Speak directly to the analyst to clarify any post sales queries you may have.

A concise introduction to the evolving landscape of tissue processing systems highlighting innovation clinical demand regulatory pressure and strategic imperatives

Tissue processing systems sit at the intersection of laboratory automation, clinical diagnostics, and translational research, and their evolution reflects broader shifts across healthcare delivery and bioscience innovation. Advances in automation, robotics, and digital integration are converging with heightened clinical demand for speed, reproducibility, and regulatory compliance. Meanwhile, consumables and instrument interoperability increasingly determine procurement decisions, driving buyers to evaluate entire workflows rather than discrete devices.As clinical laboratories and research centers pursue higher throughput and lower turnaround times, tissue processing platforms are being rethought for modularity and seamless integration with staining, imaging, and data-management solutions. Supply chain resilience and supplier diversity have risen on procurement agendas, prompted by recent global disruptions and policy shifts. In parallel, end users are demanding validated workflows that support newer applications such as molecular pathology and companion diagnostics, challenging vendors to demonstrate clinical utility and workflow compatibility.

This introduction establishes the context for subsequent sections by clarifying the interplay of technology, regulatory expectations, and customer priorities. The intent is to equip decision makers with a grounded understanding of the forces reshaping tissue processing so that strategic choices around product development, market entry, and channel strategy align with emerging clinical and research requirements.

Emerging technological operational and regulatory shifts reshaping tissue processing systems and driving strategic re-evaluation across clinical and research settings

Recent transformational shifts in the tissue processing landscape are driven by three interrelated currents: technological innovation, changing clinical workflows, and heightened regulatory expectations. Technological innovation has accelerated the maturation of fully automated processors, advanced stainers, and integrated coverslipping solutions, enabling laboratories to move from manual, labor-intensive workflows to reproducible, scalable operations. At the same time, the rise of digital pathology and molecular diagnostics is changing upstream sample-preparation priorities, prompting vendors to design systems that preserve nucleic acids and antigenicity while supporting high-throughput slide production.Operationally, laboratories are consolidating workflows toward platforms that offer modular upgrades and touch-free operations to reduce variability and infection risk. This shift favors suppliers that provide validated end-to-end solutions and responsive service models. Regulatory scrutiny and quality-management expectations have increased the emphasis on traceability, documentation, and validated performance claims, which in turn affects procurement cycles and vendor selection criteria. Collectively, these changes necessitate a strategic re-evaluation of product roadmaps, partnerships, and go-to-market approaches, as companies that successfully integrate hardware, consumables, and software will capture the most sustainable advantage.

These transformative dynamics also create opportunities for niche innovation, including disposables engineered for single-use workflows and middleware that ties tissue processors to laboratory information systems, enabling tighter feedback loops between clinical needs and product development.

Assessing the cascading operational supplier and pricing consequences of United States tariff actions in 2025 on tissue processing systems and supply chains

Policy changes that affect tariffs and trade can materially influence procurement, supplier selection, and pricing strategies throughout the tissue processing ecosystem. While specific tariff measures enacted in 2025 vary by product classification and bilateral trade relationships, the general implications are consistent with past experience: increased landed costs for imported instruments and consumables, shifting supplier economics, and renewed attention to domestic sourcing and regional manufacturing partnerships.Higher duties on certain categories can prompt laboratories and distributors to renegotiate contracts, accelerate inventory planning, and look for alternative suppliers with local manufacturing footprints or favorable trade arrangements. In turn, vendors may respond by adjusting production locations, redesigning product architectures to simplify cross-border logistics, or absorbing cost through pricing strategies targeted at long-term account retention. Tariff-related uncertainty also elevates the commercial importance of flexible distribution channels and multi-source procurement policies that reduce exposure to single points of failure.

Furthermore, tariffs intersect with regulatory and reimbursement pressures: if increased import costs translate into higher per-test expenses, clinical stakeholders will assess the cost-benefit of adopting new workflows. Consequently, companies should prioritize scenario planning, tariff impact modeling at the SKU level, and supplier resilience assessments to maintain service continuity and competitive pricing when trade policies shift.

In-depth segmentation analysis revealing product end-user technology application and distribution patterns that define adoption and procurement behavior

Understanding segmentation is essential for targeting investment and commercial efforts across product, end-user, technology, application, and distribution dimensions. Product type distinctions matter because consumables such as cassettes, reagents, and slides, and instrument classes including coverslippers-divided into automated and semi-automated-embedding centers split between cryostat embedding systems and tissue embedding stations, microtomes, stainers categorized as automated or semi-automated, and tissue processors offered as automated, manual, or semi-automated variants each carry distinct procurement rhythms and service expectations. Perceptual differences between instrument capital purchases and recurring consumable spending shape both sales cycles and customer lifetime value calculations.End-user segmentation further refines where demand concentrates, with biotechnology companies, diagnostic laboratories-encompassing clinical and reference laboratories-hospitals segmented into large hospitals, small hospitals, and specialty clinics, pharmaceutical companies, and research institutes comprised of academic research centers and government research bodies. Each of these buyers evaluates tissue processing systems through different lenses of throughput requirements, regulatory compliance, budget cycles, and validation needs. Technology segmentation highlights the contrasts among automated, manual, and semi-automated platforms, where automated offerings may include programmable systems and robotic systems while semi-automated solutions can take the form of batch processors or touchscreen-enabled systems, affecting adoption curves and service models.

