The vaginal rejuvenation industry was harmed when the pandemic broke out. Most people postponed aesthetic surgeries due to transportation restrictions and the fear of contracting a virus, which had a minor negative effect on the cosmetic surgery industry in the short term. Because of this, many individuals have put off undergoing cosmetic procedures, including vaginal rejuvenation treatments. For instance, as per the International Society of Aesthetic Plastic Surgery's 2020 report, the number of labiaplasty procedures performed in the year 2020 was 142,119. Moreover, the same source also reported that the number of surgeries performed in 2020 showed a 13.7% decrease from the number of surgeries performed in the previous years. Furthermore, as per the research article published by Aesthetic Plastic Surgery in 2021, the financial constraints and the inability to pay for aesthetic procedures by patients during the COVID-19 pandemic-related economic recession have led to a downtrend in plastic cosmetic surgeries globally. As a result, the market experienced a temporary dip at the start of the pandemic. However, with fewer COVID-19 cases, lifted lockdowns, and more patients choosing cosmetic procedures in the wake of the pandemic, the market gained momentum and is expected to continue its upward trend over the forecast period.

The surging demand for energy-based treatments, increasing adoption of non-invasive gynecological procedures, and changing lifestyles of women are the major factors driving the market growth. Furthermore, the incidences of pelvic floor disorders, such as urinary incontinence, and pelvic organ prolapse are also propelling the market growth as these disorders can be cured by vaginal rejuvenation treatment. About a quarter of American women, for example, experience pelvic floor disorder, as reported in a study article published in June 2022. The prevalence of pelvic floor disorders among women aged 80 and up has increased by a factor of two. As a result, the high incidence of pelvic floor disorders could increase interest in vaginal rejuvenation procedures and fuel market expansion.

As disposable incomes rise in countries all over the world, demand for cosmetic surgical procedures like female cosmetic genital surgery is expected to increase. In addition, the market is being propelled by the rising demand for radio frequency-based treatments like Viveve and Geneveve. These treatments are in high demand because of their many desirable characteristics, including their lack of invasiveness and their ability to produce visible results after just one session.This treatment helps in improving the blood circulation of vaginal tissue (Viveve) and stimulates the natural collagen formation process in 30 minutes (Geneveve). Thus, the rising awareness about these treatments is creating a lucrative opportunity for the studied market over the forecast period.

However, stringent regulations for energy-based gynecological procedures and social stigma associated with gynecological procedures are expected to hinder market growth over the forecast period.

Vaginal Rejuvenation Market Trends

Cosmetic Vaginal Rejuvenation Segment is Estimated to Witness Considerable Growth Over the Forecast Period

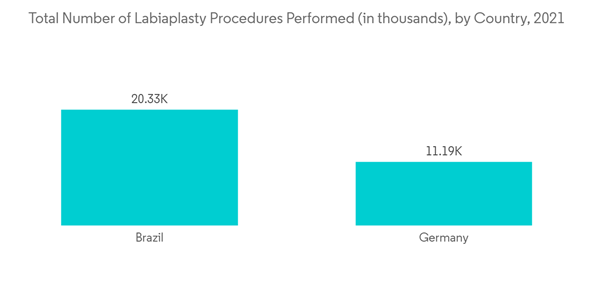

Vast expansion in the cosmetic vaginal rejuvenation market is anticipated over the forecast period as more women seek out procedures like vaginoplasty, labia majoraplasty, clitoral hood reduction, labiaplasty, and monsplasty. Labiaplasty, for example, accounted for 1.4% of all surgical procedures performed by plastic surgeons worldwide in 2020, as reported by the International Society for Aesthetic Plastic Surgery's 2020 report. Vaginal rejuvenation using energy-based treatment procedures does not involve surgery. Currently, radiofrequency (RF) treatment and carbon dioxide (CO2) laser treatment are the two most common energy-based treatments for vaginal rejuvenation. The Geneveve by Viveve and the ThermiVa are two examples of radiofrequency treatment devices that use electromagnetic radiations to heat tissue as part of the radiofrequency treatment protocol.The CO2 laser treatment employs laser light that heats the upper layer of the tissue. This will enable the tissues in the lower layer to synthesize more collagen, thus making the skin firm and tight. Examples of devices that work on CO2 laser technology include MonaLisa Touch, FemTouch, and FemiLift. The increasing technological advancements in providing improved products with better features for outstanding results have been driving segment growth over the forecast period. Thus, with the high incidence of labiaplasty procedures being performed along with the increasing awareness and adoption of minimally invasive surgeries, the cosmetic vaginal rejuvenation segment is expected to grow over the forecast period.

