The tonometer market has been impacted by the COVID-19 outbreak, which is majorly attributed to the lockdown placed by several countries. The visits to ophthalmic centers or hospitals have reduced drastically, and only emergency procedures are being performed. Moreover, the supply of newer devices is temporarily obstructed due to the pandemic, as companies have reduced or paused the production of devices. The situation is already affecting the company revenues of the market players. For instance, one of the global leaders in the world, Alcon Inc., reported decreased revenue in the Q2 2020 report. The company's revenue decreased by 36% on a reported basis in Q2 2020. Also, for the six months ended 2020, the company revenue was USD 3,020 million compared to the USD 3,640 million in the six months ended 2019. In addition, according to the study published in the British Journal of Surgery, in May 2020, based on a 12-week period of peak disruption to hospital services due to COVID-19, around 28.4 million elective surgeries worldwide were canceled or postponed. More than 580,000 planned surgeries in India may be canceled or delayed as a result of the COVID-19 pandemic, according to a study conducted by an international consortium in May 2020. The above factors can lead to negative market development for tonometers in the next few months.

The major factor attributing to the growth of the studied market is the increasing incidence of glaucoma and the rising geriatric population and diabetic patients who are more prone to developing glaucoma.

According to Glaucoma Research Foundation (2020), about 3 million Americans are living with glaucoma, and 19% of all blindness among African Americans is associated with open-angle glaucoma. According to a research study by Gabriela Thomassiny et al., published in ARVO Journal in June 2020, glaucoma is one of the leading causes of blindness in Latin America. Latin Americans have an increased risk of developing glaucoma. In this region, around 75% of the affected population is undiagnosed. Mexico is the second most populated country in Latin America. The study results found that in Mexico, in 2030, the number of people with glaucoma will likely be 2.5 million, increasing to 3 million in 2040 and 3.4 million in 2050. Increasing awareness among patients about early diagnosis and regular monitoring of intraocular pressure (IOP) to prevent avoidable vision loss is anticipated to drive the market in the near future.

Therefore, the high incidence of glaucoma is expected to drive the demand for tonometer devices. Providing favorable reimbursement policies for tonometers is expected to aid its adoption rate in hospitals and clinics.

Tonometer Market Trends

The Applanation Tonometry Segment is Expected to Hold a Significant Market Share Over the Forecast Period

The applanation tonometry test measures the fluid pressure in the eye. The test involves using a slit lamp equipped with forehead and chin supports and a tiny, flat-tipped cone that gently comes into contact with the patient's cornea. The test essentially measures the amount of force needed to flatten a part of the cornea temporarily. It is used in the diagnosis of glaucoma.In applanation tonometry, the cornea is flattened, and the IOP is determined by varying the applanating force or the area flattened. There are three types of applanation tonometers, Goldmann applanation tonometer, non-contact tonometer, and ocular response analyzer. The advantages of applanation tonometry include its almost universal acceptance as the clinical standard method of IOP assessment, ease of use from the technician's perspective, and acceptability for most patients.

Moreover, companies, such as Carl Zeiss, offer applanation tonometers (AT 020 and AT 030) that were designed on the principle introduced by Professor Goldmann, which provide precise measurements of intraocular pressure (IOP) and represents the gold standard in tonometry. Measurement of IOP forms a crucial component in the diagnosis and management of multiple ocular conditions, especially glaucoma.

Market players are adopting various strategies such as product launches and developments to increase their market shares. For instance, in November 2021, Takagi launched AT-2 Applanation Tonometer, which has the capability to be used with slit lamps and provides a significant sense of uniformity. This applanation tonometer is expected to provide rapid, safe, and accurate intraocular pressure measurement. Increased usage of applanation surface is expected to aid the market development in a positive manner.

Apart from the advantages of the applanation tonometer, the factor boosting the segment growth is the increasing glaucoma prevalence, fueled by the increasing geriatric population and the diabetic population who are more prone to glaucoma.

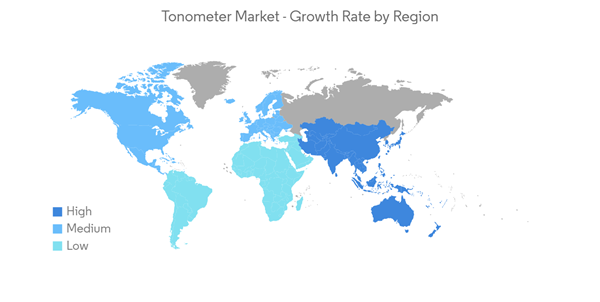

North America Dominates the Market and is Expected to do the Same in the Forecast Period

North America is expected to dominate the overall market throughout the forecast period. The market growth is due to the factors such as the presence of key players, the high prevalence of glaucoma in the region, and the established healthcare infrastructure.During the COVID-19 pandemic, in the United States, the Glaucoma Research Foundation stated that taking steps to protect vision was more challenging during the pandemic. Moreover, the COVID-19 pandemic has presented many challenges, including cancelation or delay of regular medical appointments. In the United States, eye care professionals have gone to great lengths to make modifications to their offices and procedures to allow them to see patients safely.

Furthermore, beneficial government initiatives and an increase in the number of research partnerships are some of the factors expected to drive market growth. In this region, the United States has the maximum share due to supportive healthcare policies, the high number of patients, and a developed healthcare market. According to Brighfocus.org, glaucoma costs the United States economy USD 2.86 billion every year, and more than 120,000 are blind from glaucoma, accounting for 9% to 12% of all cases of blindness. Moreover, recent product launches, a growing number of optometrists, and increasing awareness regarding available treatment options are fueling the market growth. For instance, in January 2020, Revenio Group's Icare ic200, the next-generation tonometer for intraocular pressure screening, was granted marketing authorization in the United States.

According to the United States Bureau of Labor Statistics 2020, there were 43,300 optometrist jobs in the United States. Employment of optometrists is projected to grow 9% from 2020 to 2030, faster than the average for all occupations. This signifies the increasing adoption of various treatments. The statistics indicate that the increasing patient pool and increasing disposable revenue in this country are boosting the market growth of the region.

Tonometer Industry Overview

The tonometer market is moderately consolidated. The key players have been involved in various strategic alliances such as mergers and acquisitions to secure their positions in the global market. Some of the companies currently dominating the market are Keeler Ltd, Carl Zeiss, Icare Finland Oy, Ametek Inc., Oculus, Kowa American Corporation, Nidek Co. Ltd, Rexxam Co. Ltd, Canon, Haag-Streit Group, etc.Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

This product will be delivered within 2 business days.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Halma plc (Keeler Ltd)

- Carl Zeiss Meditec AG

- Revenio Group PLC (iCare Finland OY)

- AMETEK Inc.(Reichert Technologies)

- Oculus Inc.

- Kowa American Corporation

- Nidek Co. Ltd

- Rexxam Co. Ltd

- Canon Medical Systems Corporation

- Metall Zug Group (Haag-Streit Group)

- Belrose Refracting Equipment

- Tomey Corporation

- 66 Vision Tech Co. Ltd

- Topcon Corporation