Application-based differentiation reveals where clinical and research investments concentrate. Drug development activities, split across clinical trials and preclinical work, place particular emphasis on reproducibility and traceability. Genetic research applications spanning animal genetics, human genetics, and plant genetics demand protocols that preserve nucleic acids. Infectious disease testing divided among bacterial, parasitic, and viral testing requires workflows optimized for pathogen-specific preservation. Oncology diagnostics, with emphasis areas such as breast, lung, and prostate cancer, often drives demand for validated, high-performance staining and processing pipelines. Finally, distribution channels vary from direct sales and distributor networks to online retail and OEM resellers, where distributors may be global or regional and OEM resellers categorized into authorized partners and value-added resellers. Together, these segmentation lenses guide prioritization of R&D investments, commercialization strategies, and channel development to align with differentiated customer needs.

Key regional dynamics and comparative strengths across Americas Europe Middle East & Africa and Asia-Pacific that influence procurement suppliers and innovation

Regional dynamics play a pivotal role in shaping procurement priorities, regulatory pathways, and supplier footprints. In the Americas, demand is driven by a concentration of reference laboratories and large hospital systems with an emphasis on throughput, regulatory compliance, and integration with digital pathology infrastructure. North American procurement cycles favor vendors who can demonstrate robust service networks and validated workflows that align with clinical laboratory accreditation standards. Latin American markets, by contrast, display heterogeneous adoption rates and a higher sensitivity to total cost of ownership, creating opportunities for modular or semi-automated offerings that balance performance with capital constraints.In Europe, Middle East & Africa, regulatory harmonization across jurisdictions and the presence of sophisticated research institutions drive interest in systems that support molecular applications and multifaceted validation data. The EMEA region also values energy efficiency, serviceability, and supply continuity, leading buyers to prioritize suppliers with regional support capabilities. In Asia-Pacific, rapid expansion of diagnostic capacity, significant investments in biotech research, and strong manufacturing ecosystems influence both demand and supply. Countries in this region increasingly adopt automation to meet growing clinical volumes while also fostering local OEM development, which can alter competitive dynamics and cost structures.

Understanding these regional nuances helps vendors tailor product configurations, after-sales models, and channel strategies to align with the operational realities and regulatory frameworks that define buyer decision processes across geographies.

Competitive intelligence and capability mapping of leading device makers consumable suppliers and service providers steering innovation in tissue processing

Company-level dynamics are central to competitive positioning and the diffusion of next-generation tissue processing solutions. Market leaders combine product breadth-ranging from robust consumable portfolios to integrated instrument suites-with global service networks and strong regulatory track records. At the same time, specialized players focus on niche strengths such as cryostat embedding, advanced robotic integration, high-throughput staining, or single-use consumable innovations that address specific clinical and research pain points. Smaller, agile companies can disrupt established channels by offering rapid iteration cycles, tight software-hardware integration, or compelling total-cost propositions tailored to targeted end-user segments.Strategic partnerships and alliances have become a common route to extend capabilities quickly. Collaborations between instrument manufacturers and reagents or consumable providers create validated bundles that simplify procurement and reduce validation burdens on customers. Similarly, alliances with software and digital pathology providers enhance the value proposition by connecting tissue processing outputs directly to downstream analysis and reporting workflows. Mergers and acquisitions also continue to reshape capability portfolios as companies seek to internalize service networks, proprietary consumables, or specialized technologies.

For decision makers, the critical takeaways are to evaluate potential partners not only on product performance but also on their ability to offer end-to-end validated solutions, dependable service coverage, and a clear roadmap for compliance and interoperability.

High-impact strategic recommendations for industry leaders to optimize operations advance technology adoption and mitigate supply chain and policy risks

Industry leaders should act decisively to secure a sustainable competitive edge by implementing a coordinated strategy that addresses product, supply chain, and customer engagement simultaneously. First, prioritize modular and interoperable product architectures that allow incremental upgrades and ensure compatibility with digital pathology platforms and laboratory information systems. This reduces customer friction during deployment and increases attachment rates for consumables and software services. Second, diversify manufacturing and sourcing strategies to mitigate exposure to tariff volatility and logistical disruptions; selectively nearshore production for critical consumables while maintaining specialized manufacturing hubs for complex instruments.Next, invest in validated workflow bundles that pair instruments with consumables and software, thereby simplifying validation and shortening procurement timelines for clinical and research buyers. Complement these product initiatives with scalable service offerings, including remote diagnostics, predictive maintenance, and outcome-focused support contracts. Strengthen partnerships with academic centers and diagnostic labs to build clinical evidence for new system claims and to accelerate acceptance in earlier-adopter segments.

