The significant aspect influencing market expansion is consumer preference for natural products. The industry in the United Kingdom is expanding as consumers' concerns about preventative healthcare and the efficacy of probiotic microorganisms on health develops. Demand for probiotics has risen due to a growth in the use of functional foods, which, in addition to providing essential nourishment, can potentially improve health. Obesity, digestive problems, and gastrointestinal infections are major problems most of the population faces. The probiotics industry is fueled by consumer demand for health-related products, particularly among the younger population.

Functional foods and beverages containing probiotics are recognized for enhancing intestinal health and providing other benefits like increased immunity. Additionally, These digestive supplements are being recommended by medical specialists around the region to help consumers who suffer from indigestion or heartburn. According to information supplied by the British health insurance provider Bupa in 2021, almost four out of 10 Britons experience dyspepsia each year. Indigestion symptoms frequently include pain or a burning sensation behind the ribs or higher up in the chest, though it can affect people differently. The point of sale for these supplements through pharmacies and drug stores rose.

UK Probiotics Market Trends

Demand for Probiotic Infused Functional Food & Beverages Products

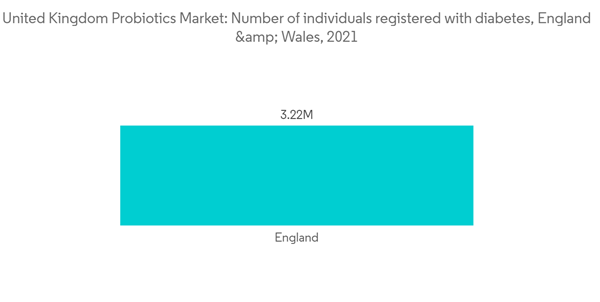

The importance of gut health and its connection with mental health, weight loss, and healthy skin fosters the growth of probiotic products in the United Kingdom. Consumers are opting for digestive supplements with muscular bacterial strains and high CFU (Colony Forming Units) since they claim to increase the chances for good bacteria to colonize the gut. This trend is expected to boost the growth of the probiotic functional food & beverages products market during the forecast period. Additionally, those suffering from acne or hormonal imbalances opt for probiotics & prebiotics that specifically focus on the immune system to soothe skin irritation. Moreover, probiotics assist in recovering from diabetes and are preferred by consumers in the region. Since the ultimate disease prevention is healing the root cause rather than superficial treatments, probiotics are gaining popularity in the country. Manufacturers are focusing on developing products to achieve a more extensive consumer base.Innovation in Formulation, Delivery and Marketing of Probiotics

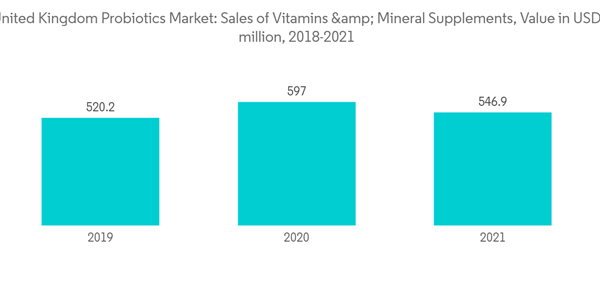

Probiotics are one of the world's most adaptable substances. Immunity, feminine health, oral health, skin health, weight control and diabetes, cognitive health, sports endurance, the gut-brain axis, gut-muscle axis, and cardiovascular health are all probiotics. As a result, consumer preferences and requirements are constantly shifting, yet knowing them is critical for seizing market possibilities. This results in the usage of supplements such as vitamins and minerals that assist in overall well-being are being extensively retailed across the region. Major players in the market are focused on product innovations and developments. For example, BioGaia launched its probiotic product in the United Kingdom, Diorabyota, which is a probiotic digestive supplement. People are experimenting with new distribution techniques as they become more familiar with probiotics. For instance, in march 2022, Cymbiotika company launched its e-commerce platform that offers probiotic supplements across the United Kingdom. These products are claimed to be natural and are usually available in capsule and tablet formats. Traditional dietary supplement formats will continue to be significant, but their application will change. Companies such as BeLive and BioGaia began producing probiotic candies and gummies.UK Probiotics Industry Overview

Major players, such as Nestle, Danone, and Yakult, dominate the probiotics market in the United Kingdom. Actimel, Activia, and Yakult are the top brands in probiotics globally. The other prominent players are Lifeway Foods Inc., Bright Dairy (Bright Foods), and BioGaia. Product innovation and increased R&D expenditure are key strategies adopted by companies operating in the region. The major players are focusing on catering to the altering demands of consumers for probiotic products while keeping an eye on sustainable packaging/delivery formats.Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

This product will be delivered within 2 business days.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Nestle SA

- Groupe Danone

- Pepsico Inc.

- Yakult Honsha

- BioGaia

- Lifeway Foods

- Now Foods

- Bio & Me

- Optibac Probiotics

- Protexin Probiotics