The COVID-19 pandemic has had a substantial impact on the diabetes care devices market. The prevalence of diabetes in people hospitalized with COVID-19 infection and the recognition that improved glycemic control might improve outcomes and reduce the length of stay in patients with SARS-CoV-2 have underlined the importance of diabetes care devices. A retrospective analysis was presented at the virtual 81st Scientific Sessions of the American Diabetes Association® (ADA) which showed diabetes was the main risk factor for the accelerated advancement to a severe state in Japanese COVID-19 patients.

Throughout the pandemic, diabetes has persisted as a significant risk factor for COVID-19. In hospitalized patients with diabetes and COVID-19, one in 10 people died within seven days of admission.

The pandemic also highlighted opportunities for continuing and expanding innovations in the delivery of diabetes care, through virtual consultations between healthcare providers and people with diabetes, and the use of diabetes technology. Crisis management has created unprecedented interest in remote care from both patients and providers and removed many long-standing regulatory barriers. Thus, the COVID-19 outbreak increased the Japanese diabetes care device market's growth.

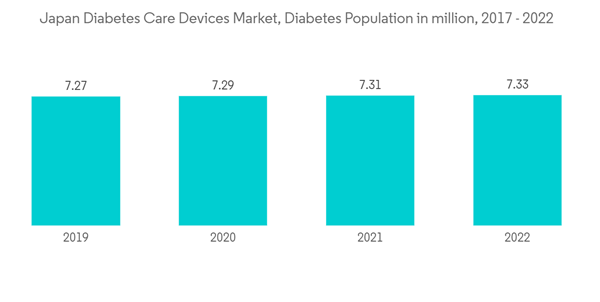

Diabetes has emerged as a global epidemic, Japan has around 11 million people with diabetes according to IDF 2021 data. While Type 1 diabetes is caused by an immune system malfunction, Type 2 diabetes is linked to leading a sedentary lifestyle, which results in the development of inherent resistance to insulin. Hence, Type 1 diabetes can be characterized as insulin-requiring, while Type 2 diabetes can be characterized as insulin-dependent diabetes. Japan has one of the largest elderly populations in the world which is more susceptible to the onset of type 2 diabetes. As Japan's population continues to age, the prevalence of diabetes increases as well. The monitoring and management of blood glucose levels are on the rise, to avoid negative consequences, such as cardiovascular diseases, kidney disorders, and many other conditions.

Japan Diabetes Care Devices Market Trends

The continuous glucose monitoring segment is expected to witness the highest growth rate over the forecast period

The continuous glucose monitoring segment is expected to register a CAGR of more than 11% over the forecast period.To use a CGM, a small sensor is inserted into the abdomen or arm with a tiny plastic cannula penetrating the top skin layer. An adhesive patch holds the sensor in place, allowing it to take glucose readings in interstitial fluid throughout the day and night. Generally, the sensors must be replaced every 7 to 14 days. A small, reusable transmitter connected to the sensor allows the system to send real-time readings wirelessly to a monitor device that displays blood glucose data. Some systems contain a dedicated monitor, and some display the information via a smartphone app.

Continuous glucose monitoring sensors use glucose oxidase to detect blood sugar levels. Glucose oxidase converts glucose to hydrogen peroxidase, which reacts with the platinum inside the sensor, producing an electrical signal to be communicated to the transmitter. Sensors are the most important part of continuous glucose monitoring devices. Researchers are trying to find and develop alternatives to electrochemical-based glucose sensors and create more affordable, minimally invasive, and user-friendly CGM sensors. Optical measurement is a promising platform for glucose sensing. Some technologies with high potential in continuous glucose sensing are reported, including spectroscopy, fluorescence, holographic technology, etc. Eversense, a CGM sensor based on fluorescence sensing developed by Senseonics Company, presents a much longer lifespan than electrochemical sensors. Technological advancements to improve the sensor's accuracy are expected to drive segment growth during the forecast period.

The frequency of monitoring glucose levels depends on the diabetes type, which varies from patient to patient. Type-1 diabetic patients need to check their blood glucose levels regularly to monitor their blood glucose levels and adjust the insulin dosing accordingly. The current CGM devices show a detailed representation of blood glucose patterns and tendencies compared to a routine check of glucose levels at set intervals. Furthermore, the current continuous glucose monitoring devices can either retrospectively display the trends in blood glucose levels by downloading the data or give a real-time picture of glucose levels through receiver displays. Continuous glucose monitoring devices are becoming cheaper with new technologies, like cell phone integration. It is likely to drive the segment growth during the forecast period.

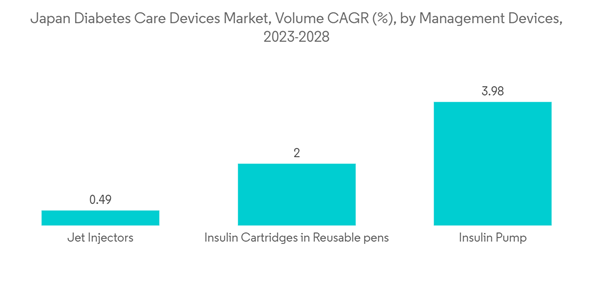

Insulin cartridges in reusable pens occupied the highest share in the management devices segment in the current year

Insulin cartridges in reusable pens occupied the highest market share of about 68% in the management devices segment in the current year.Insulin cartridges in reusable pens are an upgraded version of insulin vials. Most types of insulins are manufactured in the form of cartridges, making them easily accessible. These devices include all the functional benefits of reusable pens and are cost-effective, as these cartridges are less expensive compared to disposable insulin pens in the long run.

Due to the increasing demand for insulin cartridges, most insulin device manufacturers produced reusable insulin pens compatible with various insulin manufacturers' cartridges. These insulin cartridges are considered more consumer-friendly, as they are smaller and less noticeable than the classic vial-and-syringe. These devices are also more portable for consumers. Open cartridges do not need to be refrigerated, making storage easy for consumers. Thus, cartridges are the most cost-effective insulin use, as reusable pens are a one-time investment, unlike disposable pens.

Diabetes is identified as a healthcare priority by the Ministry of Health, Labour, and Welfare. The high prevalence of type 2 diabetes is associated with a significant economic burden. The costs of diabetes are increased in patients with co-morbidities such as hypertension and hyperlipidemia and in patients who develop complications. Costs increase with an increasing number of complications. Well-organized medical insurance systems cover all medical fees for diabetes mellitus, and people with diabetes can visit doctors freely in Japan. Also, insulin therapy by self-injection became legal and is covered by health insurance. Such advantages helped the adoption of these products in the Japanese market.

Japan Diabetes Care Devices Industry Overview

The Japanese diabetes care devices market is semi-consolidated, with major manufacturers like Roche, Abbott, Novo Nordisk, Dexcom, Medtronic, etc., and other region-specific manufacturers.Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

This product will be delivered within 2 business days.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Abbott Diabetes Care

- Roche Diabetes Care

- LifeScan (Johnson & Johnson)

- Sanofi

- Medtronic

- Novo Nordisk A/S

- Terumo

- Eli Lilly

- Arkray

- Becton Dickinson