The COVID-19 pandemic positively impacted the electric wheelchair market. Many hospitals and health institutes were flooded with people infected with the virus. Thus, the demand for electric wheelchairs increased in 2020. In 2020 electric chairs reached sales of almost 2 million units worldwide. This growth is anticipated to continue during the forecast period, primarily due to the increasing elderly population.

Over the long term, the increase in disabilities due to a rise in the elderly population and the prevalence of chronic diseases, encouraging hospitals and healthcare facilities to use electric wheelchairs to improve the welfare of patients and healthcare workers is anticipated to remain a major driving factor for the market studied. In addition, electric wheelchairs are used in-home care settings to transfer patients safely and comfortably from one place to another. Thus, the demand for electric wheelchairs is expected to increase in hospitals and elderly care homes, owing to the unprecedented increase in the geriatric population. For instance

Key Highlights

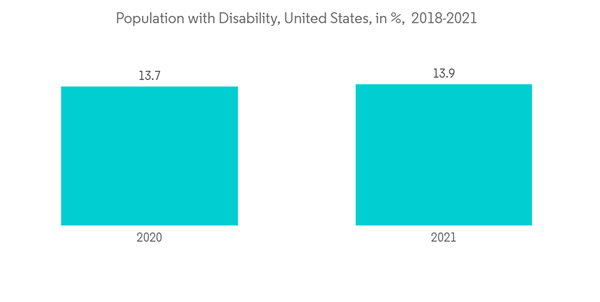

- In 2021, one billion people were reported to live with some disability by the World Health Organisation, constituting 15% of the total population in the world.

Key Highlights

- In January 2022, Permobil AB launched the flagship Progeo Noir 2.0 carbon fiber wheelchair in the United Kingdom.

- In August 2021, Pride Mobility Products Limited introduced the Jazzy EVO 613 2 electric chair, which is powered by a Li-ion battery and has a maximum speed of 5.1 miles per hour.

Electric Wheelchairs Market Trends

Growing Elderly Population Across the World

The growing elderly population across the world is driving the electric wheelchair market. As per the data released by the World Health Organization, the number of people aged 65 years and over may double as a proportion of the global population from 7% in 2000 to 16% in 2050. By then, the number of older adults may be greater than that of children (aged 0-14 years) in the population. Thus, an increase in the elderly population is anticipated to create an opportunity to adopt electric wheelchairs in the global market.The United Nations estimates that by 2030, with a ratio of 1.04 to 1, the elderly population will outnumber children. Economic development in countries like India created many work opportunities for the younger population, who cannot care for the elderly. Both younger people who work hard and older people who lack upper body strength find manual wheelchairs exhausting.

According to the World Health Organization, 50 million people are injured annually due to vehicle accidents worldwide. Electric wheelchairs aid in patients' safe and comfortable movement from one area to another. Thus, the increase in accidents is expected to raise the demand for electric wheelchairs over the forecast period.

According to Worldbank.org, nearly 200 million people are suffering from significant disabilities globally. Wheelchairs are used by disabled people and people with lung and cardiovascular ailments who cannot afford to walk for long distances. The rising elderly population and the increasing number of chronic diseases are expected to contribute to the demand for electric wheelchairs during the forecast period.

Also, the trend of rapidly aging demographies like Europe, North America, Japan, and China is further accelerating the growth in the electric wheelchair market.

Key players are expanding their manufacturing capacity to address the growing market for electric wheelchairs. For instance

- In October 2021, Ottobrock, the global health-tech company, officially opened a new manufacturing plant for wheelchairs located at Blagoevgrad in Bulgaria. This is the company's tenth manufacturing facility worldwide. The manufacturing plant will undertake fabrication work for wheelchairs from other Ottobrock plants in China, Germany, and Austria.

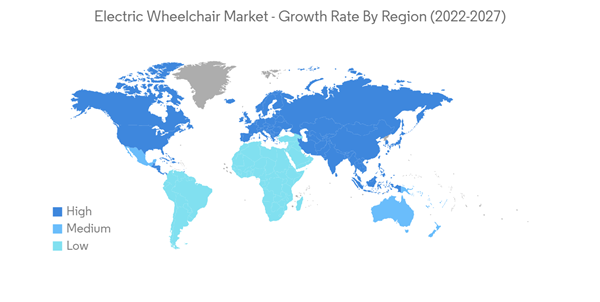

Asia-Pacific to Exhibit the Highest Growth Rate

China and India are the two most populated countries in the Asia-Pacific. With over 241 million Chinese individuals over 60 years, China is considered an aging economy. Moreover, China produces roughly 75% of the world's electric wheelchairs, owing to the aluminum production hubs and major players operating in the country.India is the second most populated country in the world, with a tally of about 1.40 billion. About 2% of the total population suffers from a disability, and about 30% have a mobility impairment and need assistance. India ranks first out of all countries in road accidents. According to the National Crime Records Bureau data, 422659 accidents occurred in India in 2021, leading to 155000 deaths and 371000 injured people. Thus the rising number of injured people due to the increasing road accidents is also likely to contribute to the growth of the electric wheelchair market in India.

North America is expected to follow Asia-Pacific during the forecast period. As per the United States disability statistics for 2021, 61 million adults in the US lived with some disability. These disabilities are more common among older individuals, with almost half of those aged 75 years and older living with a disability, which is expected to increase the demand for electric wheelchairs across North America.

Electric Wheelchairs Industry Overview

The electric wheelchair market is fragmented, with global and local players dominating the market. Some major players are OttoBock Healthcare GmbH, Invacare Corporation, Pride Mobility Products Corp., Sunrise Medical, and Permobil AB.To provide additional comfort to the patients, major key players are working on the design and ergonomics of the wheelchair. For instance

- In February 2022, Invacare Corporation introduced its next-generation e-fix eco Power Assist Device, which converts manual wheelchairs into electric wheelchairs.

- In January 2022, Swiss startup Scewo launched Scewo BRO, a new electric wheelchair for people with mobility issues to climb stairs.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

This product will be delivered within 2 business days.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Sunrise Medical Limited

- Invacare Corporation

- Permobil AB

- OttoBock Healthcare

- Pride Mobility Products Corp.

- Drive Medical Ltd

- LEVO Ag

- MEYRA GmbH

- Karman Healthcare

- GF Health Products

- Golden Technologies