Key Highlights

- Onshore wind is the Philippines ' largest wind power generator, which makes them dominant in the wind energy market in the Philippines.

- The integration of artificial intelligence (AI), Internet of Things(IoT), robotics, and data analytics in wind turbines will enable advanced condition monitoring and predictive maintenance, resulting in increased efficiency and reduced operational and maintenance costs, which is likely to provide the opportunity for growth in the deployment of wind turbines in coming future.

- The Philippines has an extensive wind potential among Southeast Asian countries, which is expected to drive the market's growth during the forecast period.

Key Market Trends

Onshore Wind Energy Segment is Expected to Dominate the Market

- As energy demand is rising, wind turbines are helping the Philippines diversify its energy sources beyond fossil fuels and generating power.

- According to the National Renewable Energy Plan, the Philippines has set the goal of adopting an additional 1,548MW of renewable energy by 2030. A breakdown of this reveals that wind power is expected to account for the greatest share of this at 38% (593MW).

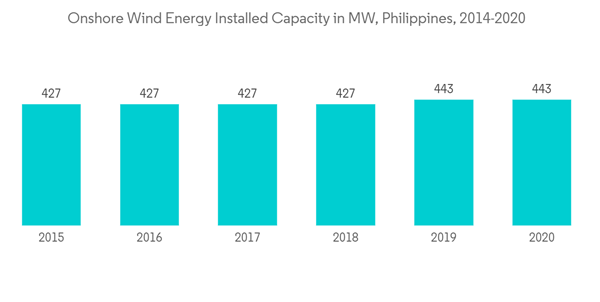

- The Philippines has significant wind energy resources spread across various islands. As of 2020, the Philippines has installed an onshore wind capacity of 443 MW.

- In May 2021, AC Energy started constructing 160 MW Balaoi and Caunayan onshore wind farms in partnership with UPC Renewables in the Ilocos Norte, Philippines. The project has an investment cost of USD 238.48 million, and the project is expected to get operated by 2023.

- Similarly, in July 2021, Wpd AG started constructing a 75.6 MW Aklan onshore wind project on the Island of Panay. The project is featured with 18 units of Vestas V136 4.2-MW wind turbines and is expected to get commissioned by the end of 2023.

- Moreover, as of 2020, Bangui Bay Wind Power Project (51MW), Burgos Wind Power Project (150MW), Caparispisan Wind Power Project (81MW), San Lorenzo Wind Power Project (54MW), Pililla Wind Power Project (54MW), and Nabas Wind Power Project (36MW) are the few wind power farms operating commercially. These wind projects are expected to drive the onshore wind energy market during the forecast period.

Wind Potential is Expected to Drive the Market

- The greatest wind resources of the Philippines are in northern and central areas, such as Batanes and Babuyan, and the northern and central Luzon areas. Because of the high potential of wind energy in the country, wind energy developers are interested in commercializing wind energy in the Philippines.

- The Philippines has 11,055 km2 of windy land estimated to have good-to-excellent wind resource potential. Wind speeds at these sites range from 6.4 meters per second (m/s) to 10.1 m/s, with wind-power-density values of 300-1,250 Watts per square meter (W/m2 ).

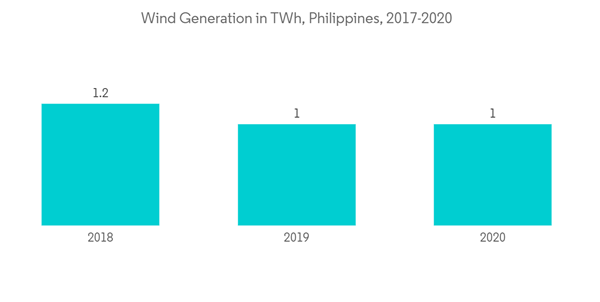

- Using conservative assumptions of about 7 MW/km2, these areas will support more than 77,000 MW of potential installed capacity, providing more than 195 billion kWh per year. As of 2020, the Philippines generated around 1 TWh of electricity through wind energy.

- Moreover, in January 2022, Iderbola SA signed an agreement with Triconti ECC Renewables to construct five offshore wind projects with up to 3.5 GW capacity in the upcoming years. This project helps the Philippines for promoting its National Renewable Energy Program (NREP) for 2020-2040, which has set a target of 35% share of renewable energy in the power generation mix by 2030 and 50% share by 2040.

- Therefore factors such as huge wind energy potential and increasing investments in the country's renewable energy sector are expected to drive the market studied in the coming years.

Competitive Landscape

The Philippine wind energy market is moderately consolidated. Some of the key players in this market include Vestas Wind Systems AS, Alternergy Ltd, AC Energy Inc., PetroEnergy Resources Corporation, and General Electric Company.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

This product will be delivered within 2 business days.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Vestas Wind Systems AS

- Alternergy Ltd

- AC Energy Inc.

- PetroEnergy Resources Corporation

- General Electric Company