The market is negatively impacted by COVID-19 in 2020. Presently the market has now reached pre-pandemic levels.

Key Highlights

- Over the medium term, factors, such as growing impetus for renewable energy generation in Africa (like concentrated solar power, increasing demand for thermal energy storage systems in heating, ventilation, and air conditioning (HVAC) application), government incentives for thermal energy storage systems, and advancements in material sciences, are some of the major factors driving the demand for the market studied in the region.

- On the other hand, the declining battery costs leading to an increase in installations of battery storage and high costs of developing and installing thermal energy storage systems associated with thermal energy storage are expected to hinder the growth of the market in Africa.

- Nevertheless, Algeria’s energy requirements are heavily dependent on natural gas, which amounts to about 93% of power generation in the country. However, the country has enormous solar energy potential and is planning to release several tenders for renewable capacity creating ample opportunity for the market players.

- South Africa is expected to be the largest market for thermal energy storage in the Africa region, due to large deployments of CSP with thermal energy storage, along with increasing demand for backup power for commercial and industrial applications.

Africa Thermal Energy Storage Market Trends

Power Generation Sector to Dominate the Market

- Excess energy generation available during low demand time can be used to charge a thermal energy storage system to increase effective generation capacity during high-demand periods. This results in a higher load factor for the plants, helping them to generate energy stably.

- In many African countries, energy storage technology aids the grid operators in managing variable energy generation from renewable, like solar and wind energy. Utilities use energy storage technologies in various applications, such as time shifts and supply capacity, to meet the demand-supply gap efficiently, hence, driving the thermal energy storage market.

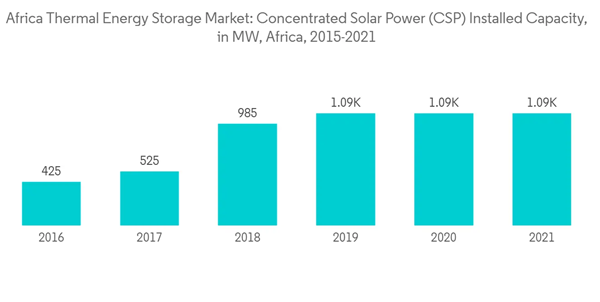

- Concentrated Solar Power (CSP) plants dominate African energy storage deployment, which is the cheapest way to store solar energy over long hours. In 2021, CSP installation in Africa totalled 1,085 MW, an increase of over 230% from 2015. Therefore, it is a stabilizing factor for the energy-supply system and is expected to drive the market during the forecast period.

- In February 2022, Botswana's Ministry of Mineral Resources, Green Technology, and Energy Security (MMGE) invited bids from national and international independent power producers (IPPs) to design, construct, own, operate, and maintain a 200 MW concentrated solar power (CSP) project (2*100 MW) in the country. A total of two 100 MW units will be constructed in the villages of Letlhakane and Maun in Botswana. The project is expected to be operational by 2026/2027, based on a Power Purchase Agreement (PPA) with the Botswana Power Corporation for 30 years.

- Therefore, Africa holds great potential for growth in the future, as the region has many concentrating solar power (CSP) projects, which include thermal energy storage, installed in countries, like South Africa and Morocco, in turn, increases the demand for thermal energy storage system during the forecast period.

South Africa to Dominate the Market

- South Africa's grid is challenged by increasing demand due to a growing economy. Therefore, the country is shifting toward CSP with energy storage. Moreover, the integration of renewable generation is likely to drive the African thermal energy storage market.

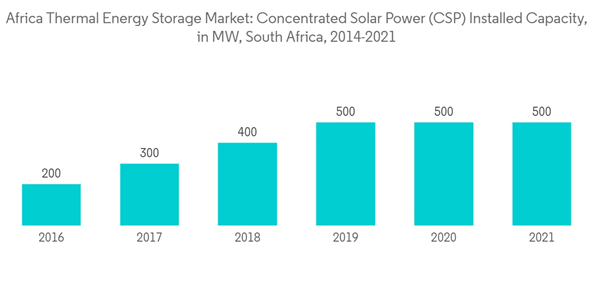

- Under South Africa's Renewable Energy Independent Power Producer Procurement Program, the government included bidding rounds for CSP plants with energy storage. These initiatives are, therefore, expected to supplement the increasing demand for thermal energy storage technologies during the forecast period. In 2021, CSP installation in South Africa totaled 500 MW, an increase of over 400% from 2015.

- In February 2022, A South African concentrated solar power (CSP) project named Redstone completed its first debt drawdown on the largest renewable energy investment in South Africa. The African Development Bank served as the mandated lead arranger (MLA) for the total investment amounting to USD 0.67 billion and coordinated the project with a commitment of USD 0.13 billion. The commercial operation is scheduled to begin in the fourth quarter of 2023

- In November 2021, Wee Bee Ltd., a South African farming company, placed an order with Azelio for eight units providing 1.3 MWh of clean electricity supply for its long-duration energy storage, TES.POD. As a thermal energy storage system, the TES.POD uses recycled aluminum storage media. Although the system has a lifespan of 30 years, recycled aluminum storage media can be reused many times without degradation of capacity over time, resulting in a truly sustainable and reliable solution.

- As several thermal energy storage technologies exist, South Africa plans to incorporate it to add grid flexibility at a low cost and meet the increasing electricity demand, in turn promulgating the thermal energy storage market in the region.

Africa Thermal Energy Storage Market Competitor Analysis

The African thermal energy storage market is moderately consolidated. Some of the major companies (in no particular order) include Eskom Holdings SOC Ltd, Abengoa SA, ACWA Power International, SENER Group, and Engie SA, among others.Additional benefits of purchasing the report:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

This product will be delivered within 2 business days.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Abengoa SA

- ACWA Power International

- Azelio AB

- BrightSource Energy Inc.

- Engie SA

- Eskom Holdings SOC Ltd

- SENER Group

- SolarReserve LLC

- Calmac