Biopsy devices are medical instruments specifically designed for extracting tissue samples from a patient's body for diagnostic purposes. They are widely used in various healthcare settings and are instrumental in diagnosing a wide range of conditions, including cancer, infections, and inflammatory diseases. They are available in different types, such as needle, forceps, and vacuum-assisted biopsy devices, each serving particular medical requirements. By employing real-time imaging techniques like ultrasound, CT scans, or MRI, healthcare professionals can pinpoint the exact location from which the tissue needs to be taken, thereby improving the procedure's success rate. As a result, biopsy devices have gained immense traction as indispensable tools in modern diagnostic medicine, facilitating precise and timely interventions.

The aging population, which is more susceptible to diseases requiring biopsy for diagnosis, will stimulate market growth during the forecast period. Additionally, the heightened focus on personalized medicine, which often necessitates multiple biopsy procedures to monitor the disease's progression and adapt the treatment plan accordingly, increases the frequency of biopsy device usage. In line with this, the global push toward minimally invasive procedures for patient comfort and quicker recovery times has accelerated the adoption of biopsy devices designed for these less intrusive techniques. Furthermore, the rising healthcare expenditure and supportive reimbursement policies in several countries are contributing to market growth. As governments and private insurers across the globe aim to provide better healthcare services, there is a higher likelihood of reimbursements for diagnostic procedures like biopsies, making them more accessible to patients fueling the market growth.

Biopsy Devices Market Trends/Drivers

Rising Incidence of Cancer

The increasing burden of cancer worldwide is a significant driver for the biopsy devices market. Cancer diagnoses require precise and early-stage identification for optimal treatment, making biopsies an essential diagnostic tool. According to the World Health Organization, cancer is the second leading cause of death globally, responsible for an estimated 9.6 million deaths in 2018. As cancer rates continue to escalate, there has been a rise in the need for accurate and efficient diagnostic methods. Therefore, biopsy devices are becoming vital in identifying malignant tissues, allowing clinicians to formulate appropriate treatment plans. The rising incidence of cancer catalyzes the demand for advanced biopsy devices, thus positively influencing market growth.Rapid Technological Advancements

Innovations in biopsy devices represent another major growth-inducing factor. Technological advancements are improving the efficacy, speed, and safety of biopsy procedures. For instance, vacuum-assisted biopsy devices allow quicker and more comfortable extraction of tissue samples, thereby enhancing patient experience. Additionally, the integration of real-time imaging techniques such as ultrasound, CT scans, or MRI with biopsy devices provides physicians with a more accurate target area, reducing procedural complications and increasing diagnostic reliability. Such technological enhancements contribute to higher product adoption rates among healthcare professionals, which in turn is propelling market growth.Extensive Investments in Healthcare Infrastructure

The rising investments in healthcare infrastructure, especially in emerging economies, also drive the market toward growth. The increased funding by public and private agencies facilitates the modernization of medical facilities, including diagnostic labs and the acquisition of state-of-the-art medical equipment. As healthcare systems globally are focusing on delivering more accurate and timely diagnostics, the incorporation of advanced biopsy devices becomes a natural progression. This has expanded the market for these devices while ensuring broader access to high-quality diagnostic procedures for patients, thus providing a positive thrust to the market growth.Biopsy Devices Industry Segmentation

This report provides an analysis of the key trends in each segment of the global biopsy devices market report, along with forecasts at the global, regional, and country levels for 2025-2033. The report has categorized the market based on procedure type, product, application, guidance technique, and end user.Breakup by Procedure Type

- Surgical Biopsy

- Needle Biopsy

The report has provided a detailed breakup and analysis of the market based on the procedure type. This includes surgical biopsy and needle biopsy. According to the report, surgical biopsy represented the largest segment.

Surgical biopsy is widely preferred among healthcare professionals for accurate and comprehensive tissue analysis due to its high diagnostic accuracy and versatility. Unlike other biopsy methods, such as needle or liquid biopsies, surgical biopsies enable the removal of an entire tumor or a larger section of tissue, providing a more comprehensive sample for analysis. This increased sample size enhances the ability of pathologists to make accurate and definitive diagnoses, particularly in complex cases where malignancy is suspected but not confirmed through less invasive methods. Additionally, surgical biopsies are often employed in locations difficult to access by needle-based techniques, such as deeper tissues or organs. Another major contributing aspect is its utility beyond diagnosis; it often serves as both a diagnostic and therapeutic procedure by allowing for the complete excision of small malignant masses. The surgical approach is also favored in cases requiring immediate intervention or when other biopsy methods have yielded inconclusive results, thus supporting the segment growth.

