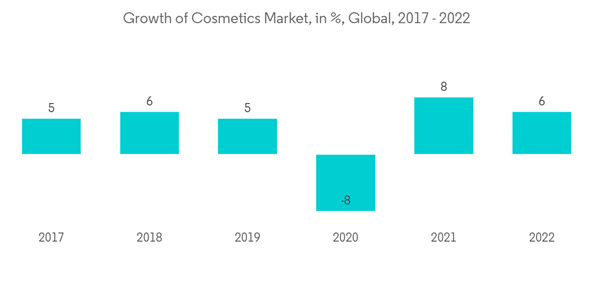

The COVID-19 pandemic had a negative impact on the caprylic/capric triglycerides sector. Global lockdowns and severe rules enforced by governments resulted in a catastrophic setback as most production hubs were shut down. Nonetheless, the business has been recovering since 2021 and is expected to rise significantly in the coming years.

Key Highlights

- Over the short term, rise in adoption in cosmetics and personal care sector and increase in demand from emerging economiesare are some of the factors driving the growth of the market studied.

- On the flip side, side effects associated with the use of caprylic/capric triglycerides and high cost of caprylic capric triglyceride and availability of low-cost substitutes are some of the factors restraining the growth of the market.

- Furthermore, increasing demand for products derived from natural ingredients is likely to act as a growth opportunity for the market studied.

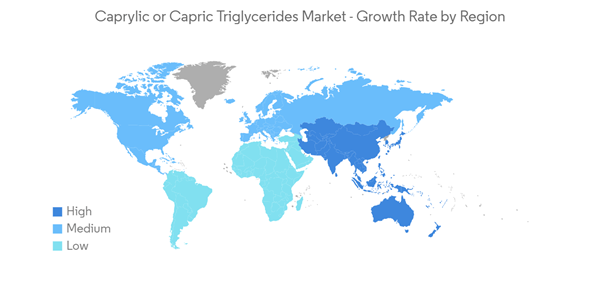

- Asia-Pacific is expected to dominate the global caprylic/capric triglycerides market during the forecast period.

Caprylic/Capric Triglycerides Market Trends

Cosmetics and Personal Care Sector to Dominate the Market

- Caprylic triglycerides is an oily liquid, typically produced by combining coconut oil with glycerine. This ingredient is sometimes called capric triglycerid and also known as fractionated coconut oil. It assists in smoothening the skin and also works as an antioxidant.

- Caprylic triglycerides are compounds made of naturally occurring fatty acids. The high-fat substance in them alongside their surface and antioxidant agent characteristics, make them of specific use for cleanser and skincare items.

- Caprylic triglycerides are added to cosmetics the products in order to extend the shelf life of their active ingredients as they operate as a preservative by binding other chemicals.

- Germany is the largest cosmetic market in Europe, followed by France and the United Kingdom. For instance, according to IKW, the German Cosmetic, Toiletry, Perfumery and Detergent Association, in 2022, the market value of beauty and personal care in Germany is estimated to be EUR 14,333 million (USD 15,104.115 million) , which shows an increase of 5.36% compared to 2021. Therefore, an increase in the market value of beauty and personal care products in the country is expected to create an upside demand for the caprylic/capric triglycerides in the country.

- The market for men's skincare is expanding as a result of rising disposable income, celebrity endorsements, and increased product launches among men who are becoming more conscious of their personal hygiene. Men's preferences for skincare products are expanding beyond those for traditional grooming. For instance, according to L'Oréal - Universal Registration Document 2022, in 2022, skincare products made up 41% of the global cosmetic market.

- Therefore, the aforementioned factors are expected to show a significant impact on the caprylic/capric triglycerides market in the coming years.

Asia-Pacific Region to Dominate the Market

- The Asia-Pacific region is dominating the global caprylic/capric triglycerides market. In the region, China is the largest economy in terms of GDP. China and India are among the fastest-emerging economies in the world.

- According to the National Bureau of Statistics of China, in January 2022, the retail trade revenue of cosmetics in China amounted to about USD 9.18 billion and reached about USD 9.76 billion in January 2023. As the demand for cosmetic products expands further in second-and third-tier cities of China, the caprylic/capric triglycerides market is expected to maintain its growth momentum in the near future. In addition, the changing attitude among men toward skin care fosters the booming of the men's cosmetics market in China.

- According to the India Brand Equity Foundation, India's domestic pharmaceutical market is likely to reach USD 65 billion by 2024 and further expand to reach USD 120-130 billion by 2030. Moreover, in the global pharmaceuticals sector, India is a significant and rising country. For instance, according to IBEF, India is the 12th largest exporter of medical goods in the world. Indian drugs are exported to more than 200 countries in the world, with the United States being the key market. Generic drugs account for 20% of the global export in terms of volume, making the country the largest provider of generic medicines globally. Indian drug and pharmaceutical exports stood at USD 24.60 billion in FY22 and USD 24.44 billion in FY21. Indian drug and pharmaceutical exports stood at USD 2,196.32 million in September 2022. Therefore, increasing in the exports of pharmaceutical products from the country is expected to create an upside for caprylic/capric triglycerides market.

- Moreover, according to L'Oréal - Universal Registration Document 2022, the Asia Pacific accounts for over 42% of the global cosmetics market in the year 2022, which is expected to boost caprylic/capric triglycerides market.

- Therefore, the aforementioned factors are expected to show significant impact on the caprylic/capric triglycerides market in the coming years.

Caprylic/Capric Triglycerides Industry Overview

The Caprylic/Capric Triglycerides Market is consolidated in nature. The major players in this market (not in a particular order) include Croda International Plc, Oleon NV, Oxiteno, KLK OLEO, and IOI Oleo GmbH, among others.Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

This product will be delivered within 2 business days.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Alzo International Inc

- Berg + Schmidt

- Croda International Plc

- PT. Ecogreen Oleochemicals

- IOI Oleo GmbH

- KLK OLEO

- Oleon NV

- Peter Cremer North America, LP

- Vantage Specialty Chemicals