Over the long term, the interest and preferences toward electric vehicles increased significantly in various countries across the globe. Moreover, globally, the government encourages automobile manufacturers to invest and develop electric vehicles to reduce carbon emissions caused by diesel and gasoline fuel combustion. Such factors enhance the growth of the wiring harness used in electric and autonomous vehicles.

Technology advancement and increasing safety norms are increasing the components and electronics in the vehicle, which is also boosting the requirement of the wiring harness. Technological advancements and innovations in systems primarily drive the market.

In developed nations, the rising consumer preference toward driving convenience and safety is driving the market's growth. The adoption of navigation and infotainment systems, among others, became standard features in most cars across the world. To connect these systems and the central electronic control unit, automotive wiring harnesses are required.

The rising demand for vehicle safety and stringent government rules drive the ADAS market growth. Introducing new technologies in vehicles, such as x-by-wire systems, blind spot detection, collision avoidance systems, adaptive cruise control, etc., are increasing the usage of electronic equipment and systems. The use of more electronic equipment is expected to drive the wiring harness market in electric and autonomous vehicles.

Electric & Autonomous Vehicles Wiring Harness Market Trends

Increasing Demand for Electric cars and Autonomous Cars

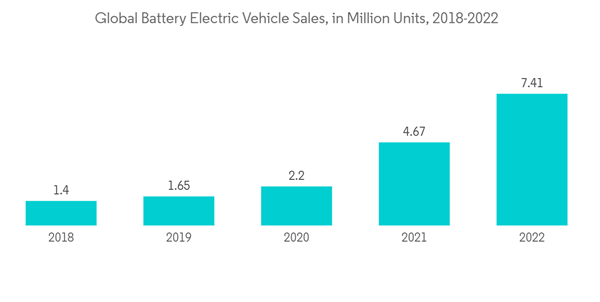

Global EV sales were marked at 10 million units during 2022, which was significantly higher compared to sales figures in 2021. The volume includes all segments, like passenger vehicles, light commercial vehicles, light trucks, and all propulsion types.The movement to accelerate the adoption of light-duty passenger electric cars (EVs) and phase out traditional vehicles with internal combustion engines is gaining traction around the world. The increase in average fuel prices reflects the fact that Europe holds a higher share of new electric car registrations than other parts of the world. Hence, mass adoption of electric vehicles, owing to rising fuel prices, is expected to increase the business globally.

The market studied is furthermore driven by the increasing sales of BEVs and PHEVs globally, which also remained a major cause for bolstering electric vehicle demand. Manufacturers around the globe consistently drove the demand for EVs.

China also witnessed a steady rise in the BEV segment driven by top Chinese manufacturers, including Wuling HongGuang, Tesla, BYD, Nissan, Toyota, and Honda. The Chinese government constantly provided regulated incentive programs to elevate EV sales.

The government of India undertook multiple initiatives to promote the manufacturing and adoption of electric vehicles in India, reduce emissions from international conventions, and develop e-mobility in the wake of rapid urbanization.

Electric vehicles became a hot topic these days as automakers are announcing their ambitious electrification plans. India witnessed a phenomenal growth of ~160% in 2021, as compared to 2020 in battery electric sales. The sales of electric vehicles are attributed to shifting customer preference toward energy-sustainable mobility, improving charging infrastructure, rising fuel prices, and decreasing fuel prices.

India is the second-largest two-wheeler market, which subsequentially channelizes the demand for the two-wheeler segment in the country. In context to this, many tier-2 manufacturers, for instance, Okinawa Motors, UltraViolette Automotive, and Revolt Motors entered the market to take the early mover's advantage.

With the development mentioned above across the globe, the demand for electric vehicles is likely to enhance during the forecast period.