Breakup by Product

- Biopsy Guidance Systems

- Needle Based Biopsy Guns

- Biopsy Needles

- Biopsy Forceps

- Others

A detailed breakup and analysis of the market based on the product has also been provided in the report. This includes biopsy guidance systems, needle based biopsy guns, biopsy needles, biopsy forceps, and others. According to the report, biopsy guidance systems accounted for the largest market share.

Biopsy guidance systems are crucial in enhancing the accuracy and efficiency of biopsy procedures. These guidance systems often integrate with imaging technologies like ultrasound, MRI, or CT scans to provide real-time visualization of the tissue area being targeted. Such integration allows healthcare professionals to precisely locate and assess the tissue sample needed for diagnosis, thereby reducing the risk of complications and procedural errors. In a medical landscape where precision is paramount, these guidance systems offer a significant edge. Their utility is especially prominent in complex cases where the targeted tissue is located deep within the body or near critical organs, where pinpoint accuracy is essential. Moreover, guidance systems are becoming increasingly user-friendly and compatible with various types of biopsy devices, which promotes their adoption across different healthcare settings. By facilitating quicker, more accurate, and safer procedures, biopsy guidance systems are indispensable tools that clinicians rely on, which is fueling the segment growth.

Breakup by Application

- Breast Biopsy

- Lung Biopsy

- Colorectal Biopsy

- Prostate Biopsy

- Others

The report has provided a detailed breakup and analysis of the market based on the application. This includes breast biopsy, lung biopsy, colorectal biopsy, prostate biopsy, and others. According to the report, breast biopsy represented the largest segment.

The main factor driving the growth of this segment is the high incidence of breast cancer globally. According to the World Cancer Research Fund, breast cancer is the most commonly occurring cancer in women and the second most common cancer overall. Early detection is critical for effective treatment, and biopsy remains one of the most reliable diagnostic methods for confirming the presence or absence of cancerous cells in breast tissue. Furthermore, advances in imaging technologies such as mammography and ultrasound have significantly improved the accuracy of breast biopsies, making it a preferred diagnostic option. Public awareness campaigns about the importance of early detection have also played a role in the frequent utilization of breast biopsy procedures. Increasingly, women are becoming proactive about their breast health, leading to more screenings and, subsequently, more biopsies to confirm or rule out malignancy. As a result, the breast biopsy segment continues to maintain its leading position in the biopsy devices market.

Breakup by Guidance Technique

- Ultrasound Guided Biopsy

- Stereotactic Guided Biopsy

- MRI Guided Biopsy

- Others

A detailed breakup and analysis of the market based on the guidance technique has also been provided in the report. This includes ultrasound guided biopsy, stereotactic guided biopsy, MRI guided biopsy, and others. According to the report, ultrasound guided biopsy accounted for the largest market share.

Ultrasound-guided biopsy provides real-time imaging, allowing healthcare professionals to visualize the exact area from which the tissue sample is to be extracted. This enhances the accuracy and efficiency of the biopsy procedure. Moreover, ultrasound-guided biopsies are less invasive and generally quicker than other methods, requiring only local anesthesia. This further improves patient comfort and reduces recovery time. Compared to other imaging modalities like MRI or CT scans, ultrasound is considerably less expensive and more widely available across healthcare settings, including smaller clinics and outpatient centers. This accessibility makes it a go-to option for many physicians. Besides this, ultrasound does not involve exposure to ionizing radiation, making it a safer alternative for repeated procedures and specific patient populations, such as pregnant women. Due to these advantages - real-time imaging, cost-effectiveness, minimal invasiveness, and safety - ultrasound-guided biopsy is widely preferred, contributing to segment growth.

Breakup by End User

- Hospitals and Clinics

- Academic and Research Institutes

- Others

Hospitals and clinics are often the first point of contact for patients requiring diagnostic procedures, including biopsies. These healthcare settings are equipped with advanced diagnostic tools and skilled professionals capable of performing a wide range of biopsy types. The growing incidence of diseases requiring biopsies, coupled with the expansion of healthcare infrastructure globally, has led to higher adoption of biopsy devices in these institutions. Moreover, hospitals often have the financial capacity to invest in the latest biopsy technologies, further augmenting the market growth.

Although smaller in market share compared to hospitals and clinics, academic and research institutes are an essential segment. These institutions primarily focus on research and development activities aimed at improving biopsy technologies or devising new diagnostic methods. They may also conduct clinical trials to evaluate the efficacy of new biopsy devices. While the volume of biopsies performed may be lower compared to hospitals, their influence on product innovation and validation is significant.

