Key Highlights

- Over the medium term, the factors such as increasing investment in the sector and increasing production of oil and gas are expected to boost the demand for the Egypt oil and gas midstream market during the forecast period.

- However, increasing demand for renewable sources is likely to hinder the market growth as energy demand will be fulfilled by the cleaner sources of energy.

- Nevertheless. exploration and production of gas fields in the East Mediterranean are expected to become an opportunity for the companies working in the oil and gas midstream industry as more pipeline and storage infrastructure is expected to be required in the near future.

Egypt Oil And Gas Midstream Market Trends

Transportation Sector to Witness Growth

- According to the U.S. Energy Information Administration (EIA), in Egypt, the Suez Canal and the Suez-Mediterranean (SUMED) pipeline are the major strategic routes and transit chokepoints for crude oil and LNG shipments, and it gives Egypt a significant role in global crude oil and natural gas trade. If both the Suez Canal and the SUMED Pipeline close, tankers would have to divert around the southern tip of Africa, adding approximately 8–15 days of transit to the United States or Europe and leading to increased shipping costs.

- Moreover, the country has a significant natural gas infrastructure like pipelines. In addition, natural gas transporting pipelines, such as the Arab Gas pipeline that exports Egyptian natural gas to Jordan, Syria, and Lebanon, have a total length of 1,200 kilometres built for USD 1.2 billion. All these midstream oil & gas infrastructures support the country's growing energy demand and increase exporting potential to other countries.

- Further, like the country's significant natural gas production potential, it also has a considerable domestic gas demand, particularly from the power generation and industrial sectors. In addition, according to the Gas Exporting Countries Forum (GECF), Egypt is also a decent exporter of natural gas, exporting more than 10 billion standard cubic meters of gas equivalent in 2021. Therefore, the increasing demand for oil and gas is expected to boost the midstream oil & gas segment during the forecast period.

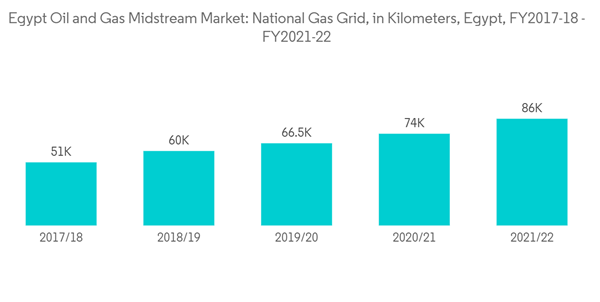

- National Gas Grid has been expanding through the completion of new gas pipelines, as well as other pipelines under implementation, to support the maximum number of individuals and industrial activities using natural gas. In 2022, the natural gas grid length was extended to reach 86,000 km.

- Egypt is also expected to witness considerable growth in the midstream oil & gas market in coming years owing to the government’s plans to expand its oil & gas transportation sector. For instance, in May 2022, the Minister of Petroleum and Mineral Resources announced the construction of a natural gas pipeline from Egypt to Cyprus, with a capacity of around 4.5 trillion cubic meters. The project is likely to get completed by 2024-2025. Further, Egypt and Israel planned to construct a new onshore pipeline with investments of USD 200 million to transport 3 to 5 billion cubic feet per year of natural gas from Israel to Egypt, then shipped to Europe. The gas is expected to be liquefied in Egypt to transport to Europe.

- Egypt’s transformation from a gas importer to an exporter occurred in late 2019 following the discovery of numerous wells that radically altered the country’s gas supply. Further, the government has set an ambitious target to raise its petroleum exports by 15% in 2023. In addition, according to the Egyptian petroleum ministry, the country aims to increase its LNG exports by around 40% starting in 2025, most of which will be earmarked for the European market in the long term.

- Therefore, the country’s plans to meet the rising domestic demand and boost its petroleum & natural gas exports will likely see significant developments in the Egyptian midstream oil and gas market over the forecast period.

Increasing Natural Gas Exploration and Production Activities to Drive The Market

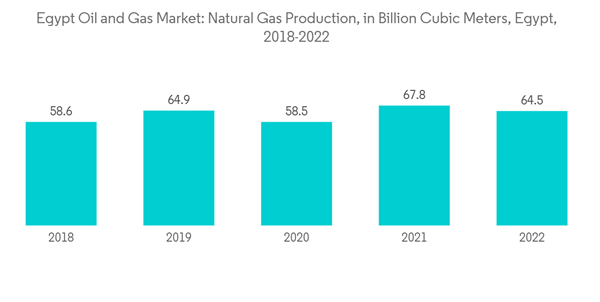

- Egypt is the third-largest producer of natural gas in Africa. The country produced around 64.5 billion cubic meters (bcm) of natural gas in 2022. The increased production of natural gas was attributed to the increase in demand at the national and international levels. It was recorded in the 2022 that the LNG exports from the country were around 8.9 billion cubic metres, the highest among all the Arab countries.

- According to the United States Energy Information Administration, Egypt has 2.186 trillion cubic meters (tcm) of proven natural gas reserves, placing it 16th in the world. These reserves are equivalent to around 1.6 billion tons of LNG.

- The Egyptian government has fast tracked the development of the Zohr and Atoll fields and the West Nile Delta (WND) project. These fields are expected to make substantial additions to the overall supply. Discovered in August 2015 the Zohr gas field has an estimated reserve of 30 (Tcf)( 0.85 (Tcm)) and is producing 2 (Bcf/d)(0.0566(Bcm/d))

- In line with Egypt Vision 2030, the Ministry of Petroleum and Mineral Resources structured its actions in the ‘Oil and Gas Sector Modernization Programme’ to transform the energy sector and increase its contribution to the ambitions of economic progress. The program revealed plans to transform the country into LNG export hub.

- For instance, in January 2022, Eni, the Italy-based oil and gas company, bagged an exploration contract in five blocks in Egypt. The blocks are located in the Eastern Mediterranean Sea, Western Desert, and Gulf of Suez. The company will be partially investing in the projects with other companies.

- Moreover, Egypt’s exports of natural gas amounted to USD 8.40 billion in 2022, a surge of 171% when compared to USD 3.50 billion in the previous year - 2021. The leap in Egypt’s revenues from natural gas sales was attributed to higher liquefied natural gas exporting prices globally.

- Therefore, owing to above points, the growing LNG exports, increasing natural gas exploration and production activities across the country is expected to in turn favors the growth of the market in near future.

Egypt Oil And Gas Midstream Industry Overview

The Egypt oil and gas midstream market is semi-consolidated. Some of the major companies (in no particular order) include Egyptian Natural Gas Holding Company, Eni S.p.A, Shell PLC, Egyptian General Petroleum Corporation, and BP p.l.c., among others.BP p.l.c is actively involved in the production of natural gas supply in Egypt. Through its Joint venture with Egyptian natural Gas holding company (EGAS), Egyptian General Petroleum Products (EGPC), International Egyptian Oil Company (IEOC) – ENI, the Pharaonic Petroleum Company (PhPC) and through collaboration with Belayim Petroleum Company (Petrobel), BP Egypt now produces more than 60% of Egypt’s total gas supply

The company will accelerate growth in hydrocarbon exploration and development activities through its advanced technology and investments in R&D sector. As per the company’s annual report 2022, the company invested around USD 274 million in research and development activities in 2022.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

This product will be delivered within 2 business days.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Egyptian Natural Gas Holding Company

- Eni S.p.A

- Royal Dutch Shell PLC

- Egyptian General Petroleum Corporation

- BP PLC