The demand for RO membranes was significantly affected in the wake of the COVID-19 pandemic, with industrial activity experiencing a significant slowdown. However, the residential segment witnessed a slight increase in demand from increased awareness about the benefit of UV combined with RO in reducing the viral load of drinking water.

Key Highlights

- In the medium-long term, increasing demand for pure drinking water and the growing demand for the physical water treatment process is anticipated to drive the market demand.

- On the flip side, the high initial set-up and recurring maintenance costs associated with installing RO systems could hinder the market growth.

- However, rising concerns over water conservation in the industrial sector are anticipated to provide future opportunities to the RO membrane market, with more and more industries switching to RO water in their utilities for reduced water consumption and higher recyclability.

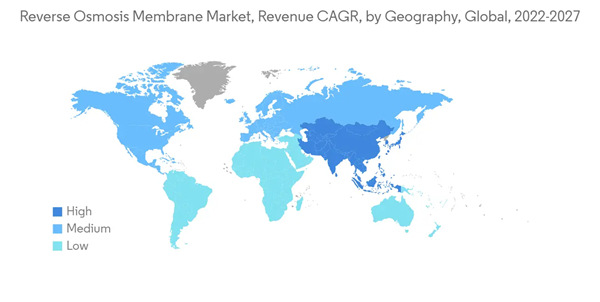

- Asia-Pacific dominated the global market with the most significant consumption from countries such as China, India, and Japan.

Reverse Osmosis Membrane Market Trends

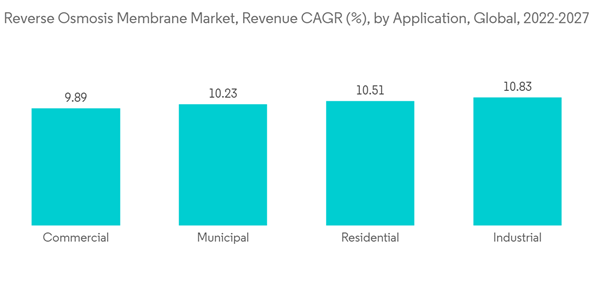

Growing Application in Industrial Sector

- Reverse osmosis is extensively used in various industries, from process water and feeds to boilers for steam production and, in some cases, for process cooling towers. The generation of steam is critical for the production process. Therefore, with a significant expansion of production capacity, steam generation must also be increased to meet the demand.

- In pharmaceutical, chemical, and food & beverage industries, purified water plays a vital role in the reaction mechanism, where reverse osmosis member technology plays an important role. The growth of such initiatives is anticipated to drive demand for RO product water, thereby driving demand for RO membranes in the market.

- According to the Food & Drink Federation (FDF), the F&B industry's turnover across the United Kingdom was valued at EUR 112 billion (USD 132.51 billion) in 2021, registering a year-on-year growth of 4.8% during this period. The total business investment in the industry also witnessed a 7.9% year-on-year growth reaching EUR 4 billion (USD 4.73 billion).

- According to ACC, the chemical industry in the United States witnessed a strong rebound in 2021 in the COVID-19 pandemic aftermath. The total chemicals trade saw a growth of 26.8% in comparison to last year, reaching a valuation of USD 281.4 billion.

- According to ACC, specialty chemicals output in the United States grew by 6.2% year-on-year in 2022. Capital spending also reached a valuation of USD 34.5 billion in 2022, growing by over 12.3% year-on-year.

- The growth of the industrial sector is anticipated to drive the demand for reverse osmosis membranes in the market.

Asia-Pacific Region to Dominate the Market

- The Asia-Pacific region is expected to dominate the market for reverse osmosis membranes during the forecast period. In countries like China, India, and Japan, the demand for reverse osmosis membrane technology is increasing due to the growing need for pure water and the growing industrial sector.

- The largest producers of reverse osmosis membranes are in the Asia-Pacific region. Some of the leading companies in the production of reverse osmosis membranes are BNKO Environmental Technology (Shanghai) Co., Ltd, Permionics Membranes Private Limited, Samco Technologies, Inc, NITTO DENKO CORPORATION, TORAY INDUSTRIES, INC.

- The steady growth of the chemical and food & beverage industry is anticipated to propel the demand for RO membranes in the market. According to China's National Bureau of Statistics, the food & beverage industry in the country witnessed a strong recovery in 2021, registering a year-on-year growth of 18.6%, reaching USD 704.83 billion in revenue.

