Key Highlights

- COVID-19 had a significant impact on the separation systems within the commercial biotechnology market as manufacturers of reagents encountered production and sales difficulties due to the global lockdown. Laboratories worldwide also faced shortages throughout the pandemic. For example, according to an article published in March 2022 on PubMed, laboratories and manufacturers were developing and conducting assays at an accelerated rate during the pandemic, resulting in a severe scarcity of fundamental and essential laboratory reagents. This had a substantial effect on multiple processes in both conventional and modern methods of separation techniques in biotechnology.

- However, as the pandemic restrictions are eased, in the post-pandemic situation, the market is anticipated to witness growth in the coming years due to the advancement in separation systems and the rise in the adoption of separation systems in the biopharmaceutical industry,

- The major factor attributing to the growth of the market is the increasing advancement of cell separations and increasing demand for biopharmaceuticals. For instance, in November 2022, Sony Corporation launched the SFA - Life Sciences Cloud Platform, a flow cytometry data analysis cloud solution that can quickly identify rare cells, such as cancer cells and stem cells, from a wide variety of cell populations, using data obtained from flow cytometers.

- Similarly, in September 2022, Tosoh Bioscience GmbH, a provider of chromatographic solutions for the separation and purification of biomolecules, launched the Octave BIO multi-column chromatography (MCC) system. This system, combined with the SkillPak BIO pre-packed columns, enables customers to quickly and efficiently develop pre-clinical processes. Thus, the development of such innovative cloud platforms and the launch of various chromatography systems are expected to augment the demand for separation systems, thereby contributing to the market growth over the forecast period.

- Moreover, research studies involving the recent advancement of cell separation are expected to drive market growth. For instance, as per the article published in January 2022 in MDPI, magnetic cell separation has emerged as a critical technology for isolating specific cell populations from biological suspensions, with applications ranging from diagnosis and therapy in biomedicine to environmental applications or fundamental research in biology. Hence, owing to the increase in advantages offered by separation systems, the studied market is expected to witness significant growth over the forecast period.

- Thus, due to the increase in product launches and advancements in cell separation in biotechnology, the separation systems for the commercial biotechnology market are expected to witness significant growth over the forecast period. However, the high cost involved in research and development is likely to restrain the market growth.

Separation Systems For Commercial Biotechnology Market Trends

Biopharmaceutical Segment is Anticipated to Witness a Growth Over the Forecast Period

- In the biopharmaceutical field, the separation stage is applied to remove unwanted by-products from API manufacturing, and the most used technologies are chromatography, nanofiltration, ultrafiltration, sublimation, de-sublimation, distillation, and crystallization. The biopharmaceutical segment is expected to witness significant market growth in the market owing to the increase in demand for personalized medicines and cell-based therapies coupled with advancements in the biopharmaceutical industry.

- For instance, in November 2022, Alfa Laval launched a new multipurpose membrane filtration system that can be seamlessly connected to both up and downstream operations. It increases flexibility across a range of process applications. This includes the purification of proteins, sugar, and starch, the concentration of peptides and amino acid streams, and the recovery of water from condensates.

- Moreover, according to the article published in September 2022 in London, The identification of a molecule with therapeutic potential is the initial step in the development of a medicine, after which molecules such as drug candidates are examined for metabolism and pharmacokinetics. Because of their great sensitivity and selectivity, these chemicals are routinely tested using combination techniques such as liquid chromatography-mass spectrometry (LC-MS) or LC-MS/MS.

- Furthermore, an increase in biopharmaceutical plants across the globe is likely to increase the utilization of separation systems. For instance, in May 2022, INCOG BioPharma Services, an Indiana-based contract development and manufacturing organization (CDMO) specializing in sterile injectables, opened a biomanufacturing facility in Indiana.

- Hence, due to the increase in product launches and advancements in cell separation in biotechnology, the biopharmaceutical segment is expected to witness significant growth over the forecast period.

