The Corona-Virus had very little impact on the property and casualty insurance. The segment showed slight growth in terms of premium written compared to the previous year's.

Norway has approximately one-fourth of the total Nordic Property and Casualty Insurance, making it the third-largest country in Nordic Property and Casualty Insurance. The value of the P&C insurance sector in Norway was approximately EUR XX bn in 2019. The sector experienced a growth rate of 1.7% in earned premiums in 2020 compared to the previous year. The Norwegian insurance market is highly concentrated. A total of 74.5% of all premiums were written in 2020 by the four largest life and P&C insurance companies or groups, while the rest of 25% is contributed by the rest of the firms. Motor vehicle insurance contributes the largest share, almost one-third of Norway's property and casualty insurance. Insurance against Fire and other property damage contributes to the second-largest share. Similarly, Marine, Transport, and Aviation Insurance contribute to Norway's third largest share of Property and Casualty insurance.

Key Market Trends

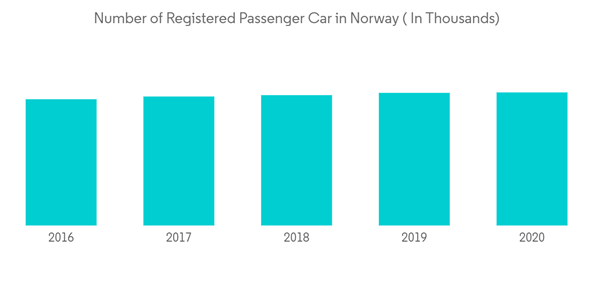

Increased Number of Registered Passenger Car is Driving the Motor Insurance

Motor Insurance is the largest segment of the Norway Property and Casualty Insurance market, contributing to almost one-third of the property and casualty insurance. The number of registered passenger cars in the country is constantly increasing. In 2015, the number of registered passenger cars in the country was 2.61 million, while in 2020, the number reached 2.81 million.

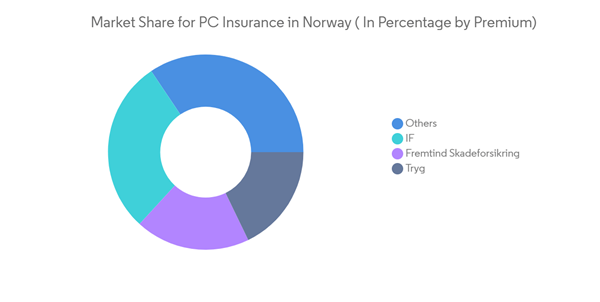

The Property and Casualty Insurance in Norway is highly concentrated.

Norway’s Property and Casualty insurance can be characterized as a highly concentrated market as the four largest firms cover almost three fourth of the market share in terms of premium. Four of the largest life and P&C insurance group, Gjensidige, IF, Fremtind Skageforsikring, and Tryg, contribute 74.5% of the market share in terms of premium for the year 2020.

Competitive Landscape

The Property and Casualty Insurance Market in Norway is highly concentrated, and few larger players are operating in the market. The report covers the major players operating in Norway's Property and Casualty insurance market. The market is consolidated. Four players for several years have dominated the non-life insurance market. In recent years, however, several other players have joined, and some of the smaller ones have grown, so the "other" category now accounts for almost one-third of the market.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

This product will be delivered within 2 business days.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- If Skadeforsikring Norsk Avdeling Av Utenlandsk Foretak

- Gjensidige Forsikring ASA

- Tryg Forsikring

- Fremtind Forsikring AS

- Sparebank 1 Forsikring AS

- Frende Forsikring

- Tide Forsikring AS

- Codan Forsikring

- Eika Forsikring