Small kitchen appliances are usually minor compared to large appliances and are portable or semi-portable. These appliances are used on platforms, such as countertops and tabletops, to achieve a specific household task. Small appliances are often known to have both commercial and home versions, and only the home version for some devices, such as blenders and coffee makers.

The small kitchen appliance market is expected to grow in the coming years, owing to the growing living standards of the people, especially in the developing regions. The main factor that will likely drive the demand for small appliances is the development of innovative products in the market. As modern-day people are working in a hectic lifestyle, they will require devices that can work fast and efficiently in less time. Such concerns have led to the development of multifunctions at the same time. This has led to the developing of various multifunctional small appliances in the market, which have high growth opportunities. These kitchen appliances will likely witness strong demand in the coming future due to the need for easy kitchen work and the emergence of the modular kitchen.

People in the market are looking for products that are convenient to use and at the same time in their affordability range. The capacity and functionality of products are other important factors that are looked upon when consumers buy small kitchen appliances in the market. To meet varying customer demands, manufacturers are working on incorporating robotic technologies in small kitchen appliances to provide a user-friendly interface and enable ease of operations. Post-COVID, the small kitchen appliances market has seen a surge in demand as more people cook at home.

Small Kitchen Appliances Market Trends

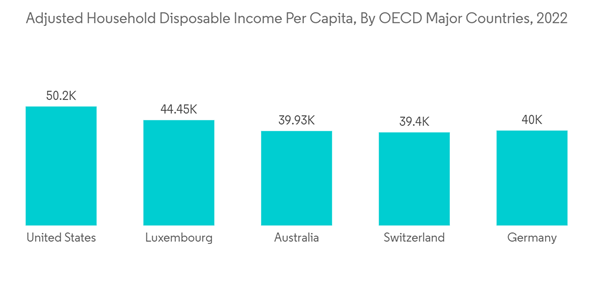

Increasing Disposable Income of the Households is Expected to Drive Growth of Small Kitchen Appliances Market

Disposable income within each household is expected to spur the growth of small kitchen appliances across developed and developing economies. As the income of the average household increases, there has been a rise in the consumer need for kitchen appliances, which would lead to the growth and demand for small kitchen appliances as they are more convenient and easy to use.New innovations in small kitchen appliances and products have augmented the time and efficiency of the operation of kitchen appliances. These developments have further incentivized the need to buy small kitchen appliances. Innovations, such as modular kitchens, an increase in surplus money, and the growing working population in urban societies are anticipated to drive the demand for high-end products.

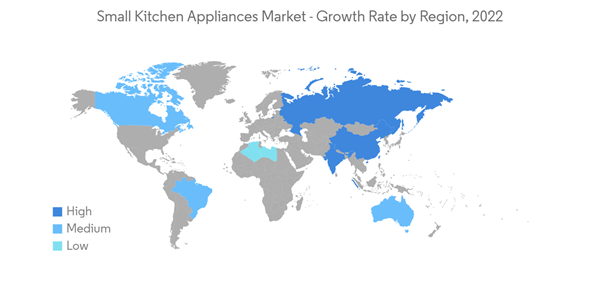

Asia Pacific Region along with BRICS Countries are Fastest Growing Market

The Asia-Pacific is the fastest-growing market for small kitchen appliances and leads in volume sales of small kitchen appliances. The growth of this market is mainly governed by a growing population, rising disposable incomes, single families, and developing economies in the region. China, India, and Brazil are expected to lead the market in volume growth. Other factors, such as the high penetration rate of small appliances compared to other regions, will influence the market positively.The growing working-class population in the Asia Pacific region, coupled with the trend of fast food consumption, is further expected to drive innovation in the small kitchen appliances market. E-commerce has grown tremendously between 2017 and 2022 in selling small kitchen appliances through the Internet. The growth of distribution through online retail channels is mainly attributed to increased internet access, growing usage of smartphones and tablets, and improved internet retailers.

Small Kitchen Appliances Industry Overview

The small kitchen appliances market is fragmented and highly competitive due to many small and large players. Companies are trying to innovate new multi-functional appliances to remain competitive and attract customers in the market. Stakeholders are implementing an omnichannel marketing strategy to reach many customers worldwide. Diversification in terms of products and places will likely be able to help companies maintain their businesses in the future. Many start-ups are also innovating different products, such as the Air Fryer and the Power Smokeless Grill by GoWISE, which can further increase the competition for existing brands.Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

This product will be delivered within 2 business days.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- BSH Hausgerate GmbH

- Whirlpool Corporation

- Haier lnc.

- AB Electrolux

- Panasonic

- Dongbu Daewoo Electronics

- LG

- Sub-Zero

- Samsung

- Fotile

- Robam

- Midea

- Others (Instant Pot and Keurig)