Key Highlights

- The offshore sector is likely to witness significant growth in the German wind energy market during the forecast period.

- With a significant share in energy production, wind energy met one-fourth of the demand for electricity in 2020. There are ambitious plans for the expansion of wind energy to 40 GW by 2035 and 70 GW by 2045. This is expected to create immense opportunities for the German wind energy market players.

- Upcoming projects and investments in the wind energy sector are likely to drive Germany's wind energy market during the forecast period.

Key Market Trends

Offshore Sector to Witness Significant Growth

- Installation of wind farms in the offshore area is becoming a lucrative market because of the higher wind speed in comparison to onshore wind speed. Thus, offshore wind power generation capacity is expected to witness significant growth during the forecast period.

- Both onshore and offshore wind turbines together generated around 132.1 terawatt-hours of electricity in 2020, almost 5% more compared to 2019 (125.9 terawatt-hours). Wind energy set a record again, accounting for 23.9% of gross electricity consumption.

- In 2020, with the amendment of the Offshore Wind Energy Act (WindSeeG) 2017, the framework conditions for the further development of offshore wind energy were also adjusted to attract investments. The expansion target for 2030 was also increased from 15 GW to 20 GW, with a long-term target of 40 GW by 2040.

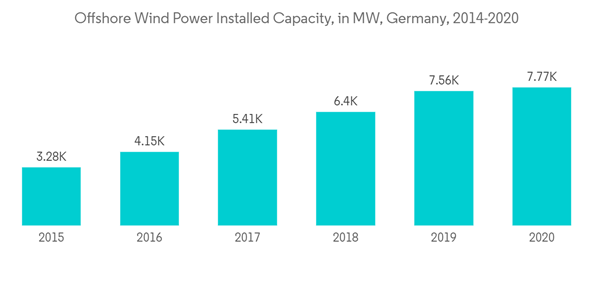

- In 2020, the offshore wind energy installed capacity accounted for 7.7 GW, and there has been a 2.7% Y-o-Y growth compared to 2019. Offshore wind energy accounted for a 6% share of the total renewable energy mix. The increasing offshore installations are expected to drive the offshore segment during the forecast period.

- Therefore, based on the above-mentioned factors, the offshore wind energy segment is expected to witness significant growth, in turn increasing the demand for the German wind energy market during the forecast period.

Upcoming Projects and Investments Driving the Market Demand

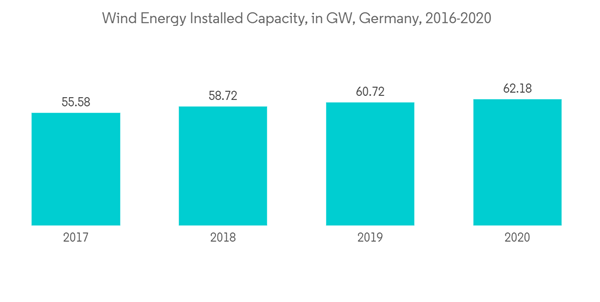

- Germany has vast reserves of high-quality, cost-competitive wind energy resources. Owing to this, Germany held the first-largest installed wind power capacity in the European region, with a total installed capacity of 62.18 GW in 2020. This installed capacity is enough to power approximately 3.4 million homes in the country.

- With the increasing need for affordable, reliable, clean, and diverse electricity supply, the government and utilities across the nation are increasingly considering wind power as a solution. Moreover, with the country's unparalleled wind resources, there are ample opportunities to maximize the economic and environmental benefits associated with wind energy development.

- In 2020, the total electricity from renewable energy sources covered more than 45%, almost half of Germany's total electricity consumption. Wind energy accounts for more than 47% of installed capacity in Germany's renewable energy mix. This is expected to attract investments during the forecast period.

- In May 2021, RWE and BASF planned to invest USD 4.9 billion in offshore wind power projects. As part of the project, RWE intends to build a 2 GW offshore wind park by 2030. The project aims to supply energy to BASF's Ludwigshafen chemical complex.

- Also, in October 2021, EnBW Energie Baden-Wuerttemberg AG acquired the rights to a 12.6 MW wind power project in southern Germany, with construction set to start in 2022 and likely to be commissioned by Q1 of 2023. The Keltenschanze-Weilerhoehe wind park is expected to generate about 25,000 MWh of green electricity, which is enough to supply some 7,200 households.

- In November 2021, RWE announced plans to invest EUR 50 billion (USD 57 billion) by 2030. The investment aims to double its green energy to 50 gigawatts (GW).

- Therefore, the increasing investments and upcoming projects like solar and bioenergy are likely to drive the growth of wind energy during the forecast period.

Competitive Landscape

The German wind energy market is moderately fragmented. The key players in the market include Nordex SE, Enercon GmbH, General Electric Company, Vestas Wind Systems AS, and Siemens Gamesa Renewable Energy SA.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

This product will be delivered within 2 business days.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Nordex SE

- Enercon GmbH

- General Electric Company

- Vestas Wind Systems AS

- Orsted AS

- Siemens Gamesa Renewable Energy SA

- RWE AG

- Suzlon Energy Limited

- PNE AG