Speak directly to the analyst to clarify any post sales queries you may have.

10% Free customizationThis report comes with 10% free customization, enabling you to add data that meets your specific business needs.

Key Market Drivers

The Increasing Demand for a Seamless and Convenient Shopping Experience

The surging demand for a seamless and convenient shopping experience is serving as a powerful catalyst for the rapid expansion of the global smart shopping cart market. In an era where consumers' lives are increasingly fast-paced and digitalized, traditional shopping methods often fall short of meeting expectations. Smart shopping carts, equipped with cutting-edge technologies such as Internet of Things (IoT) sensors, Radio-Frequency Identification (RFID) systems, and artificial intelligence, are stepping in to bridge this gap. These innovative carts revolutionize the shopping journey by offering a range of features designed to streamline and enhance every aspect of the process. Smart shopping carts eliminate the frustrations of wandering through aisles in search of products, as IoT sensors and RFID technology enable real-time inventory tracking and navigation assistance. Shoppers can effortlessly locate items on their shopping lists, saving valuable time and energy. Furthermore, these intelligent carts leverage data analytics to provide personalized recommendations, considering a customer's preferences, purchase history, and even real-time choices. This not only enhances the shopping experience but also exposes shoppers to new products and encourages upselling.In addition, the convenience of self-checkout is another pivotal factor driving the adoption of smart shopping carts. With integrated payment systems and touchless scanning capabilities, customers can efficiently complete their purchases, avoiding the hassle of long lines and minimizing physical contact. This feature aligns seamlessly with the post-pandemic shift towards contactless transactions, catering to health-conscious consumers. In an increasingly competitive retail landscape, businesses are constantly seeking innovative ways to attract and retain customers. Smart shopping carts offer a unique and engaging shopping experience that sets retailers apart from their competitors. The integration of these advanced technologies not only appeals to tech-savvy consumers but also projects an image of modernity and customer-centricity, fostering brand loyalty.

Moreover, smart shopping carts are at the forefront of this evolution, responding to the needs of modern consumers while simultaneously offering retailers invaluable data insights that can drive operational improvements and targeted marketing strategies. In this symbiotic relationship between consumer demand and technological innovation, the smart shopping cart market is poised for sustained growth, reshaping the retail landscape and redefining the very essence of convenience in shopping.

The Rising Adoption of Digital Transformation in The Retail Sector

The relentless rise in the adoption of digital transformation within the retail sector is propelling the global smart shopping cart market to new heights. In an era where technological innovation is reshaping traditional business models, smart shopping carts have emerged as a pivotal component of this digital revolution. Retailers are leveraging these intelligent carts, equipped with state-of-the-art technologies such as Internet of Things (IoT) sensors, Radio-Frequency Identification (RFID) systems, and data analytics, to usher in a new era of customer engagement and operational efficiency. Smart shopping carts enable retailers to gather real-time data on consumer behavior and shopping patterns, providing invaluable insights that can inform strategic decisions. From optimizing store layouts and product placements to tailoring marketing campaigns based on individual preferences, these data-driven insights empower retailers to enhance the overall shopping experience and maximize revenue potential. This data-centric approach also allows retailers to respond dynamically to shifting consumer trends and preferences, ensuring their offerings remain relevant in a fast-paced market.Moreover, the adoption of digital transformation is not solely driven by operational improvements. It's also a response to changing consumer expectations. Modern shoppers increasingly seek personalized experiences and seamless interactions across both physical and digital touchpoints. Smart shopping carts address these demands by offering features like personalized product recommendations, interactive store maps, and hassle-free self-checkout options. This harmonious integration of technology with the shopping journey enhances convenience and customer satisfaction, which in turn drives brand loyalty and customer retention. As retailers continue to invest in digital transformation strategies, the smart shopping cart market stands poised to benefit from this profound industry shift. The scalability and adaptability of these innovative carts make them an ideal vehicle for retailers to showcase their commitment to modernity and innovation. With each deployment of a smart shopping cart, the retail sector takes another step towards a future where technology seamlessly intertwines with the consumer experience, solidifying the smart shopping cart market's integral role in shaping the future of retail.

