Key Highlights

- The Ghanaian grain market caters mainly to domestic demand. The grain market includes cereals, pulses, and oilseeds. Ghana is not a self-sufficient country in the cereal market, and various kinds of cereals are imported from other countries to satisfy domestic needs. In Ghana, cereals, such as maize and rice, are consumed significantly as these commodities are produced locally in significant volumes, and therefore are the major ingredients in traditional Ghanaian cuisine. For instance, Kenkey is a staple dish prepared with corn dough in the country. Kenkey is a popular dish among the Ghanaian population, which is usually served with pepper sauce and fried fish. Likewise, Rice remains a popular and rising part of the Ghanaian diet, owing to its convenience and changing palates.

- According to FAO, maize is the most widely cultivated cereal, with a production of 3.1 million metric ton in 2020. Rice and sorghum are the most cultivated crops in Ghana, after maize, with production totaling 973 thousand million metric ton and 356.0 thousand metric ton, respectively. Beans and peas are the most widely cultivated pulses, while groundnut is the most cultivated oilseed. As the trend suggests, the grain market in Ghana is expected to witness slow but steady growth over the forecast period.

- Furthermore, the growth of the middle-class population which is moving away from consuming traditional starches, like cassava and yam towards rice and maize-based convenience foods signifies a burgeoning market for Ghana grain producers. However, the threat of climate change, lack of efficient financial support, and extension activities to the small-scale farmers of Ghana, are expected to restrain the grain market during the forecast period.

Ghana Grains Market Trends

Maize Dominates the Grain Market in Ghana

Maize is the most important cereal crop on the domestic market in Ghana. It is one of the largest agricultural commodities in terms of production volume, it is also important for poultry feed as well as a substitute for the brewing industry, and it is cultivated under traditional production methods and rain-fed conditions. Maize is grown throughout Ghana. However, the leading producing areas are mainly in the middle-southern part (Bono & Ahafo, Eastern and Ashanti regions) of the country.Furthermore, maize is a widely consumed and cultivated staple crop in Ghana. It accounts for more than one-quarter of calories consumed. About three-quarters of maize, consumption is from its local production.

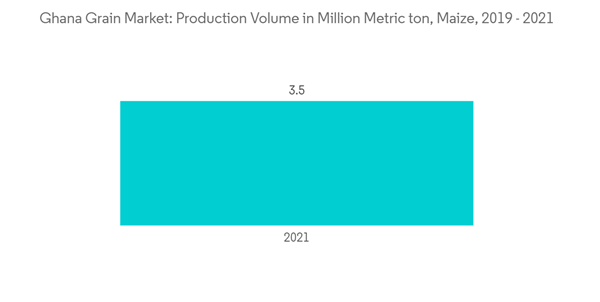

According to data published by FAO, the production of maize increased to 3,500,000 metric ton in 2021 compared to 2,900,000 metric ton in 2019. An increase in the production of maize is due to the high demand for domestic consumption. For instance, as per a report published by the Statistics Research and Information Directorate (SRID) of the Ministry of Food and Agriculture (MoFA), the per capita consumption of maize in Ghana stood at 75.91 kg per annum in the year 2020, an increase of approximately 3% from the previous year. Thus, the growing need to meet domestic consumption is expected to drive the grain market in Ghana in the forecast period.

Favorable Government Policies Supporting the Market’s Growth

The Government of Ghana has brought many structural changes in its policies, favoring the regional development of grains to boost domestic production by reducing imports.In 2021, The Planting for Food and Jobs (PFJ) Programme run by the Government of Ghana has been contributing to the agricultural growth and development of the country. Results show that there has been an increase in fertilizer usage from 8kg/ha in 2017 to 20kg/ha in 2020. There is also a notable improvement in the usage of certified seeds. A vibrant seed industry is also being established and there is an increased willingness of private sector actors partnering with the Government to deliver the desired results and impacts. Ministry procured and distributed 31,797 metric ton of improved seeds, comprising 11,289 metric ton of maize, 16,382 metric ton of rice, 4,126 metric ton of soybean, and 26 metric ton of vegetables to farmers across the country as of September 2021. In addition, 259,500 metric ton of various fertilizers were also distributed to PFJ beneficiary farmers across the country. This is expected to increase productivity and incomes as well as improve the livelihoods of beneficiary farmers.

Therefore, these types of initiatives taken by the government will gradually help the country in reducing imports of cereals and grains and will enhance the rank of the country in terms of food security. For instance, as per ITC Trade Map, the total import value of Cereals in Ghana in 2021 was USD 438,561 thousand, a decrease of approximately 32.9% from the year 2018.

Ghana Grains Industry Overview

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

This product will be delivered within 2 business days.