Speak directly to the analyst to clarify any post sales queries you may have.

10% Free customizationThis report comes with 10% free customization, enabling you to add data that meets your specific business needs.

These technologies require higher operating speeds to achieve better surface finishes, driving the need for products that can meet these performance requirements. This trend is expected to continue in the coming years, fueling the growth of the Super Abrasives market. The outstanding properties offered by Super Abrasives, including extraordinary hardness, unparalleled performance, and extended lifespan, enable the attainment of high-quality surface finishes on hard materials. Moreover, their longevity results in longer product life and reduced machine downtime, compensating for their higher initial costs. For instance, the utilization of metal-bonded design wheels, which exhibit superior wear resistance, can lead to shorter cycle times and longer wheel life, ultimately reducing machining costs for customers.

Diamond and cubic boron nitride (CBN) Super Abrasive products are extensively used in the aerospace industry and other industrial applications where price considerations are less significant. These industries prioritize precision in machining operations and are willing to invest in Super Abrasives despite their higher initial costs. Materials such as nickel, cast iron, and cobalt-based superalloys often require the use of these advanced abrasives to achieve the desired machining outcomes.

Key Market Drivers

Growing Demand of Super Abrasives in Automotive Industry

Super abrasives, advanced materials specifically designed for precision grinding, cutting, and polishing of hard materials, have gained immense popularity in various industries. With their remarkable hardness, thermal conductivity, and exceptional wear resistance, they offer superior performance compared to conventional abrasives.In the automotive industry, the applications of super abrasives are vast and significant. They are extensively utilized in grinding engine components, cutting, and shaping gears, and polishing auto bodies. These materials excel in delivering high precision and accuracy, making them ideal for the manufacturing processes of complex automotive components. As automotive technology continues to evolve, the demand for precise machining and finishing grows, and super abrasives perfectly address these requirements.

The global shift towards electric vehicles (EVs) has further fueled the demand for super abrasives. EVs require specialized components like permanent magnet motors and lithium-ion batteries, which demand precise machining and finishing. Super abrasives, with their exceptional hardness and precision, play a vital role in meeting these specific needs. The global transition to electric vehicles (EVs) is gaining significant momentum, with EV sales surpassing 17 million units in 2024, accounting for over 20% of total global automotive sales. This milestone reflects a structural shift in consumer demand, supported by stringent emissions regulations, advancements in battery technology, and expanded charging infrastructure across key markets such as China, Europe, and North America.

The automotive industry also places great emphasis on the aesthetic appeal of vehicles. With the rising trend of high-quality finishes for both interiors and exteriors, the demand for super abrasives has multiplied. These materials enhance the overall aesthetic appeal and value of vehicles, contributing to a premium and refined look.

Super abrasives have become indispensable in the automotive industry, enabling precise manufacturing processes, meeting the demands of electric vehicles, and enhancing the aesthetic appeal of vehicles with high-quality finishes.

Key Market Challenges

High Capital Intensity and Limited Accessibility for Small-Scale Manufacturers

The production of super abrasives particularly CVD diamonds and high-purity CBN requires advanced manufacturing infrastructure, including vacuum reactors, high-pressure/high-temperature synthesis equipment, and precise bond formulation systems.These facilities involve significant upfront investment, skilled technical labor, and long R&D cycles, making entry into the market cost-prohibitive for small and mid-sized tool manufacturers. Additionally, tight process tolerances and regulatory compliance in sectors like medical devices and aerospace limit outsourcing options, thereby concentrating production among a few vertically integrated players. This restricts market democratization and creates a technological entry barrier, slowing down regional diversification and the ability of niche players to scale or innovate at pace with demand.

Key Market Trends

Integration of Super Abrasives into Hybrid Machining Systems

A major trend redefining the market is the integration of super abrasives into hybrid machining platforms where traditional grinding is combined with advanced manufacturing techniques such as additive manufacturing (AM), ultrasonic machining, and laser-assisted grinding.These systems are increasingly used to machine ultra-hard composites and multi-material components, particularly in aerospace, defense, and high-performance electronics. Super abrasives especially CVD diamond and vitrified CBN wheels are being engineered to perform in environments with variable force inputs, high thermal gradients, and complex geometries. This trend not only expands the functional scope of super abrasives but also encourages co-development of application-specific tools between OEMs and abrasive manufacturers, shifting the market from commodity products to customized, system-integrated solutions.

Key Market Players

- Element Six (UK) Limited

- Henan Huanghe Whirlwind Co., Ltd.

- ILJIN DIAMOND CO., LTD

- Saint-Gobain S.A.

- SHOWA DENKO K.K.

- Zhengzhou ZZDM SUPERABRASIVES CO., LTD.

- Asahi Diamond Industrial Co., Ltd.

- 3M Company

- NORITAKE CO., LIMITED

- Hyperion Materials & Technologies, Inc.

Report Scope:

In this report, the Global Super Abrasives Market has been segmented into the following categories, in addition to the industry trends which have also been detailed below:Super Abrasives Market, By Product:

- Cubic Boron Nitride

- Polycrystalline

- CVD Diamonds

- Nano Diamonds

Super Abrasives Market, By Application:

- Aerospace

- Medical

- Automotive

- Construction

- Electrical & Electronics

- Oil & Gas

- Others

Super Abrasives Market, By Region:

- North America

- United States

- Canada

- Mexico

- Europe

- France

- United Kingdom

- Italy

- Germany

- Spain

- Asia-Pacific

- China

- India

- Japan

- Australia

- South Korea

- South America

- Brazil

- Argentina

- Colombia

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

Competitive Landscape

Company Profiles: Detailed analysis of the major companies present in the Global Super Abrasives Market.Available Customizations:

With the given market data, the publisher offers customizations according to a company's specific needs. The following customization options are available for the report.Company Information

- Detailed analysis and profiling of additional market players (up to five).

Table of Contents

Companies Mentioned

- Element Six (UK) Limited

- Henan Huanghe Whirlwind Co., Ltd.

- ILJIN DIAMOND CO., LTD

- Saint-Gobain S.A.

- SHOWA DENKO K.K.

- Zhengzhou ZZDM SUPERABRASIVES CO., LTD.

- Asahi Diamond Industrial Co., Ltd.

- 3M Company

- NORITAKE CO., LIMITED

- Hyperion Materials & Technologies, Inc.

Table Information

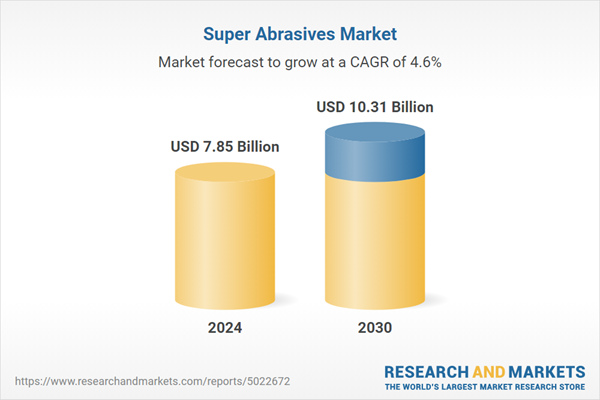

| Report Attribute | Details |

|---|---|

| No. of Pages | 188 |

| Published | August 2025 |

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 7.85 Billion |

| Forecasted Market Value ( USD | $ 10.31 Billion |

| Compound Annual Growth Rate | 4.6% |

| Regions Covered | Global |

| No. of Companies Mentioned | 10 |