Breakup by Region

- North America

- United States

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

The market research report has also provided a comprehensive analysis of all the major regional markets, which include North America (the United States and Canada); Asia Pacific (China, Japan, India, South Korea, Australia, Indonesia, and others); Europe (Germany, France, the United Kingdom, Italy, Spain, Russia, and others); Latin America (Brazil, Mexico, and others); and the Middle East and Africa. According to the report, North America accounted for the largest market share.

North America held the biggest market share since the region has a high prevalence of lifestyle-related diseases, including cancer, necessitating frequent utilization of biopsy procedures for diagnosis and monitoring. According to the American Cancer Society, in 2021, an estimated 1.9 million new cancer cases were diagnosed in the United States alone. In addition, North America boasts a highly developed healthcare infrastructure, including hospitals and clinics equipped with advanced diagnostic technologies, thereby facilitating the adoption of state-of-the-art biopsy devices.

Apart from this, the region has significant investments in healthcare research and development, often leading the way in medical innovation, including the development of new and more effective biopsy techniques and devices. Furthermore, there is a strong insurance framework supporting medical procedures, including biopsies, which makes these diagnostic tests more accessible to a broader population. Also, high levels of public awareness about the importance of early diagnosis and preventive healthcare catalyze the demand for diagnostic procedures such as biopsies. These combined factors position North America as the leading regional market for biopsy devices.

Competitive Landscape

The market is experiencing steady growth as key players are actively engaged in a range of strategic activities aimed at consolidating their market position. These actions include the development of technologically advanced devices, such as vacuum-assisted and image-guided biopsy systems, to increase accuracy and patient comfort. Companies are also focusing on mergers, acquisitions, and strategic collaborations to expand their product portfolios and geographic reach. Additionally, significant investment is being made in research and development (R&D) to innovate new products and improve existing ones. Regulatory approvals and patent filings are other critical areas of focus aimed at securing exclusivity for innovative devices. Through these combined efforts, key market players are shaping the trajectory of the biopsy devices industry.The market research report has provided a comprehensive analysis of the competitive landscape in the market. Detailed profiles of all major companies have also been provided. Some of the key players in the market include:

- Argon Medical Devices

- Becton Dickinson and Company

- Boston Scientific Corporation

- Cardinal Health Inc.

- CONMED Corporation

- Cook Group Incorporated

- Hologic Inc.

- INRAD Inc.

- Medtronic plc

Key Questions Answered in This Report

How has the global biopsy devices market performed so far, and how will it perform in the coming years?What are the drivers, restraints, and opportunities in the global biopsy devices market?

What is the impact of each driver, restraint, and opportunity on the global biopsy devices market?

What are the key regional markets?

Which countries represent the most attractive biopsy devices market?

What is the breakup of the market based on the procedure type?

Which is the most attractive procedure type in the biopsy devices market?

What is the breakup of the market based on the product?

Which is the most attractive product in the biopsy devices market?

What is the breakup of the market based on the application?

Which is the most attractive application in the biopsy devices market?

What is the breakup of the market based on the guidance technique?

Which is the most attractive guidance technique in the biopsy devices market?

What is the breakup of the market based on the end-user?

Which is the most attractive end-user in the biopsy devices market?

What is the competitive structure of the global biopsy devices market?

Who are the key players/companies in the global biopsy devices market?

Table of Contents

Companies Mentioned

- Argon Medical Devices

- Becton Dickinson and Company

- Boston Scientific Corporation

- Cardinal Health Inc.

- CONMED Corporation

- Cook Group Incorporated

- Hologic Inc.

- INRAD Inc.

- Medtronic plc

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 141 |

| Published | February 2025 |

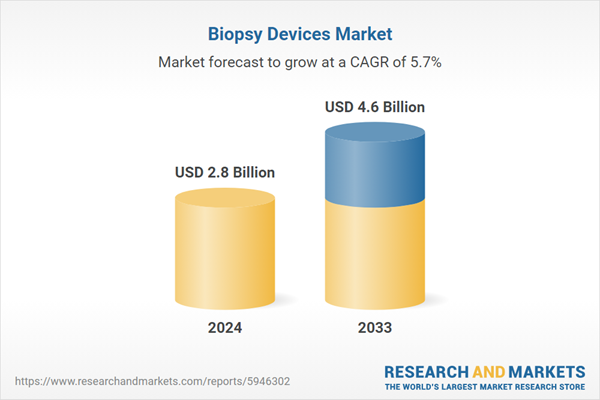

| Forecast Period | 2024 - 2033 |

| Estimated Market Value ( USD | $ 2.8 Billion |

| Forecasted Market Value ( USD | $ 4.6 Billion |

| Compound Annual Growth Rate | 5.7% |

| Regions Covered | Global |

| No. of Companies Mentioned | 9 |