Key Highlights

- Over the medium term, factors such as favorable government policies, the increasing investment in upcoming offshore wind power projects, and the reduced cost of wind energy, which has led to increased adoption of wind energy, are expected to drive the market during the forecast period.

- On the other hand, the heavy and large equipment movement to the offshore location resulting in the high cost of the offshore wind power system is a major factor that is expected to restrain the market growth during the forecast period.

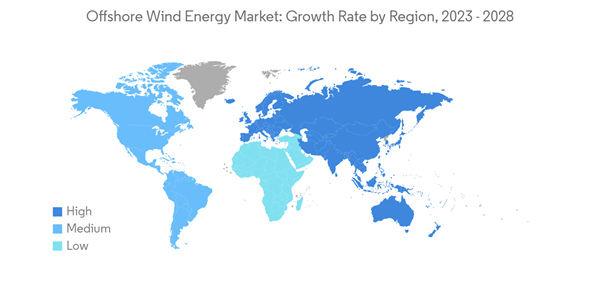

- Nevertheless, the emerging markets in Africa and South America offer a robust business opportunity for the wind power sector, as countries, including Brazil, South Africa, and Chile, are on the cusp of development, and there is an increased demand for electricity, which is expected to provide market opportunities for wind power development in the coming years.

- Europe is expected to have a significant share in the market during the forecast period, as different European countries are exploring the offshore wind energy segment.

Offshore Wind Energy Market Trends

Floating Foundation Type to Witness Significant Growth

- As energy demand rises, major countries and companies are adopting renewable energy sources, especially wind energy, as they can provide clean energy. Adopting offshore wind energy with advanced technologies attracted many countries and companies to high investments.

- As of 2022, offshore wind turbines are usually installed in water depths of up to 40 meters and as far as 80 kilometers from shore. These turbines, rooted in the seabed by either monopile or jacket foundations, are still restricted to waters less than 50 meters deep. This is a significant limitation, as some of the largest potential markets for offshore wind, such as Japan and the United States, have only a few shallow-water sites.

- Therefore, the floating wind farm is one of the most exciting developments in ocean energy technologies. Floating foundations offer essential opportunities, like access to sites with waters deeper than 50 meters and easy turbine set-up, even for mid-depth conditions (30-50 meters). Floating offshore platforms can be built and installed in almost any marine environment. In the long term, these foundations offer a lower-cost alternative to fixed foundations.

- Floating wind energy production has taken off in Asia and Europe, leading the world in floating offshore energy, mainly from shallow waters. These foundations are entering the market as commercial projects. According to industry estimates, the technical potential for floating wind power is valued at around 7,000 GW in Europe, the United States, and Japan combined. Among the high-potential markets, Japan has set a target of 4 GW installed by 2030, followed by around 2 GW in France, the United States, and the United Kingdom, and 1 GW in Taiwan.

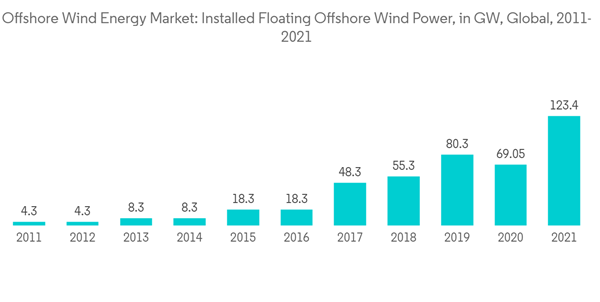

- At the end of 2021, 123.4 MW floating offshore wind energy projects were operating globally. Seven of those ten projects (112.9 MW) are in Europe, and three (10.5 MW) are in Asia.

- In January 2022, Repower Renewable announced its plan to build a 495 MW floating offshore wind plant in Italy with an investment of approximately USD 1.7 billion. The project is planned to feature 33 wind turbines with an individual capacity of 15 MW installed on floating foundations.

- Moreover, In May 2022, China deployed its largest floating offshore wind turbine as part of a project designed to advance the technology and demonstrate the capabilities of floating wind power generation. The floater, called Fuyao and developed by the China State Shipbuilding Corporation (CSSC’s) subsidiary Haizhuang Wind Power, is equipped with a 6.2 MW typhoon-resistant wind turbine with a rotor diameter of 152 meters. The Fuyao floating platform has a total length of 236 feet, a depth of 108 feet, and a width of 262 feet. The site was chosen due to its complex seabed topography and water depths ranging between 50 and 70 meters.

- Therefore, owing to the above points, the floating foundation type segment is expected to witness significant growth in the offshore wind energy market during the forecast period.

Europe to Dominate the Market

- Europe holds the highest share of offshore wind energy installations across the world. According to the European Union, Europe represents a quarter of global installations of the total offshore wind market. Thus, Europe (primarily North Sea countries) is likely to be at the helm of the offshore wind market.

- Around 85% of the total offshore wind installations are globally in European waters. The governments of the European region, particularly in the North Sea area, have set an ambitious target for installing offshore wind farms in their territorial waters.

- In 2021, Europe added 2,899 MW of offshore wind power capacity, i.e., total offshore wind energy is 27814 MW. The Netherlands 2490 MW), Belgium (2262 MW), and the United Kingdom (12700 MW) supplied this new capacity to the grid.

- In May 2022, the Government of Norway launched an investment plan to allocate sea areas for offshore wind development by 2040, targeting 30 GW of capacity. In Europe, floating offshore wind offers unique opportunities. Floating turbines can produce electricity in deeper waters and further offshore than bottom-fixed turbines. This floating technology opens up offshore wind to countries that do not have shallow water so that offshore wind can be developed in deep sea basins like the Mediterranean or Atlantic.

- In 2021, to build new wind farms in Europe, USD 48.5 billion was spent, helping to finance a record 24.6 GW of additional capacity. With a record 17.3 GW of projects changing hands as of 2021, there was also EUR 15.6 billion worth of project acquisition activity. Wind energy has been a popular investment in Europe, and the future holds enormous potential. For instance, the German government has scheduled three tender dates that will occur yearly between 2021 and 2028, with a total tender volume of almost 31 GW.

- The European Commission published a new EU strategy on offshore renewable energy under the European Green Deal. The strategy aims to install 60 GW of offshore wind projects and at least 1 GW of ocean energy by 2030. In addition, the policy aims to reach 300 GW offshore wind turbine capacity in 2050.

- Therefore, these recent trends, in turn, are expected to present Europe as an excellent business destination for players involved in the offshore wind farm business during the forecast period.

Offshore Wind Energy Industry Overview

The offshore wind energy market is moderately fragmented. The major companies market (in no particular order) include Siemens Gamesa Renewable Energy SA, Vestas Wind Systems AS, Xinjiang Goldwind Science Technology Co. Ltd, Ørsted AS, and E.ON SE., among others.Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

This product will be delivered within 2 business days.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Service Providers

- Operators