The Evolving Consumer Behavior and Preferences

The dynamic evolution of consumer behavior and preferences is a driving force behind the surging growth of the global smart shopping cart market. As modern shoppers increasingly prioritize convenience, personalization, and seamless interactions, smart shopping carts have emerged as a compelling solution to meet these demands. Equipped with cutting-edge technologies like Internet of Things (IoT) sensors and RFID systems, these carts offer real-time product tracking, personalized recommendations, and efficient self-checkout options. In an era where contactless experiences and tailored offerings are paramount, smart shopping carts resonate with consumers by providing a shopping journey that aligns with their expectations. Retailers are quick to recognize this shift and are embracing these innovative carts to engage customers in new ways, driving higher satisfaction, increasing sales, and fostering long-lasting brand loyalty. This symbiotic relationship between evolving consumer preferences and the capabilities of smart shopping carts is propelling the market's expansion and reshaping the retail landscape.The Increasing Potential for Increased Sales and Revenue Through Targeted Marketing and Upselling

The burgeoning potential for amplified sales and revenue through targeted marketing and upselling is a significant driving force behind the rapid growth of the global smart shopping cart market. These intelligent carts, embedded with advanced technologies such as IoT sensors and data analytics, empower retailers to gather valuable insights into customer preferences and behaviors. By leveraging this data, retailers can offer personalized product recommendations and promotions tailored to each shopper, enhancing the likelihood of additional purchases. Smart shopping carts serve as a direct avenue for strategic upselling, effectively maximizing revenue opportunities while simultaneously delivering a more tailored and engaging shopping experience. As businesses increasingly seek avenues for boosting profitability and customer engagement, the integration of smart shopping carts emerges as a potent solution with the potential to reshape retail dynamics worldwide.Key Market Challenges

Initial High Costs Associated with Implementing These Advanced Technologies

The progress of the global smart shopping cart market is hindered by the significant initial high costs associated with the implementation of advanced technologies. Integrating IoT sensors, RFID systems, and data analytics infrastructure into retail operations demands substantial financial investment. This challenge is particularly pronounced for smaller retailers with limited resources, potentially deterring their adoption of these innovative solutions. The upfront expenses for development, installation, and maintenance can delay or discourage widespread adoption, limiting the market's growth trajectory. Addressing this challenge requires innovative pricing models, cost-sharing strategies, and clear demonstrations of the long-term benefits that smart shopping carts offer, thereby making these transformative technologies more accessible to a diverse range of businesses.Interoperability and standardization

The global smart shopping cart market encounters a hurdle in the form of interoperability and standardization issues. As various manufacturers introduce smart shopping carts with differing technologies and communication protocols, achieving seamless integration and compatibility across diverse retail environments becomes complex. Retailers may face challenges in adopting these carts due to the need to ensure that they can effectively communicate with existing infrastructure, point-of-sale systems, and data management platforms. The lack of standardized interfaces can lead to fragmented adoption and limit the scalability of smart cart solutions. Overcoming this challenge necessitates industry-wide collaboration to establish common protocols and standards, enabling a smoother integration process and fostering a cohesive ecosystem where smart shopping carts can operate seamlessly across different retail settings.Key Market Trends

The Integration of Internet of Things (IoT) Technology and Sensors into Smart Shopping Carts

The integration of Internet of Things (IoT) technology and sensors into smart shopping carts is a pivotal driver propelling the global smart shopping cart market. By embedding IoT sensors and sensors, these innovative carts offer real-time tracking of products, personalized recommendations, and navigation assistance. This seamless interaction between technology and shopping experience not only enhances consumer convenience but also provides retailers with valuable data insights. The ability to analyze shopper behavior, optimize store layouts, and tailor marketing strategies based on real-time data fosters operational efficiency and customer engagement. As consumer expectations continue to evolve, the integration of IoT technology and sensors in smart shopping carts is redefining the retail landscape and fueling market growth.The Adoption of Contactless Shopping Solutions

The rapid adoption of contactless shopping solutions is a driving force behind the global smart shopping cart market. As consumers increasingly prioritize hygiene and convenience, smart shopping carts equipped with self-checkout features and digital payment options are gaining significant traction. These carts allow shoppers to complete their purchases without the need for physical contact, minimizing health risks and enhancing the overall shopping experience. The demand for contactless transactions, accentuated by the ongoing global pandemic, has accelerated the integration of such solutions, making smart shopping carts an attractive proposition for both retailers and consumers alike. This trend towards contactless shopping is reshaping the retail landscape and contributing to the growth of the smart shopping cart market on a global scale.Segmental Insights

