are within a 15-minute walk. And in accordance with that, the worth of the sports sector should be 5 trillion yuan.

- The government has announced that in the coming years, over 2,000 sports parks, public fitness centers, and public stadiums will be established or expanded. Such initiatives are further expected to motivate people toward fitness, thus positively impacting the market's growth.

Whey Protein Concentrate Held the Major Share

- Concentrates are more popular for boosting the immunity of the body. Whey protein concentrates account for a major share of the whey protein ingredients market owing to their competitive price and availability. Of all forms of whey proteins, whey protein concentrates are rich in lactose and low in protein, and they constitute over one-third of the market in terms of usage in the production of protein beverages and nutritional supplements. Whey protein concentrate is widely considered to be the most efficient and economical form of protein for the human body, which is one of the major factors boosting the market's growth.

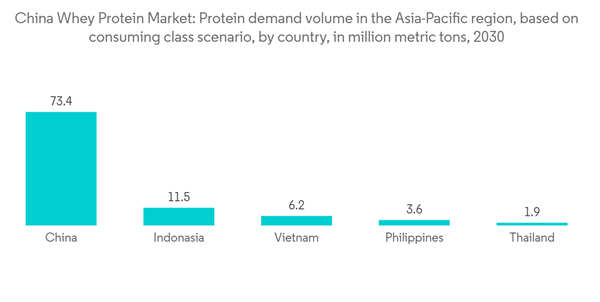

- Moreover, China tops in the need for protein demand from consumers among the countries in the Asia-Pacific region as the protein content that is available to the population of the country is very low. For instance, according to Green Queen, in 2019, the protein demand in China amounted to over 56 million metric tons, representing the market with the highest protein demand in Asia. By 2030, China was forecast to remain the largest market under all scenarios. Such factors are expected to increase the need for affordable protein products like whey protein concentrates to manage the demand. In line with this, manufacturers in the region are launching whey protein concentrate products to capture the growing market demand.

- For instance, in February 2021, China-based firm ffit8 announced the launch of a probiotic protein powder containing whey protein concentrate to boost immunity and mood. The company claimed that the product contains whey protein concentrate, milk powder, and bacillus coagulants to maintain immune function and internal health, relieve stress, and mood-boosting and aid sleep. Such developments in the country are expected to further boost the demand and growth of the market.

China Whey Protein Industry Overview

The Chinese whey protein market is fragmented, with the presence of various global players and developing regional players. The companies in the market are involved in strategic joint ventures to rapidly tap the actively growing nutrition industry, which is expected to evolve during the forecast period. Several small and international players are involved in the manufacturing and distribution of whey protein ingredients in the country. Manufacturers are focusing on product innovation and advertising their products through fitness enthusiasts across the country. A few major players in the market include Arla Foods, LACTALIS Ingredients, FrieslandCampina, Glanbia plc, and Fonterra Co-operative Group Limited.Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

This product will be delivered within 2 business days.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Glanbia PLC

- Arla Foods

- Lactalis Group

- FrieslandCampina

- Fonterra Co-operative Group

- Hilmar Cheese Company

- Agropur Cooporative

- Euroserum

- Danone

- MuscleTech