Finally, align commercial models to customer buying behaviors by offering flexible financing, consumable subscription models, and outcome-based agreements where feasible. These measures, executed in concert, will improve resilience, accelerate adoption, and protect margin in a dynamic policy and procurement environment.

Transparent research methodology detailing data sources stakeholder interviews analytical frameworks and validation approaches used for rigorous industry analysis

The research underpinning this analysis relied on a mixed-methods approach combining primary stakeholder engagement, product-level technical assessments, and secondary literature synthesis. Primary inputs included structured interviews with laboratory directors, procurement leads, R&D managers, and service engineers to capture real-world operational constraints and adoption drivers. These qualitative insights were complemented by product scans and technical comparisons that evaluated instrument capabilities, consumable compatibility, and integration features across representative offerings.Secondary data sources comprised regulatory guidance documents, clinical standards, and publicly available technical briefs that informed assessments of compliance and validation demands. Analytical frameworks employed included value-chain mapping to identify cost and service bottlenecks, scenario analysis to explore tariff-related contingencies, and segmentation matrices to align product and channel strategies with buyer archetypes. Triangulation of data streams ensured that conclusions reflect both empirical observations and broader industry trends.

To ensure methodological transparency and reproducibility, the study documented interview protocols, product evaluation criteria, and the logic behind scenario assumptions. Stakeholders can therefore review how insights were derived and request custom validations or additional deep dives to tailor findings to their strategic questions.

Executive conclusion synthesizing key insights strategic implications and expected operational priorities for stakeholders across the tissue processing ecosystem

In conclusion, the tissue processing systems landscape is undergoing a period of strategic recalibration driven by automation, application expansion, and evolving procurement priorities. Vendors that design interoperable, validated systems and that pair hardware with consumables and software will stand out in procurement processes that increasingly favor end-to-end solutions. At the same time, tariff dynamics and supply chain uncertainties underscore the importance of manufacturing flexibility and regional support networks, which are now central considerations in customer evaluations.End users-from diagnostic laboratories to pharmaceutical and academic research centers-will reward suppliers who can demonstrate clinical-grade performance, streamlined validation pathways, and robust after-sales service. Companies seeking to win in this environment should adopt a dual focus on product excellence and commercial model innovation, including subscription-based consumable offerings and outcome-oriented service contracts that align incentives with customer success.

Taken together, these strategic imperatives form a cohesive agenda for organizations aiming to capture long-term value in tissue processing, balancing near-term operational resilience with investments in technology and partnerships that drive sustained adoption and clinical impact.

Additional Product Information:

- Purchase of this report includes 1 year online access with quarterly updates.

- This report can be updated on request. Please contact our Customer Experience team using the Ask a Question widget on our website.

Table of Contents

7. Cumulative Impact of Artificial Intelligence 2025

17. China Tissue Processing Systems Market

Companies Mentioned

The key companies profiled in this Tissue Processing Systems market report include:- Agar Scientific Ltd.

- Agilent Technologies, Inc.

- Amos Scientific Pty Ltd

- Avantor, Inc.

- Beijing YIDI Medical Equipment Co., Ltd.

- Bio-Optica Milano S.p.A.

- BioGenex Laboratories, LLC

- Boekeler Instruments, Inc.

- Bühlmann Laboratories AG

- Cardinal Health, Inc.

- Clarapath, Inc.

- Danaher Corporation

- Diapath S.p.A.

- General Data Company, Inc.

- Histo-Line Laboratories Corporation

- INTAS Scientific Pvt Ltd

- JOKOH Co., Ltd.

- MEDITE GmbH

- Milestone S.r.l.

- PHC Holdings Corporation

- Sakura Finetek Japan Co., Ltd.

- SLEE Medical GmbH

- Thermo Fisher Scientific Inc.

- Unimedicare SRL

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 195 |

| Published | January 2026 |

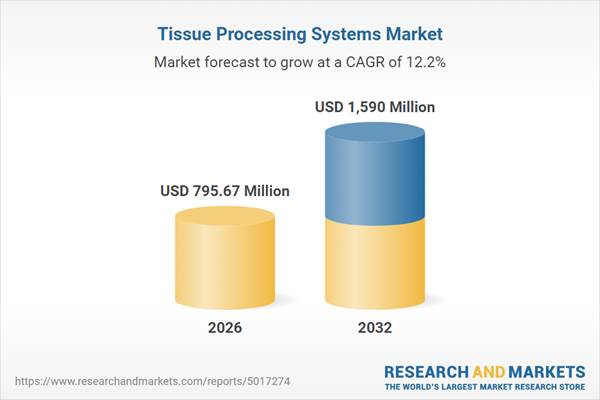

| Forecast Period | 2026 - 2032 |

| Estimated Market Value ( USD | $ 795.67 Million |

| Forecasted Market Value ( USD | $ 1590 Million |

| Compound Annual Growth Rate | 12.1% |

| Regions Covered | Global |

| No. of Companies Mentioned | 25 |