Technology Insights

Based on technology, Radio-Frequency Identification (RFID) consistently dominates this segmentation across the entire forecast period. The remarkable prevalence of RFID technology within the smart shopping cart market can be attributed to its unparalleled capabilities in transforming the retail landscape. RFID-enabled smart shopping carts offer a diverse range of benefits that significantly enhance the shopping experience. They enable real-time and precise inventory tracking, empowering both shoppers and retailers to easily locate products, check their availability, and manage stock levels with efficiency. Moreover, the adaptability of RFID to seamlessly integrate with existing retail systems and processes solidifies its position as the leading technology. Its compatibility with various retail environments, combined with its potential to improve operational efficiency and mitigate losses from theft or mismanagement, makes it an indispensable tool for contemporary retailers.Application Insights

Based on application, shopping mall application emerges as the predominant segment, exercising steadfast dominance throughout the forecast period. Shopping malls bustling retail environment and diverse customer base provide an ideal setting for the deployment of smart shopping carts. The efficiency of these carts in real-time inventory tracking and seamless navigation complements the large variety of products found in shopping malls. Moreover, the convenience of contactless interactions aligns perfectly with shoppers' preferences for frictionless transactions in such high-traffic locations. The adaptability and scalability of smart shopping carts in shopping mall settings solidify their leading position in driving the market's growth and success in the dynamic retail landscape.Regional Insights

North America holds a prominent position in the global Smart Shopping Cart market due to its advanced technological infrastructure, high internet penetration, and robust retail sector with tech-savvy consumers. The region's emphasis on convenience, personalization, and seamless shopping experiences aligns perfectly with the value proposition of smart shopping carts. The presence of leading technology companies and startups in North America drives continuous innovation, contributing to the development and deployment of cutting-edge smart shopping cart technologies. Retailers in the region quickly adopt these solutions to enhance customer engagement, optimize operations, and gain a competitive edge, making North America a significant player in the global smart shopping cart market.Key Market Players

- Veeve Inc.

- IMAGR Limited

- Caper Inc.

- Tracxpoint, Inc.

- Amazon.com, Inc.

- Cust2mate Ltd.

- V-Mark Enterprise Limited

- SK Telecom Co., Ltd.

- Retail AI, Inc.

- Smart Cart (Pty) Ltd

Report Scope:

In this report, the Global Smart Shopping Cart Market has been segmented into the following categories, in addition to the industry trends, which have also been detailed below:Global Smart Shopping Cart Market, By Technology:

- Barcodes

- Radio-Frequency Identification (RFID)

- Zigbee

Global Smart Shopping Cart Market, By Application:

- Supermarket

- Shopping Malls

- Others

Global Smart Shopping Cart Market, By Mode of Sales:

- Direct

- Distributor

Global Smart Shopping Cart Market, By Region:

- North America

- Europe

- South America

- Middle East & Africa

- Asia Pacific

Competitive Landscape

Company Profiles: Detailed analysis of the major companies present in the Global Smart Shopping Cart Market.Available Customizations:

Global Smart Shopping Cart market report with the given market data, the publisher offers customizations according to a company's specific needs.This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned

- Veeve Inc.

- IMAGR Limited

- Caper Inc.

- Tracxpoint, Inc.

- Amazon.com, Inc.

- Cust2mate Ltd.

- V-Mark Enterprise Limited

- SK Telecom Co., Ltd.

- Retail AI, Inc.

- Smart Cart (Pty) Ltd

Table Information

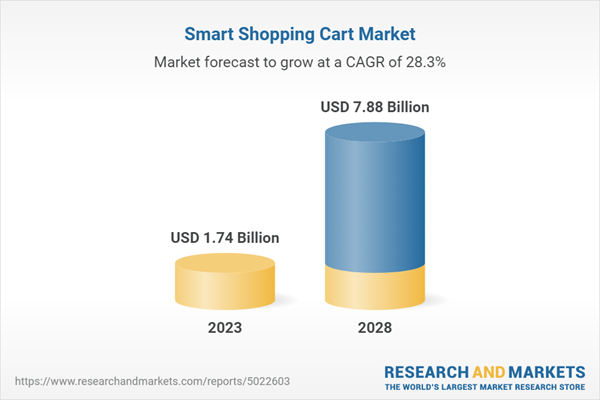

| Report Attribute | Details |

|---|---|

| No. of Pages | 190 |

| Published | September 2023 |

| Forecast Period | 2023 - 2028 |

| Estimated Market Value ( USD | $ 1.74 Billion |

| Forecasted Market Value ( USD | $ 7.88 Billion |

| Compound Annual Growth Rate | 28.3% |

| Regions Covered | Global |

| No. of Companies Mentioned | 10 |