Speak directly to the analyst to clarify any post sales queries you may have.

10% Free customizationThis report comes with 10% free customization, enabling you to add data that meets your specific business needs.

Key Market Drivers

High Prevalence of Diabetes

The increase in the geriatric population and the high prevalence of diabetes, along with the rising risk factors associated with diabetes, are key drivers for the growth of the self-monitoring of blood glucose (SMBG) market. Furthermore, government initiatives aimed at raising awareness among the population also contribute to the market's growth. However, it should be noted that the devices do not measure the exact level of glucose in the blood, which can result in inaccurate results. Moreover, the lack of reimbursement and stringent regulations for these devices may hinder the overall market growth. Nevertheless, there are untapped opportunities in emerging markets, and the growing awareness about diabetes monitoring devices is expected to generate new prospects within the forecast period. However, challenges such as the lack of patient awareness and the high cost of advanced devices and accessories are projected to impede the market's growth.Key Market Challenges

Compliance and Adherence

Regular and consistent blood glucose monitoring is essential for effective diabetes management. However, some individuals may struggle with adherence, either due to forgetfulness, discomfort associated with testing, or a lack of motivation. Properly using self-monitoring blood glucose devices requires some level of technical skill and knowledge. Some elderly individuals or those with limited dexterity may find it challenging to operate the devices correctly. Self-monitoring blood glucose devices need to be accurately calibrated and maintained to provide reliable results. Incorrect calibration or using expired test strips can lead to inaccurate readings.Key Market Trends

New Product Launches in the Market

Prominent companies operating in the self-monitoring blood glucose (SMBG) devices market are strategically focused on developing innovative technological solutions to enhance their market position. For instance, in August 2022, Intuity Medical, Inc., a commercial-stage medical technology and digital health company committed to simplifying life with diabetes, introduced the POGO Automatic® Blood Glucose Monitoring System at over 2,200 US pharmacies operated by Kroger Health, the healthcare division of The Kroger Co. The POGO Automatic from Intuity Medical is the sole FDA-approved automatic blood glucose monitor featuring 10-test cartridge technology, eliminating the need for individuals with diabetes to carry or load separate lancets and test strips. It effortlessly lances, collects blood, and provides a glucose result with just a touch of a button.Key Market Players

- Abbott Laboratories

- Medtronic plc

- F. Hoffmann-La Roche Ltd

- Ascensia Diabetes Care

- Dexcom, Inc.

- Sanofi

- Novo Nordisk

- Insulet Corporation

- Ypsomed Holdings

- Glysens Incorporated

Report Scope:

In this report, the Global Self-monitoring Blood Glucose Market has been segmented into the following categories, in addition to the industry trends which have also been detailed below:Self-monitoring Blood Glucose Market, By Product:

- Self-monitoring Blood Glucose Meters

- Continuous Glucose Monitors

- Testing Strips

- Lancets

Self-monitoring Blood Glucose Market, By Application:

- Type 1 Diabetes

- Type 2 Diabetes

- Gestational Diabetes

Self-monitoring Blood Glucose Market, By End User:

- Hospitals

- Home Settings,

- Diagnostic Centers

Self-monitoring Blood Glucose Market, By Region:

- North America

- United States

- Canada

- Mexico

- Europe

- France

- United Kingdom

- Italy

- Germany

- Spain

- Asia-Pacific

- China

- India

- Japan

- Australia

- South Korea

- South America

- Brazil

- Argentina

- Colombia

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

Competitive Landscape

Company Profiles: Detailed analysis of the major companies present in the Global Self-monitoring Blood Glucose Market.Available Customizations:

With the given market data, the publisher offers customizations according to a company's specific needs. The following customization options are available for the report.Company Information

- Detailed analysis and profiling of additional market players (up to five).

Table of Contents

Companies Mentioned

- Abbott Laboratories

- Medtronic plc

- F. Hoffmann-La Roche Ltd

- Ascensia Diabetes Care

- Dexcom, Inc.

- Sanofi

- Novo Nordisk

- Insulet Corporation

- Ypsomed Holdings

- Glysens Incorporated

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 188 |

| Published | August 2025 |

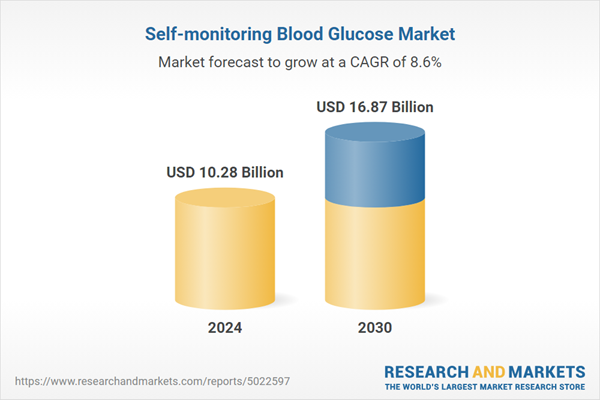

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 10.28 Billion |

| Forecasted Market Value ( USD | $ 16.87 Billion |

| Compound Annual Growth Rate | 8.6% |

| Regions Covered | Global |

| No. of Companies Mentioned | 10 |