Consumers in the country are becoming conscious of their health and are understanding the importance of the consumption of breakfast. Due to this, the demand for breakfast food and convenience food is increasing in the country. Owing to the rising disposable income and more working population, demand for ready-to-eat and ready-to-cook breakfast cereals is growing in the region. Breakfast cereals provide high amounts of nutrients like fibers, proteins, vitamins, and carbohydrates to maintain energy for the whole day. The market players have been innovating and launching new products with a variety of flavors and shapes to attract young consumers as well.

The growth of the market is mainly driven by the changing food habits and the influence of western culture on the dietary patterns of consumers, as it provides a convenient solution to readily accessible food that optimizes the ease of consumption without further preparation. Additionally, demand for free-from and gluten-free food is growing owing to the vegan population in the country. The robust growth of convenience stores that promotes brand visibility is driving the growth of the breakfast cereals market. Over the medium term, demand for breakfast cereal is expected to grow owing to increasing innovation in products and the health benefits of breakfast cereals.

UAE Breakfast Cereals Market Trends

Rising Demand for Convenience Food in the Region

- Due to the rise in disposable income, a more working population, and changing food preferences, the demand for breakfast is increasing in the country. As people have become busy, their demand for on-the-go and convenience food is increasing. The working population of women is also rising, due to which they do not have time to cook and prefer ready-to-eat breakfast cereals.

- According to World Bank data 2021, 16.6% of women are working in the United Arab Emirates. Breakfast cereals like ready-to-eat and ready-to-cook breakfast cereals are becoming very popular among all age groups owing to the variety of food and different flavors. They are becoming extremely popular, especially among working-class people, teenage children, people living in hostels, bachelors, and so on.

- Furthermore, recent innovations have led to the use of many traditional technologies like fermentation, extraction, encapsulation, fat replacement, and enzyme technology to produce new healthy breakfast cereal products and reduce/remove undesirable food components, and add specific nutrients.

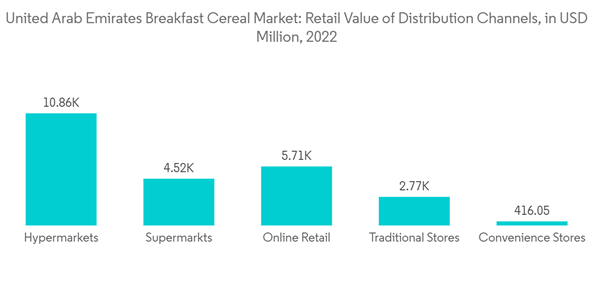

Hypermarket/Supermarkets Sales to Accelerate the Market Growth

- The availability of breakfast cereal and convenience food in supermarkets and hypermarkets drives market growth. Supermarkets and hypermarkets have a variety of products available, due to which consumers have different choices according to their preferences. Additionally, supermarkets/hypermarkets provide offers and discounts on products that attract consumer attention.

- Furthermore, other distribution channels like online retail channels and e-commerce websites are also increasing the sales of breakfast cereals. Due to busy lifestyles, consumers opt for e-commerce websites like Carrefour and Lulu, among others, to buy their products due to high discounts and offers. Market players are also launching new products with different flavors and additional nutrients in them.

UAE Breakfast Cereals Industry Overview

The United Arab Emirates breakfast cereals market is highly fragmented, owing to the presence of large regional and domestic players in different countries. Emphasis is given to the merger, expansion, acquisition, and partnership of the companies, along with new product development as strategic approaches adopted by the leading companies to boost their brand presence among consumers. Key players dominating the UAE market include Bobs Red Mill, Nestle, and General Mills Inc., among others.Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Bobs Red Mill

- Nestle SA

- PepsiCo Inc.

- Associated British Foods PLC

- Ecotone (Whole Earth)

- General Mills Inc.

- The Kellogg's Company

- The Weetabix Food Company

- Bio Familia AG

- ABF Grain Products Limited (The Jordan's)

Methodology

LOADING...