The global blood collection tubes market is poised for significant growth, driven by the rising prevalence of chronic diseases, an aging population, and increasing surgical procedures. The market is fueled by the growing need for blood testing and storage, particularly for conditions like diabetes and cancer, which require frequent diagnostics. Technological advancements in tube design, such as improved efficiency and user-friendliness, further propel demand. Despite challenges like high production costs and regulatory complexities, the market is supported by robust healthcare infrastructure, with the United States emerging as a dominant market due to its advanced medical ecosystem and high testing volumes.

Market Drivers

The increasing incidence of chronic diseases, such as diabetes and cancer, is a primary driver, necessitating frequent blood tests for diagnosis and monitoring. The World Health Organization reported 10.2 million tuberculosis cases globally, including 1.2 million children, highlighting the demand for reliable blood collection systems. The growing number of surgical procedures also boosts market growth, as blood collection tubes are essential for preoperative and postoperative testing. For instance, high surgical volumes in European countries like Portugal, Denmark, Norway, and Ireland underscore the need for efficient blood collection solutions. Additionally, technological advancements, such as BD's Vacutainer® Serum Tube with K2EDTA launched in January 2023 for serum separation, enhance usability and support surgical applications, driving market expansion. The global rise in blood donations, with 118.5 million units collected as per WHO's June 2023 data, further amplifies demand for specialized tubes to ensure safe storage and testing.Market Segmentation

The market is segmented by application, tube type, and geography. Applications include diagnostics, surgical procedures, and blood donation, with diagnostics leading due to chronic disease prevalence. Tube types encompass serum, plasma, and EDTA tubes, tailored to specific testing needs. Geographically, the market spans North America, South America, Europe, the Middle East and Africa, and Asia Pacific. The United States dominates North America, driven by its USD 3.8 trillion healthcare industry in 2022 and high surgical and diagnostic activity. The integration of microfluidics in point-of-care (POC) diagnostics, enabling portable and affordable testing, further supports market growth in the region.Industry Analysis

Porter's Five Forces model evaluates competitive dynamics, analyzing supplier power, buyer influence, and market rivalry. An industry value chain analysis identifies key players in tube manufacturing, distribution, and healthcare integration, emphasizing their roles in ensuring quality and efficiency. The regulatory framework, including standards for medical device safety and quality, is critical for maintaining trust and compliance, particularly in high-income countries with stringent healthcare regulations.Competitive Landscape

Key players, such as BD, focus on innovation, developing advanced tubes like the Vacutainer® series to meet surgical and diagnostic needs. The vendor matrix categorizes companies as leaders, followers, challengers, or niche players based on their strategies, with an emphasis on user-friendly and efficient solutions. Investments in R&D and partnerships with healthcare providers strengthen market positions.Challenges

High production costs for advanced blood collection tubes and stringent regulatory requirements pose barriers. Ensuring consistent quality across diverse applications and addressing supply chain constraints in developing regions are additional challenges requiring strategic solutions.The blood collection tubes market is set for robust growth, driven by chronic disease prevalence, surgical demand, and technological advancements. The U.S. leads due to its advanced healthcare infrastructure and high testing volumes, while Asia Pacific shows potential with rising healthcare needs. Continued innovation and regulatory compliance will be critical for overcoming cost and quality challenges, ensuring the market meets global diagnostic and surgical demands.

Key Benefits of this Report:

- Insightful Analysis: Gain detailed market insights covering major as well as emerging geographical regions, focusing on customer segments, government policies and socio-economic factors, consumer preferences, industry verticals, and other sub-segments.

- Competitive Landscape: Understand the strategic maneuvers employed by key players globally to understand possible market penetration with the correct strategy.

- Market Drivers & Future Trends: Explore the dynamic factors and pivotal market trends and how they will shape future market developments.

- Actionable Recommendations: Utilize the insights to exercise strategic decisions to uncover new business streams and revenues in a dynamic environment.

- Caters to a Wide Audience: Beneficial and cost-effective for startups, research institutions, consultants, SMEs, and large enterprises.

What do businesses use our reports for?

Industry and Market Insights, Opportunity Assessment, Product Demand Forecasting, Market Entry Strategy, Geographical Expansion, Capital Investment Decisions, Regulatory Framework & Implications, New Product Development, Competitive Intelligence.Report Coverage:

- Historical data from 2020 to 2024 & forecast data from 2025 to 2030

- Growth Opportunities, Challenges, Supply Chain Outlook, Regulatory Framework, and Trend Analysis

- Competitive Positioning, Strategies, and Market Share Analysis

- Revenue Growth and Forecast Assessment of segments and regions including countries

- Company Profiling: Strategies, Products, Financial Information, and Key Developments among others

Segmentation:

By Product Type

- EDTA Tubes

- Heparin Tube

- Heparin Plasma Separating Tube

- Serum Separating Tube

- Others

By Material Type

- Plastic

- Polyethylene Terephthalate

- Polypropylene

- Polystyrene

- Others

- Glass

By End-User

- Diagnostics Centers

- Hospitals and Clinics

- R&D Centers

By Geography

- North America

- United States

- Canada

- Mexico

- South America

- Brazil

- Argentina

- Others

- Europe

- United Kingdom

- Germany

- France

- Spain

- Others

- Middle East and Africa

- Saudi Arabia

- UAE

- Israel

- Others

- Asia Pacific

- Japan

- China

- India

- South Korea

- Indonesia

- Thailand

- Others

Table of Contents

Companies Mentioned

- BD

- Cardinal Health

- CHENGDU RICH SCIENCE INDUSTRY CO., LTD.

- FL MEDICAL S.r.l.

- Fresenius Kabi AG

- Greiner Bio One International GmbH

- Thermo Fisher Scientific Inc.

- Kawasumi Laboratories America

- McKesson Medical-Surgical Inc.

- QIAGEN

- SARSTEDT AG & Co. KG

- AdvaCare Pharma

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 140 |

| Published | August 2025 |

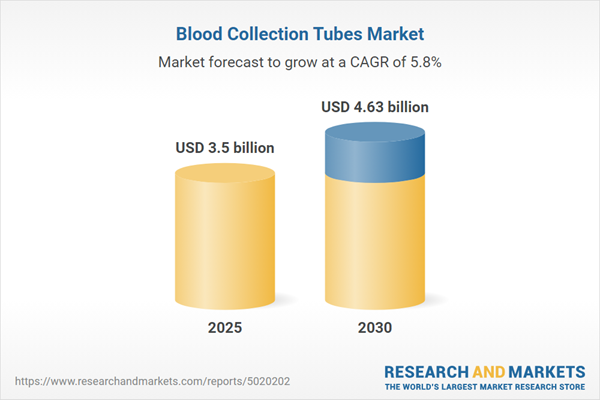

| Forecast Period | 2025 - 2030 |

| Estimated Market Value ( USD | $ 3.5 billion |

| Forecasted Market Value ( USD | $ 4.63 billion |

| Compound Annual Growth Rate | 5.7% |

| Regions Covered | Global |

| No. of Companies Mentioned | 12 |