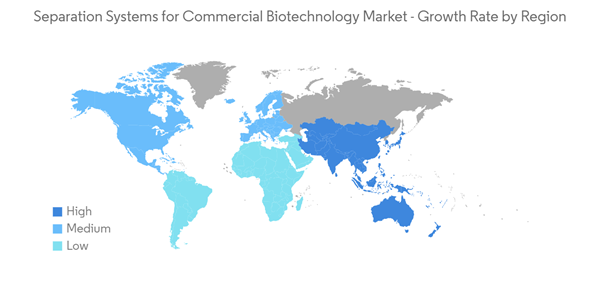

North America Anticipated to Hold a Significant Share in the Market Over the Forecast Period

- North America is expected to hold a significant market share throughout the forecast period due to factors such as the presence of key players, an increase in research activities utilizing the separation systems, and established healthcare infrastructure. Furthermore, beneficial government initiatives and an increase in the number of research partnerships are some of the drivers expected to increase market growth.

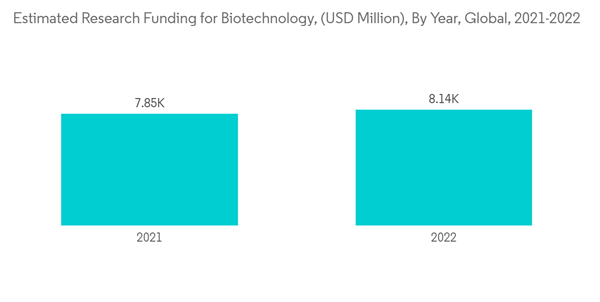

- For instance, as per the NIH 2022 update, the estimated research funding for biotechnology was USD 8,142 million in 2022. Hence, such high investments by the government are likely to drive market growth.

- Similarly, as per a 2021 update by the University of North Dakota, the UND Center of Biomedical Research Excellence (CoBRE) in Host-Pathogen interactions (HPI) has stated that the National Institutes of Health (NIH) funding will continue its funding throughout Phase 2 of the project.

- The USD 10.7 million amount renewal is granted for obtaining a better understanding of the host responses to viral, bacterial, and parasitic infections that cause acute and chronic inflammatory disorders. The Center will also enhance the innovative research capabilities of the School of Medicine & Health Sciences (SMHS) and UND by supporting three existing Phase 1 Core facilities, including flow cytometry.

- Various governmental research organizations use the HPLC technique in the analysis of specific components in a drug mixture or similar components. An article by the United States Environmental Protection Agency (EPA) updated in May 2021 on the High-Performance Environmental Sampling and Analytical Methods (ESAM) Program focused on the Determination of Carbonyl Compounds by using High-Performance Liquid Chromatography (HPLC). Such application of HPLC techniques as standard protocols for sample analysis is adding to the growth of the market in the North American region.

- Hence, due to the increase in advancements in separation systems and the rise in research funding, North America is expected to hold a significant market share over the forecast period.

Separation Systems For Commercial Biotechnology Industry Overview

The separation systems for the commercial biotechnology market are moderately competitive and consist of several major players. Currently, major players are founding strategic partnerships with other entities and collaborating to enhance their product portfolios in the field of separation systems to develop technologically advanced systems. Some of the companies that are currently dominating the market are Perkin Elmer, Inc., Sartorius AG, Thermo Fisher Scientific, Inc., Merck KGaA, Becton, Dickinson and Company, Shimadzu Corporation, bioMérieux SA, Agilent Technologies, Bio-Rad Laboratories, Inc.Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

This product will be delivered within 2 business days.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Perkin Elmer, Inc.

- Sartorius AG

- Thermo Fisher Scientific, Inc.

- Merck KGaA

- Becton, Dickinson and Company

- Shimadzu Corporation

- bioMerieux SA

- Agilent Technologies

- Bio-Rad Laboratories, Inc.