- Similarly, India is witnessing strong growth in the F&B sector, with FDI inflows amounting to USD 20.11 billion between 2000-2022, according to IBEF. Food processing had a significant stake in the FDI inflow, at 55.2% during the same period.

- The chemical industry in the Asia-Pacific region is registering strong growth figures, with major economies like China and India leading the market. For instance, India is the fourth-largest producer of agrochemicals in the world, with the United States, Japan, and China occupying the top 3 positions. The country's domestic chemical sector's small and medium players are anticipated to register strong growth figures between 18-23% during FY22.

- On the other hand, with growing concerns over water scarcity, significant economies are ensuring strong measures to recycle water, and safe and clean drinking water is widely available. In India, the average annual per capita drinking water availability in 2001 was 1,820 cubic meters, and the government estimates that this may reduce to 1,341 cubic meters by 2025 and 1,140 cubic meters by 2050, increasing the scope for the application of these membranes in purifying salt water for drinking and other sanitary usage purposes in the region.

- The traditional method of purifying water in this region with chemicals is replaced with membrane technology. The growing awareness in developing countries created scope for this market.

- The factors above, coupled with government support, contribute to the increasing demand for the reverse osmosis membrane market during the forecast period.

Reverse Osmosis Membrane Market Competitor Analysis

The reverse osmosis membrane market is partially fragmented, with players accounting for a marginal market share. A few companies include BNKO Environmental Technology (Shanghai) Co., Ltd, Permionics Membranes Private Limited, Samco Technologies, Inc, NITTO DENKO CORPORATION, and TORAY INDUSTRIES, INC.Additional benefits of purchasing the report:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

This product will be delivered within 2 business days.

Table of Contents

1 INTRODUCTION1.1 Study Assumptions

1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

4.1 Drivers

4.1.1 Increasing Demand for Pure Water

4.1.2 Growing Demand for Physical Water Treatment Process

4.2 Restraints

4.2.1 High Price Bar of Membranes

4.2.2 Other Restraints

4.3 Industry Value Chain Analysis

4.4 Porter's Five Forces Analysis

4.4.1 Bargaining Power of Suppliers

4.4.2 Bargaining Power of Buyers

4.4.3 Threat of New Entrants

4.4.4 Threat of Substitute Products and Services

4.4.5 Degree of Competition

5 MARKET SEGMENTATION (Market Size in Value)

5.1 Membrane Type

5.1.1 Thin Film Composite

5.1.2 Cellulose Based

5.2 Application

5.2.1 Residential

5.2.2 Commercial

5.2.3 Municipal

5.2.4 Industrial

5.2.5 Other Applications

5.3 Geography

5.3.1 Asia-Pacific

5.3.1.1 China

5.3.1.2 India

5.3.1.3 Japan

5.3.1.4 South Korea

5.3.1.5 Rest of Asia-Pacific

5.3.2 North America

5.3.2.1 United States

5.3.2.2 Canada

5.3.2.3 Mexico

5.3.3 Europe

5.3.3.1 Germany

5.3.3.2 United Kingdom

5.3.3.3 France

5.3.3.4 Italy

5.3.3.5 Rest of Europe

5.3.4 South America

5.3.4.1 Brazil

5.3.4.2 Argentina

5.3.4.3 Rest of South America

5.3.5 Middle-East and Africa

5.3.5.1 Saudi Arabia

5.3.5.2 South Africa

5.3.5.3 Rest of Middle-East and Africa

6 COMPETITIVE LANDSCAPE

6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

6.2 Market Share**/Ranking Analysis

6.3 Strategies Adopted by Leading Players

6.4 Company Profiles

6.4.1 Axeon Water Technologies

6.4.2 BNKO Environmental Technology (Shanghai) Co. Ltd

6.4.3 DuPont

6.4.4 Koch Membrane Systems, Inc

6.4.5 NITTO DENKO CORPORATION

6.4.6 Permionics Membranes Private Limited

6.4.7 Samco Technologies, Inc

6.4.8 Synder Filtration, Inc

6.4.9 TORAY INDUSTRIES, INC.

6.4.10 Toyobo.Co.Ltd

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

7.1 Increasing Demand for Water Purification in Developing Countries

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Axeon Water Technologies

- BNKO Environmental Technology (Shanghai) Co., Ltd

- DuPont

- Koch Membrane Systems, Inc

- NITTO DENKO CORPORATION

- Permionics Membranes Private Limited

- Samco Technologies, Inc

- Synder Filtration, Inc

- TORAY INDUSTRIES, INC.

- Toyobo.Co.Ltd