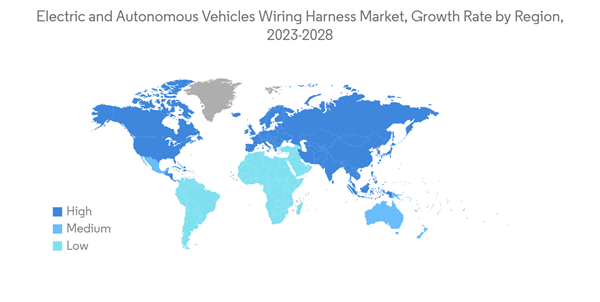

North America is Leading the Market

The growing initiatives taken by both the public and private sectors to encourage people to switch to electric vehicles can be attributed to market growth. These initiatives boosted the sales of electric vehicles while also raising consumer awareness of the benefits of owning one.The United States, although a tad behind in the electrification of heavy-duty commercial and public transport vehicles as compared to Europe, witnessed a significant increase in electrification as a direct influence of Tesla's electric cars.

In view of the same, the United States is implementing aggressive emission reduction policies and regional initiatives to reduce atmospheric CO2 concentrations. Many major cities, including New York City, Los Angeles, and Houston, are plagued by poor air quality. It resulted in respiratory diseases. Such conditions make survival in the current environment difficult.

Further, key electric vehicle Original Equipment Manufacturers (OEMs), such as Ford and General Motors, offer a diverse range of electric vehicles that piqued the interest of many consumers. It resulted in an expanded market for electric vehicles. For instance,

General Motors announced plans in June 2021 to invest USD 35 billion in developing and increasing its EV production capacity to more than one million by 2025. Furthermore, General Motors announced in January 2022 that it planned to invest approximately USD 6.6 billion in its home state of Michigan by 2024 to increase electric pickup truck production and build a new EV battery cell plant.

Further, regional bodies are taking severe initiatives like approving charging stations to ramp up electric vehicle adoption across the country. For instance, in September 2022, the US Transportation Department announced the approval of electric vehicle charging station plans for all 50 states, Washington, DC, and Puerto Rico, covering roughly 75,000 miles of highways.

The movement to accelerate the adoption of light-duty passenger electric cars (EVs) and phase out traditional vehicles with internal combustion engines is gaining traction around the world. The increase in average fuel prices reflects the fact that Europe holds a higher share of new electric car registrations than other parts of the world. Hence, mass adoption of electric vehicles, owing to rising fuel prices, is expected to increase business globally.

The market studied is further driven by the increasing sales of BEVs and PHEVs globally, which also remained a major cause for bolstering electric vehicle demand. Manufacturers around the world consistently drove the demand for EVs. For instance:

- In January 2023, the all-new Volvo EX90 was unveiled in North America for the first time at the Consumer Electronics Show (CES) in Las Vegas. It highlighted the technological collaborations that make the Volvo EX90 the company's smartest and safest vehicle yet. The Volvo EX90 is an all-electric SUV with seating for up to seven passengers.

Electric & Autonomous Vehicles Wiring Harness Industry Overview

Several key players, such as Leoni AG, Furukawa Electric, Motherson Sumi, Yazaki Corporation, Lear Corporation, and others, dominate the electric and autonomous vehicle wiring harness market. The rapid expansion of electric vehicle component manufacturing facilities across the globe is likely to witness major growth for the market during the forecast period. For instance,- In January 2023, to meet the demand for charging cables and high voltage cables for Electromobility applications, Leoni announced that it had increased its production area at its plant in Cuauhtémoc, Chihuahua, Mexico by 40% to 10,723 sq m. The USD 27 million Phase I of the EMOMEX (E-Mobility Mexico) project, which included the installation of machinery and equipment for the development and production of high-voltage cables and charging system cables, was completed.

- In September 2022, the expansion of Leoni AG's (Leoni) product developments was announced. A new wiring system will be developed by the company, gathering engineers at the Innovation Industrialization Center (IIC) in Kitzingen, Germany. The company intends to boost its development to expand autonomous mobility and meet the rising demand for wiring systems. In place of the usual central cable harness, the company will concentrate on smaller-scale connected wiring harnesses.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

This product will be delivered within 2 business days.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Furukawa Electric Group

- Leoni AG

- Motherson Sumi Systems Limited

- Sumitomo Electric Wiring Systems Inc.

- AME Systems (VIC) Pty Limited

- Electronic Technologies International Inc.

- Amphenol CTI Industries Inc.

- Cesar Scott Inc.

- Patrick Industries Inc.

- LeeMAH Electronics Inc.

- Varroc Lighting Systems