Furthermore, according to a research article titled published in April 2021, a comparative analysis was made between surgical and non-surgical methods for vaginal rejuvenation and the study declared that surgical treatment is necessary for severe- and moderate-degree vaginal laxity and non-surgical treatment is sufficient for light-degree vaginal laxity. Such studies focusing on vaginal rejuvenation are likely to boost market growth over the forecast period.

Therefore, owing to the abovementioned factors considerable segment growth is anticipated over the forecast period.

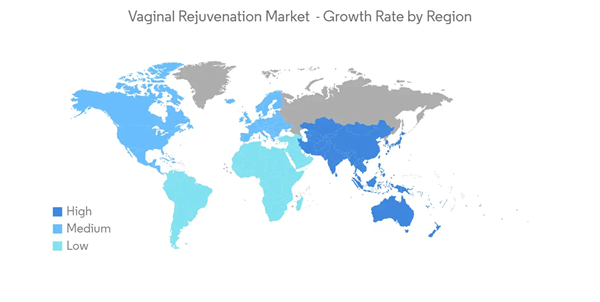

North America is Estimated to Witness Considerable Growth Over the Forecast Period

North America is expected to hold a significant share of the vaginal rejuvenation market due to the increasing number of vaginal procedures with the high disposable income of consumers. Furthermore, the inclination toward minimally invasive and non-invasive women's health procedures and the increasing interest in aesthetic procedures among women in the United States drive the market. For instance, according to the American Society of Plastic Surgeons, 2021 report, a total of 9,725 labiaplasty procedures were performed in the United States in 2020, accounting for 4.19% of the total cosmetic surgical procedures in the nation. Therefore, such instances indicate that the market is expected to witness considerable growth in the North American region.Key product launches, high concentration of market players or manufacturer's presence, and acquisition & partnerships among major players, and the presence of technologically advanced products in the United States are some of the factors driving the growth of the vaginal rejuvenation market in the country. For instance, the research article published in December 2021, indicated the high efficacy and safety of the device, ThermiVa, which is used in the treatment of vulvovaginal laxity and sexual dysfunction. ThermiVa is a device manufactured by ThermiAesthetics in the United States, for the treatment of vulvovaginal laxity and sexual dysfunction. The article indicated that the device was associated with an improvement in vaginal laxity and sexual dysfunction. Similarly, in December 2020, Viveve Medical Inc. received 510(k) clearance from the U.S. FDA to expand the manufacturing capacity for its consumable treatment tips, which can be employed with Viveve's Cryogen-cooled Monopolar Radiofrequency (CMRF) technology. Thus, owing to such positive developments considerable market growth is anticipated in the country.

Therefore, due to the aforementioned factors, the vaginal rejuvenation market is expected to witness significant growth over the forecast period.

Vaginal Rejuvenation Market Competitor Analysis

The vaginal rejuvenation market is highly consolidated and consists of few major players. Some of the companies currently dominating the market are Lutronic, ThermiGen, Alma Lasers, Viveve, VenusConcept, and Hologic. The companies are evolving through various strategies such as investments in research and development activities, acquisitions, and divestitures to secure their positions in the global market.Additional benefits of purchasing the report:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

This product will be delivered within 2 business days.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Lutronic

- ThermiGen LLC

- Alma Lasers

- Almirall

- Viveve

- VenusConcept

- Hologic

- BTL Group Companies

- Fotona