Key Highlights

- Plant growth regulators are substances that are produced naturally from higher plants and used to modify a crop by changing the rate of its response to the internal and external factors that govern development from germination through vegetative growth, reproductive development, maturity, and aging, as well as post-harvest preservation. Auxin, Cytokinin, Gibberellins, and abscisic acid are commonly used growth regulators in North America.

- Furthermore, since the demand for organic food in the region is increasing, the demand for growth regulators is also rising. The use of PGRs is quite common in greenhouse crop production. Greenhouse growers use plant growth regulators to control excessive plant growth and increase the productivity of the plant, and also PGRs are used in wide applications in the agriculture sector. These factors will fuel the market growth and tend to increase during the forecasting period.

- The organic food industry is witnessing healthy growth rates owing to sustainable farming practices. Thus these are the major driving factors for the increased demand for growth regulators. North America is the second-largest market and is expected to expand, with the increased supply of quality products from the key players. This will drive the market's growth during the forecast period.

North America Plant Growth Regulators Market Trends

Increasing Demand For Organic Food

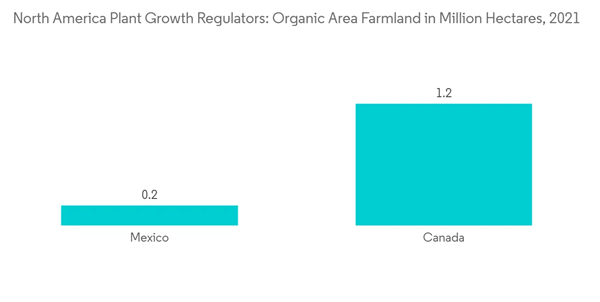

The organic food industry, which is registering a healthy growth rate, as well as encouragement from government organizations on sustainable farming, are the major driving forces for the growth of the plant regulators market. Plant growth regulators are substances that are produced naturally from higher plants. The increasing preference for organic methods of cultivation in the country has further driven the plant growth regulators market. According to FiBL, the United States has the highest organic land in 2021 with 2.3 million hectares followed by Canada and Mexico.Companies such as Fine Americas, Inc. constantly endeavor not only to improve their product lines but also to spread an understanding and use of the existing products they already have in the marketplace. Furthermore, through continuous research on PGRs, research scholars in universities across the United States help in the ongoing process of keeping the industry updated on product requirements and the latest advancements in the products.

The current market trends in the country, where the demand for premium quality crops is rapidly rising, however, input costs are being reduced, are likely to continue to propel the growth of development of new PGR products, that help growers achieve the desired marketplace balance in an effective manner. The use of PGRs is quite common in greenhouse crop production. Greenhouse growers use plant growth regulators to control excessive plant growth. The rising adoption of greenhouse cultivation methods, is further expected to augment the growth of plant growth regulators in the US market in the future.

Increase in Crop Profitability

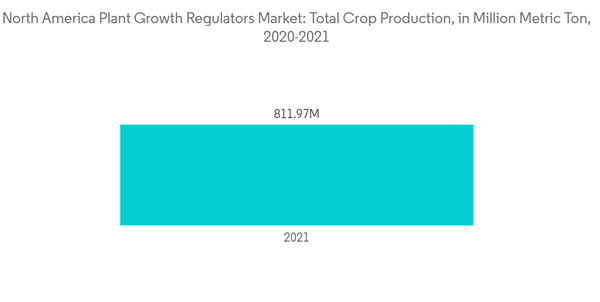

Plant-regulating chemicals have been used as an aid in obtaining viable seeds in the breeding of new plants that are of good quality and resistant to diseases.The plant growth regulator in North America acts as fulfilling the customer demand by growing the crops and vegetable in a quicker way. Not all farmers are capable of using PGRs due to the high cost. Small farmers from regions like sub sharan and Asia are not that much capable of using PGRs. But in countries like the USA, Plant growth regulators are popular across the region, as they aid in increased crop yields and better management of the crop. According to FAO, the total crop production has slightly declined in the year 2021 compared to previous year in 2020 due to pandemic.In US and Canada, the government is supporting the 'The Organic Farming Movement' which is moving towards the sustainable agriculture in the country. The United States government pays around USD 20 billion per year to farmers which directly subsidies as 'farm income stabilization'. These subsidiaries have benefited farmers a lot and change the agricultural view in the United States. Even the direct subsidiaries are provided to farmers without any economic need of the financial condition of the farm economy. This will encourage the market to grow in the coming years.

Greenhouse growers use plant growth regulators to control excessive plant growth. Chemical PGRs provide growth like Fruit ripening and thickening of the skin of the fruit. Therefore, the application of PGRs yielded considerable success in the processes of plant development, such as flowering and fruit development, as well as ripening, harvesting, and post-harvesting of fruits and vegetables. Thus, PGRs are aiding in the increase of crop production, further boosting crop profitability and market during the forecasting period.

North America Plant Growth Regulators Industry Overview

North American plant growth regulator market is highly fragmented. Key players in the market are focusing on new product launches, in order to cater to a wider consumer base and expand market share. Investments in research and development to develop cheap and effective products is another strategy adopted by market leaders. The major North American Plant Growth Regulators Companies in the market are Bayer Crop Science, ADAMA Agricultural Solutions Ltd, Corteva Agriscience, Nufarm Ltd, and Syngenta AG.Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

This product will be delivered within 2 business days.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Bayer Crop Science

- ADAMA Agricultural Solutions Ltd

- Corteva Agriscience

- Nufarm Ltd

- syngenta AG

- Nippon Soda Co. Ltd

- Crop Care Ltd

- The DOW Chemical Company

- Sumitomo Chemical Co. Ltd