Speak directly to the analyst to clarify any post sales queries you may have.

10% Free customizationThis report comes with 10% free customization, enabling you to add data that meets your specific business needs.

Key Market Drivers

Growing Demand of Printing Ink Catalyst in Packaging Industry

The packaging industry has become a central growth driver for the printing ink catalyst market due to increasing global demand for aesthetically appealing and durable printed packaging. With the packaging sector valued at approximately USD 896 billion in 2022 and expected to surpass USD 1.15 trillion by 2030, the need for high-performance printing solutions is rising.Printing ink catalysts play a crucial role in this space by improving drying times, adhesion, and print quality on various packaging substrates. The surge in e-commerce has amplified the importance of visually appealing and robust packaging, intensifying the demand for advanced printing technologies. Catalysts ensure that inks used in packaging applications deliver vibrant colors and long-lasting results, even under challenging storage or shipping conditions. Furthermore, the movement toward sustainable packaging solutions - valued at over USD 270 billion in 2024 - is further fueling catalyst adoption, as they help enhance the effectiveness of environmentally friendly inks used on biodegradable and recyclable materials.

Key Market Challenges

Growing Focus on Health and Safety Concerns

While printing ink catalysts are essential for optimizing ink performance, their chemical composition presents notable health and environmental risks. Prolonged exposure to certain catalysts may cause respiratory issues, skin irritation, or toxicity, particularly among printing industry workers. Additionally, improper disposal of spent catalysts can result in environmental hazards such as soil and water contamination.As a result, regulatory agencies have introduced stricter guidelines governing the use, handling, and disposal of these substances. Compliance with such regulations requires significant investments in safer manufacturing practices and advanced waste treatment infrastructure. These obligations can be especially burdensome for small- and medium-sized enterprises with limited financial resources. Consequently, health and environmental safety concerns are emerging as critical challenges that influence both product innovation and operational compliance in the printing ink catalyst market.

Key Market Trends

Enhancement in Durability and Adhesion

A key trend shaping the printing ink catalyst market is the emphasis on developing catalysts that improve durability and adhesion across diverse substrates. The evolution of 3D-printed porous zeolite catalysts, which offer high mechanical strength and superior heat and mass transfer properties, exemplifies this shift. In sectors like packaging and textiles, where products are frequently subjected to handling, moisture, and abrasion, enhanced ink adhesion and long-lasting print quality are essential.Printing ink catalysts are now being engineered to support advanced formulations that deliver vibrant color retention, resistance to smudging, and strong adhesion to challenging surfaces such as plastics, metals, and fabrics. These improvements are crucial for sectors such as e-commerce, where printed packaging must endure transport and storage without degradation. As manufacturers seek to meet these durability demands, the printing ink catalyst market is moving toward more specialized and high-performance solutions.

Key Market Players

- The Dow Chemical Company

- Polyone Technology Co., Ltd.

- Dorf Ketal Chemicals India Private Limited

- BASF SE

- W.R. Grace & Co.

- Clariant AG

- Flint Group

- Siegwerk Druckfarben AG & Co. KGaA

- Mcfogan

- XG Silicone

Report Scope:

In this report, the Global Printing Ink Catalyst Market has been segmented into the following categories, in addition to the industry trends which have also been detailed below:Printing Ink Catalyst Market, By Type:

- Solvent-Based

- Water-Based

Printing Ink Catalyst Market, By End User:

- Polyester Fibres

- Nylon Fibres

- Acrylic Fibres

- Polyurethane Film

- Polypropylene Film

- Others

Printing Ink Catalyst Market, By Region:

- North America

- United States

- Canada

- Mexico

- Europe

- France

- United Kingdom

- Italy

- Germany

- Spain

- Asia Pacific

- China

- India

- Japan

- Australia

- South Korea

- South America

- Brazil

- Argentina

- Colombia

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

Competitive Landscape

Company Profiles: Detailed analysis of the major companies present in the Global Printing Ink Catalyst Market.Available Customizations:

With the given market data, the publisher offers customizations according to a company's specific needs. The following customization options are available for the report.Company Information

- Detailed analysis and profiling of additional market players (up to five).

This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned

- The Dow Chemical Company

- Polyone Technology Co., Ltd.

- Dorf Ketal Chemicals India Private Limited

- BASF SE

- W.R. Grace & Co.

- Clariant AG

- Flint Group

- Siegwerk Druckfarben AG & Co. KGaA

- Mcfogan

- XG Silicone

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 185 |

| Published | June 2025 |

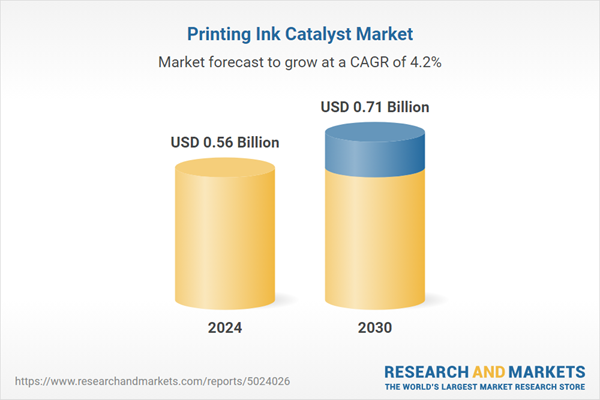

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 0.56 Billion |

| Forecasted Market Value ( USD | $ 0.71 Billion |

| Compound Annual Growth Rate | 4.1% |

| Regions Covered | Global |

| No. of Companies Mentioned | 10 |